SAP financial accounting has several sub ledgers, including accounts receivable, accounts payable and asset accounting. An account is maintained for each customer, vendor or asset in the sub ledger. When preparing financial statements the details of these individual accounts are not necessary. Instead, every asset, customer or vendor account is linked to a certain SAP reconciliation account, also known as a control account. Each SAP reconciliation account is used to reconcile the sub ledgers with the general ledger. SAP reconciliation accounts are reported on the financial statements, while the individual sub ledger accounts are not.

SAP financial accounting has several sub ledgers, including accounts receivable, accounts payable and asset accounting. An account is maintained for each customer, vendor or asset in the sub ledger. When preparing financial statements the details of these individual accounts are not necessary. Instead, every asset, customer or vendor account is linked to a certain SAP reconciliation account, also known as a control account. Each SAP reconciliation account is used to reconcile the sub ledgers with the general ledger. SAP reconciliation accounts are reported on the financial statements, while the individual sub ledger accounts are not.

The SAP general ledger is linked to the sub ledgers. For every transaction posted in the sub ledger, the same value will be updated to the corresponding reconciliation account.

For example, reconciliation account 160000 is used for trade vendors. Let’s assume we have vendor A with account 36. If we post an invoice of $2000 to vendor A, account 36 will be debited for $2000 and the reconciliation account 160000 will also be debited automatically for $2000.

Creating SAP Reconciliation Account

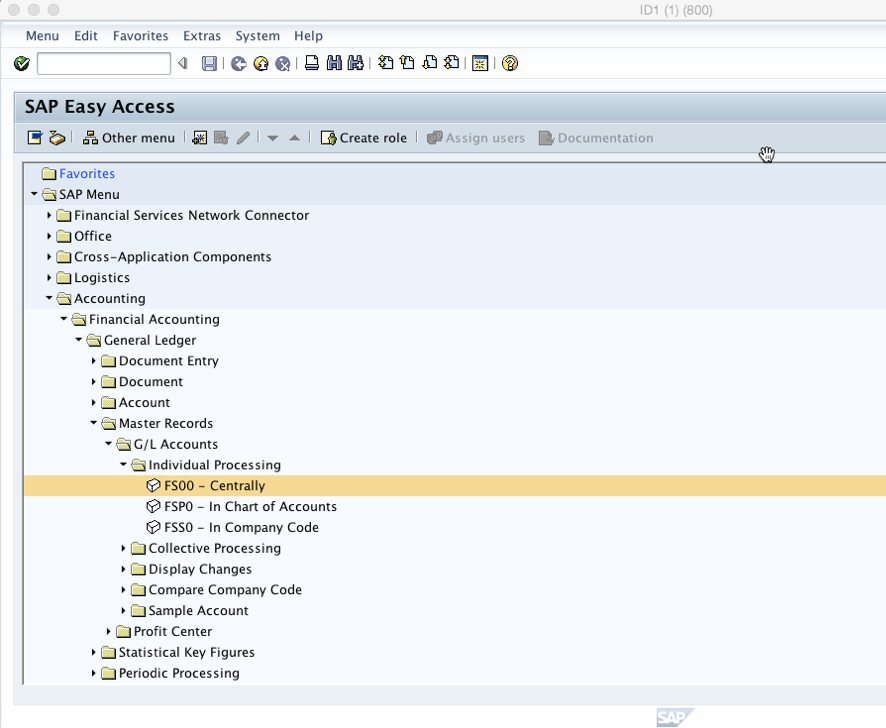

SAP reconciliation accounts are created very similar to all other general ledger accounts. There are just a few attributes that need to be set correctly. Transaction code FS00 is used to create reconciliation accounts centrally.

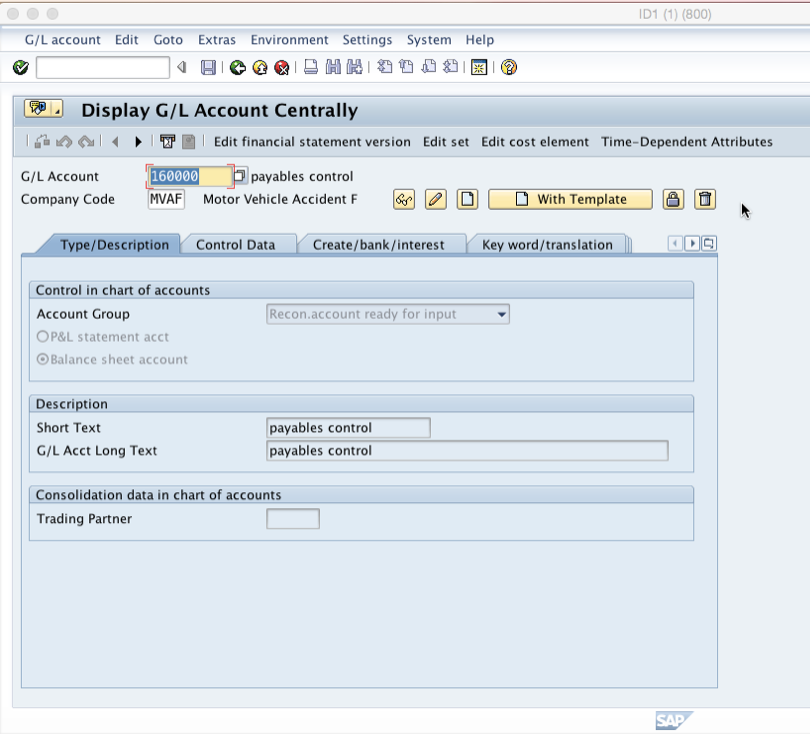

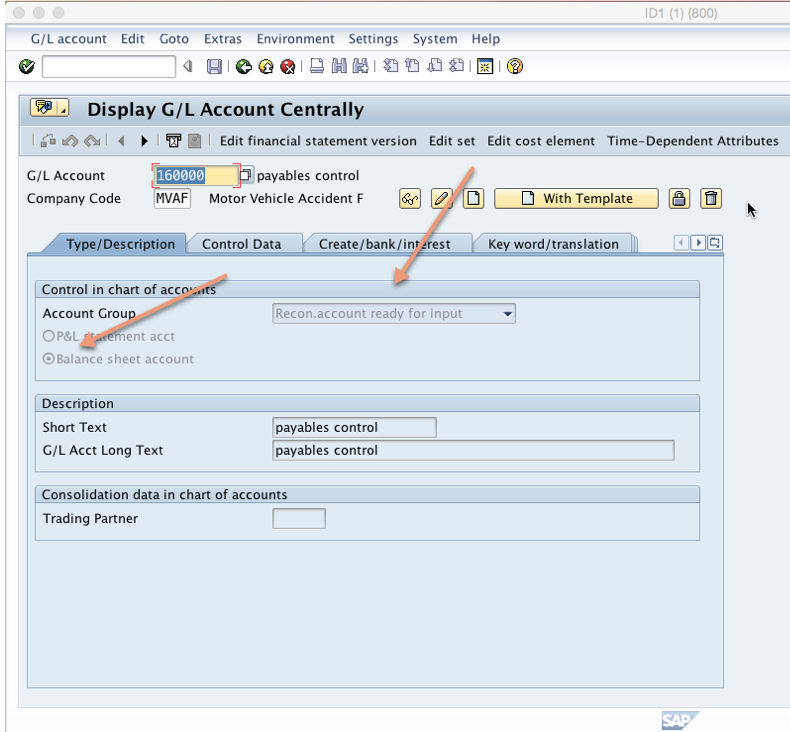

In this tutorial, we will not walk through the entire account creation process, as a reconciliation account is created in much the same way as any other general ledger account. Instead, let’s examine account 160000 for AP (Accounts Payable) reconciliation. We will walk through the three main areas where a reconciliation account differs from other accounts.

To display a reconciliation account use transaction code FS00 or you can use the following menu path:

You will be taken to the screen below:

The first area that denotes that this is a reconciliation account is the control data in the “Type/Description” tab. Here, you should note that the account group “Recon.account ready for input” is selected. Also, all reconciliation accounts should be identified as balance sheet accounts:

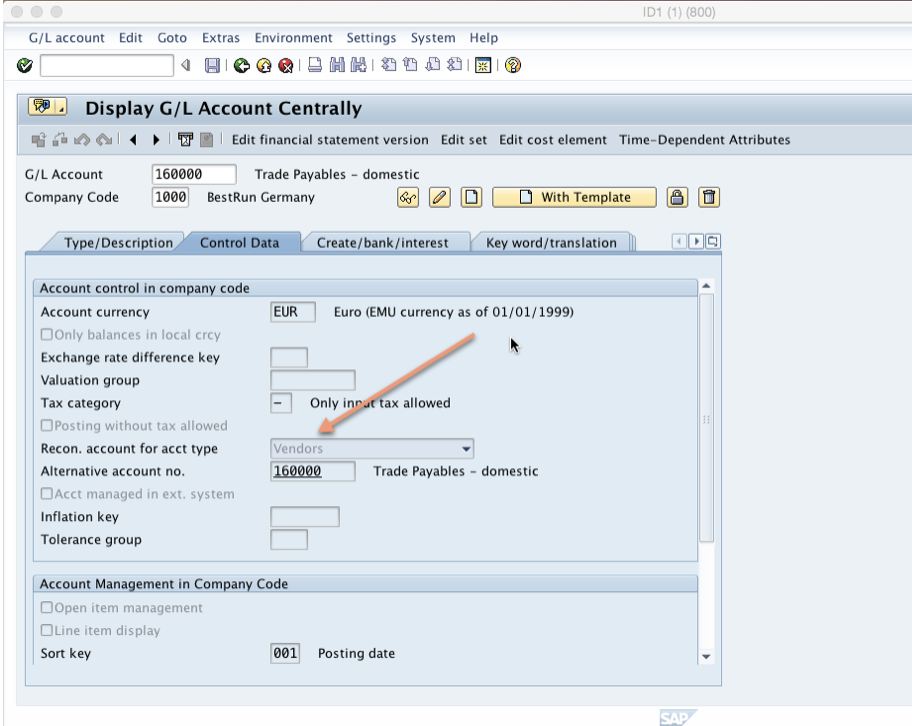

Click on “Control Data” tab and check the second area that has to be maintained when creating a reconciliation account. In the field “Recon.account for acct type” you select between assets, customers and vendors to specify which sub ledger the account reconciles:

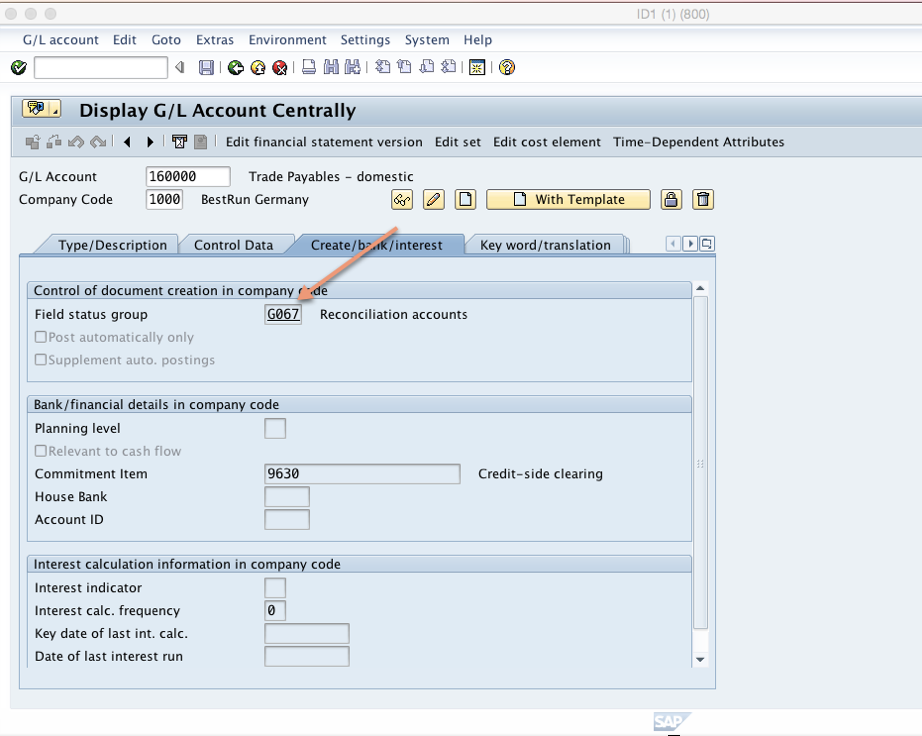

Finally, click on “Create/bank/interest” tab and check the field status group. The field status group for all reconciliation accounts is G067:

Assigning SAP Reconciliation Account to Sub Ledger Account

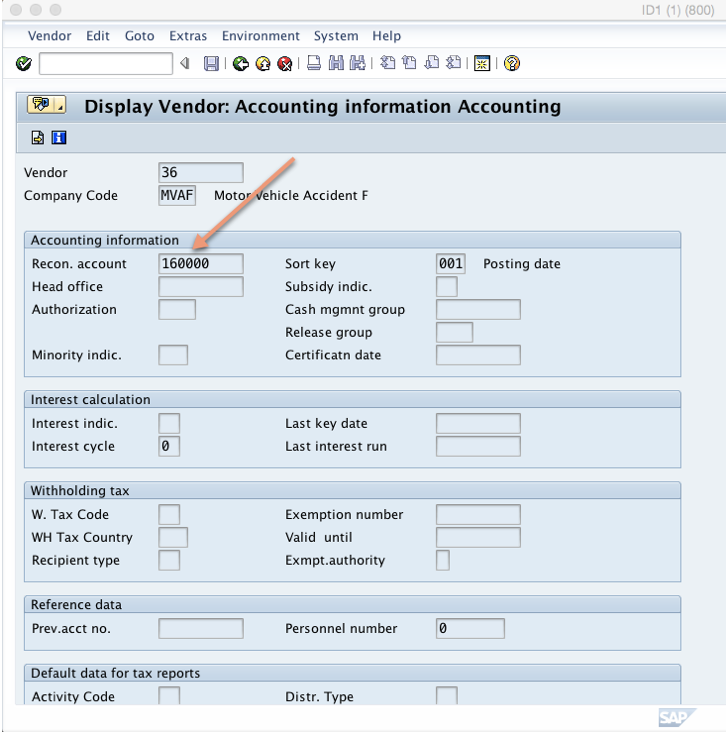

Now that we have seen how to set up a reconciliation account, complete the process by learning how to assign it to a sub ledger account. Each sub ledger account has to be linked to a certain reconciliation account for its postings to be recognized in the financial statements. Let’s see how it’s done by looking at an already created vendor.

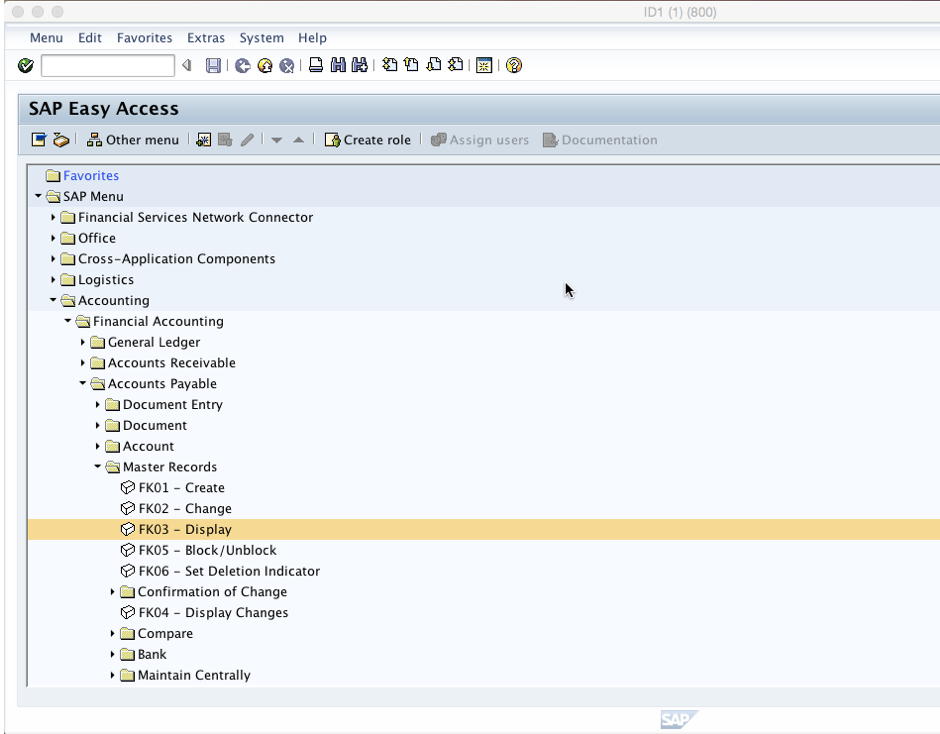

Use transaction code FK03 to display a vendor or use the the following menu path:

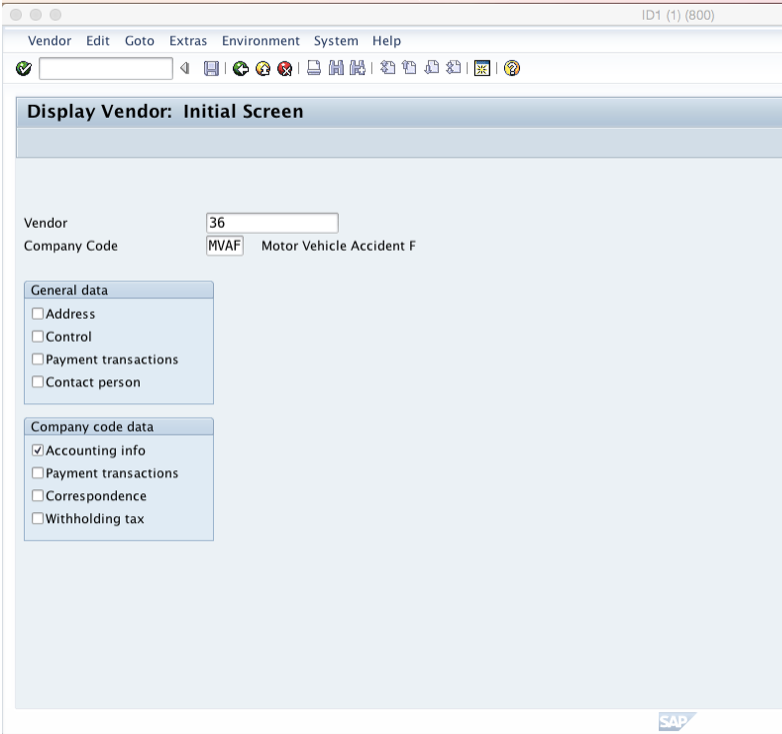

You will be taken to the screen below:

Enter a valid company code and vendor number, select the “Accounting info” tick box and press enter. The reconciliation account 160000 examined earlier is assigned in the “Recon. account” field for this vendor:

The result is that for every posting recorded under vendor 36, the general ledger updates with the same amount via reconciliation account 160000.

Posting a Vendor Invoice

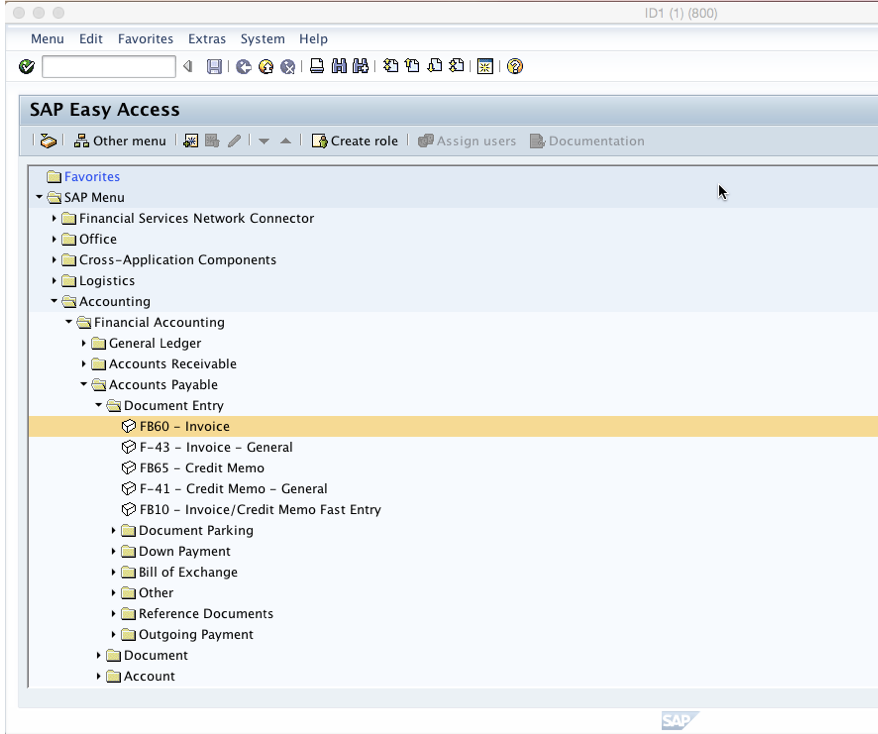

Finally, let’s see how a reconciliation account is updated when you post an invoice for a vendor.

To post a vendor invoice use transaction code FB60 or you can use the following menu path:

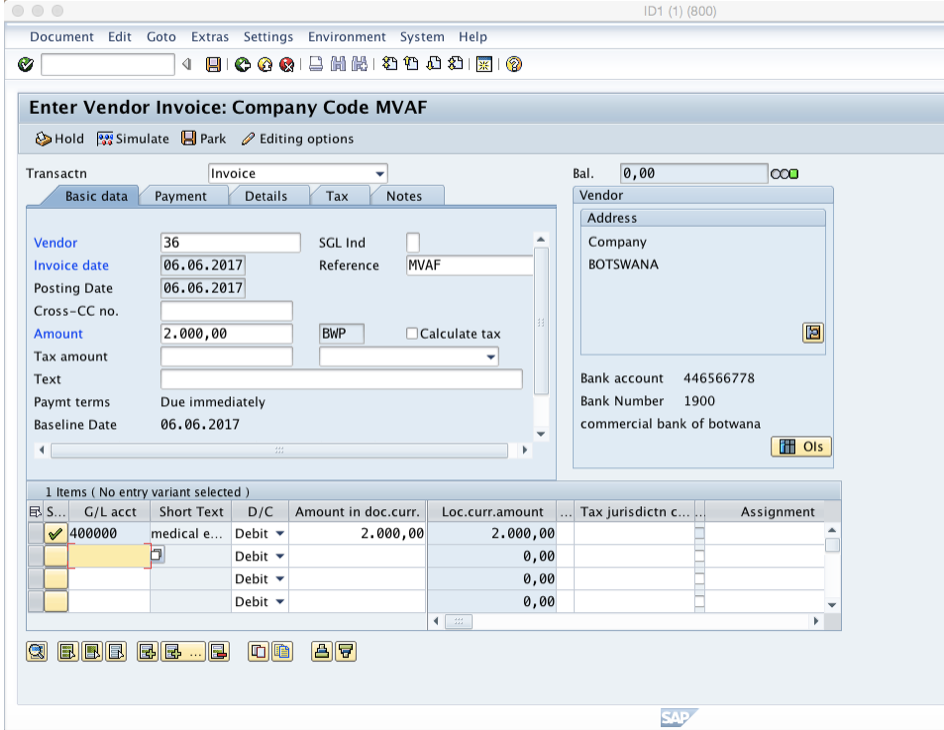

Fill in the vendor number examined above (vendor 36 in our case) and all details necessary for posting an invoice:

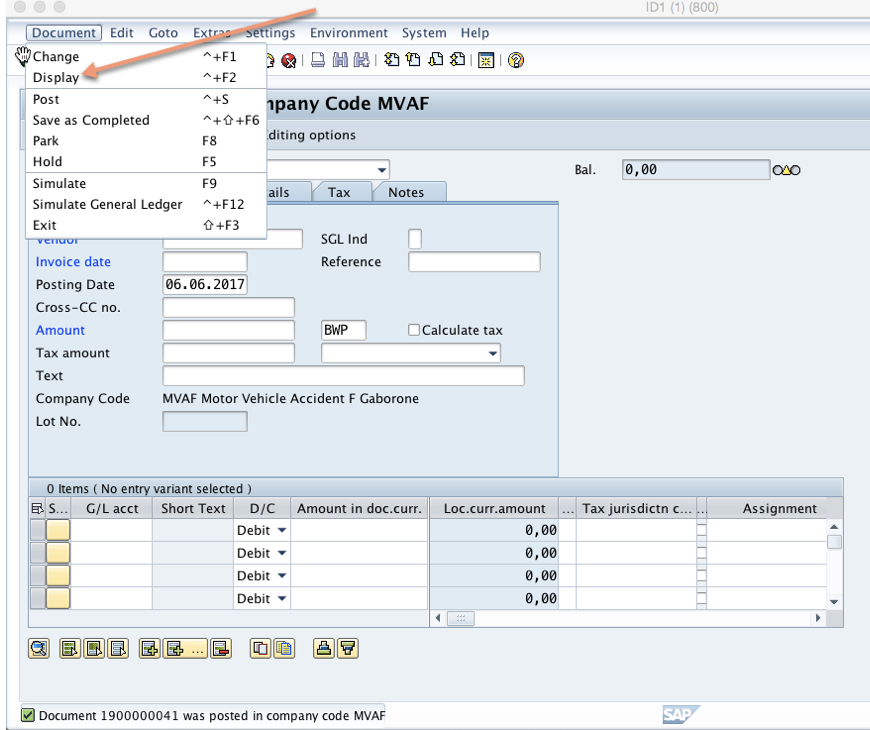

Now post the invoice and click “Document > Display” on the top far left of the toolbar to display the created document:

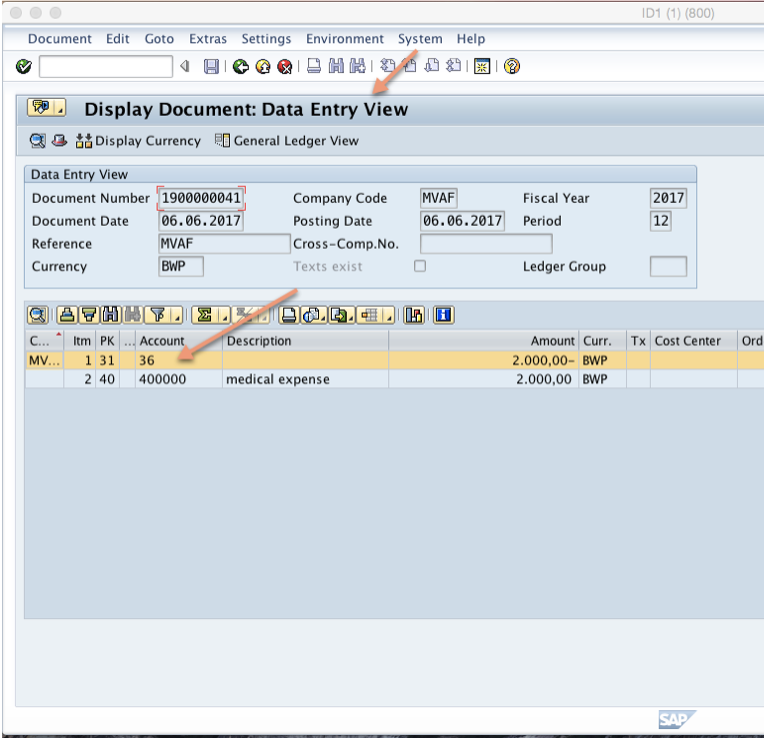

You will see the following screen. Here you see that vendor 36 has been credited with 2000 BWP. Click on general ledger view:

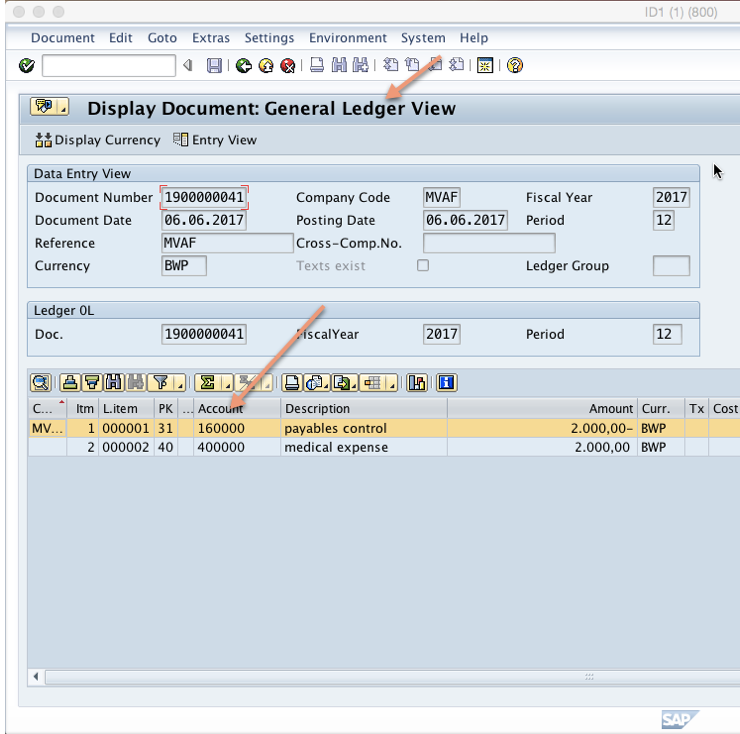

You can see the reconciliation account 160000 assigned to the vendor account is updated by the transaction above:

The end result is that reconciliation account 160000 was also credited with 2000 BWP. Therefore, every time you post a transaction to a sub ledger account the reconciliation account will be updated with the same amount in real time. In order to maintain a clean reconciliation with the sub ledger, SAP reconciliation account can only be updated by the system through the sub ledger. Direct posting to SAP reconciliation account is prohibited by the system.

Intially we post an invoice via t code FB60 (a paricular vendor) to Subsidiary GL and the same entry has been made to reconciliation account automatically. How are the postings done to General Ledger ?

Here the recon account itself is the GL account. So when vendor posting is done, credit to vendor account is automatically posted to associated recon GL account (160000). Please note that that the recon account is just a name given to the GL account which is used as a posting account for all the vendor sub-accounts. We cannot create reports and statements out of thousands of sub-GLs so attach a GL to each of them and name it as recon account. Thanks.

I downloaded a debtors age analysis for a recon account. now the balance has changed due to entries that were posted. instead of generating a new F.99, is there a way that a line item can be displayed so that i can see what are the entries that went through?

If I want to reconcile AP sub ledger with GL, Which report should I run on SAP for AP sub ledger to compare with GL report for reconciliation purpose or what’s the procedure for doing AP- GL reconciliation

This statement of yours is not correct

“Let’s assume we have vendor A with account 36. If we post an invoice of $2000 to vendor A, account 36 will be debited for $2000 and the reconciliation account 160000 will also be debited automatically for $2000”

Recon account should be credited in the above case..

The subledger transactions will be

Dr Purchase or Expense

Cr Vendor

In GL you will not have the list of vendors but a few reconciliation accounts like Domestic Vendors, Foreign Vendors etc. So for transaction above the GL View will be as below

Dr Purchase or Expense

Cr Reconciliation Account.

This means when SAP posts crediting the vendor in the Subledger this flows to GL module will same credit to Reco account. Hope this helps

Digitized

black

Hi Sri

when u purchase any from vendors we have to pay the amount to vendor. So it a liability

all liabilities will be in credit side

Purchase ac Dr….. $2000

To vendor A/c Cr………………$2000

The same will be updated in the vendor recon a/c.

Hope you get my point

Thank you