This tutorial which is part of our SAP FI course talks about SAP Balance Sheet and P&L Statement accounts in Financial Accounting. You will learn about these two types of G/L accounts in SAP FI, important differences between them, and how to maintain them in relevant transaction(s). We will mention the SAP transactions and tables that are related to this process.

This tutorial which is part of our SAP FI course talks about SAP Balance Sheet and P&L Statement accounts in Financial Accounting. You will learn about these two types of G/L accounts in SAP FI, important differences between them, and how to maintain them in relevant transaction(s). We will mention the SAP transactions and tables that are related to this process.

A general ledger (G/L) account is required to record business transactions of an organization. Financial and management reports in SAP are generated based upon the transactions booked against general ledger accounts. There are two types of G/L accounts in SAP: SAP Balance Sheet and P&L Statement accounts. P&L stands for Profit and Loss. Let’s discuss these account types in more details.

SAP Profit & Loss Statement Account

It is a financial statement which summarizes costs, expenses and revenues incurred for the specific period of time. Expenses /losses are booked on the debit side and profit/income is booked on the credit side in SAP financial accounting.

SAP Balance Sheet Account

It is a financial statement which summarizes a company’s assets, liabilities and equity for the specific period of time. At the end of the year, net profit or net loss will be moved to the capital account in the balance sheet.

Differences between SAP Balance Sheet and P&L Statement Accounts

There are several important differences between SAP Balance Sheet and P&L Statement accounts. Here are they:

1. Balance sheet accounts are prepared at the end of the financial year and show a company’s assets, liabilities and capital. Profit and loss statement accounts show expenses, income, gains and losses of a company code during a period of time. At the end of the financial year, net profit or net loss will be moved to a capital account in the balance sheet statement.

2. Balances of SAP balance sheet accounts will be carried forward to the next financial year. Balances of SAP profit and loss accounts will be moved to the retained earnings account.

3. SAP balance sheet accounts won’t be defined as cost elements. SAP profit and loss statement accounts have to be defined as cost elements.

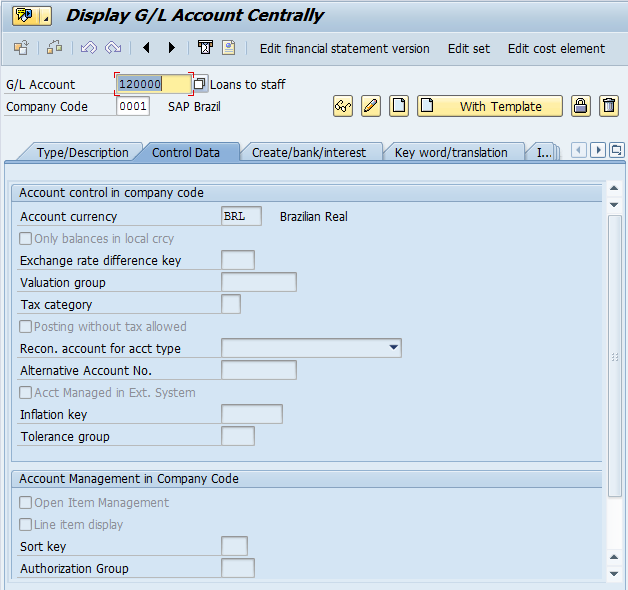

4. SAP balance sheet accounts can be defined with the open item management indicator to perform clearing. SAP profit and loss accounts won’t be defined with open the item management indicator.

5. Reconciliation account type can be maintained for SAP balance sheet accounts to create vendor, customer, asset and contract accounts receivable. SAP P&L accounts can’t be defined as reconciliation accounts.

Creating SAP Balance Sheet and P&L Statement Accounts

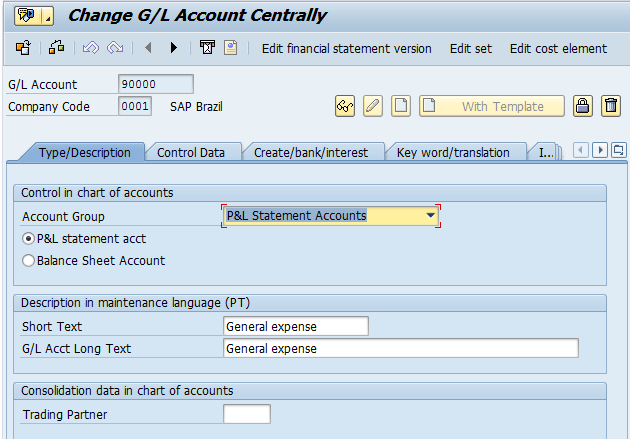

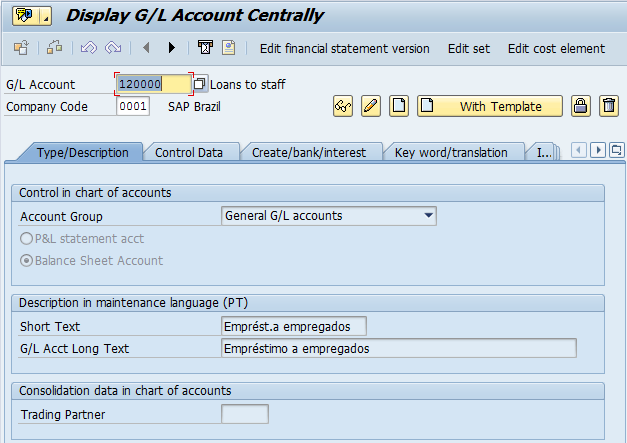

In SAP G/L account master data record, the tab Type/Description holds the information related to the chart of accounts. On the other hand, the tabs Control Data and Create/bank/interest hold the information related to a company code.

While creating a G/L account at the chart of accounts level, it is required to specify whether the G/L account is a balance sheet account or profit and loss account. Based upon the nature of activity, G/L accounts are bifurcated into multiple account groups and there is no limits in defining account groups in SAP because they can be customized as per the requirement of a client. In general, an account group holds either P&L accounts or balance sheet accounts.

In SAP, all the G/L accounts will be assign to Financial Statement Version (FSV) for reporting purposes. It is possible to create more than one FSV as per reporting requirements of the client. Balance sheet reports are designed based upon the structure of FSV.

Relevant Transactions, Tables and Screenshots

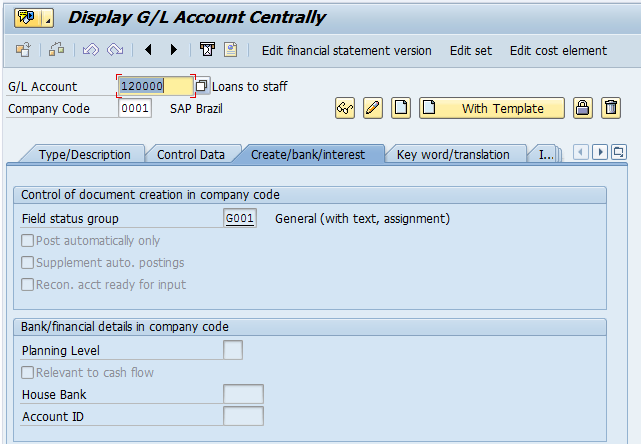

Menu path: SAP Easy Access – Accounting - Financial Accounting - General Ledger - Master Records - G/L Accounts - Individual Processing – Centrally/In chart of accounts

Transaction codes: FS00 (Create G/L account centrally, i.e. at chart of accounts and company code levels), FSP0 (Create G/L account at company code level)

Tables: SKA1 (G/L Account Master (Chart of Accounts)) and SKB1 (G/L account master (company code))

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP Account Group of G/L Accounts

Go to previous lesson: SAP G/L Account Segments

Go to overview of the course: Free SAP FI Training

Thanks for this information it is very very useful

Really nice tutorial.

Hi Isco,

I’m on lesson 1.10 of the SAP FI training, how many lessons are there approximately? Also, I am not able to buy the SAP IDES for training purposes, I’m finding the lessons are easily explained, but my question to you is, will I be able to use the software easily once I get to use it at my new employment? If I follow the paths that are laid out in the modules, will I be able to navigate and do my accounts payable duties on SAP as I go along?

Thanks again for helping me understand this SAP FI training, relatively well

Dear Sir,

From G/L Accounts creation and Accounts group creation and all data inputs where is my final data storing for reports creation of P&L Statement & Bal. Sheet for a fiscal Year. Where will I find my final reports i.e SAP Fiori, SAP Hana Studio, SAP Logon??

Jaison

Nice Tutorial, Good work keep it up. Thank you. One typo mistake in that (FSP0 (Create G/L account at company code level)) FSP0 is belongs to Chart of Accounts level not company code level. if posible plz change it. thank you.

It is very usefull tutorial

thanks for explanation

This tutorial is nice you have explained amazingly, Thank you for sharing with us