In this SAP FI tutorial, we will talk about SAP exchange rate table in SAP Financial Accounting. You will learn what tables in SAP FI are used for managing and changing exchange rates. We will mention the SAP transactions and tables that are relevant for this process.

Exchange Rates in SAP

As you should already know from our previous tutorials, Exchange rates are to be maintain in SAP to allow transactions in other than the company code currency or book value in additional local currencies in the New G/L accounting.

Example:

A company code currency is GBP and goods are purchased in EUR. In this case, first translation ratios need to be maintain for GBP/EUR and EUR/GBP combinations to allow us to maintain the exchange rate in the transaction code OB08.

SAP Exchange Rate Table

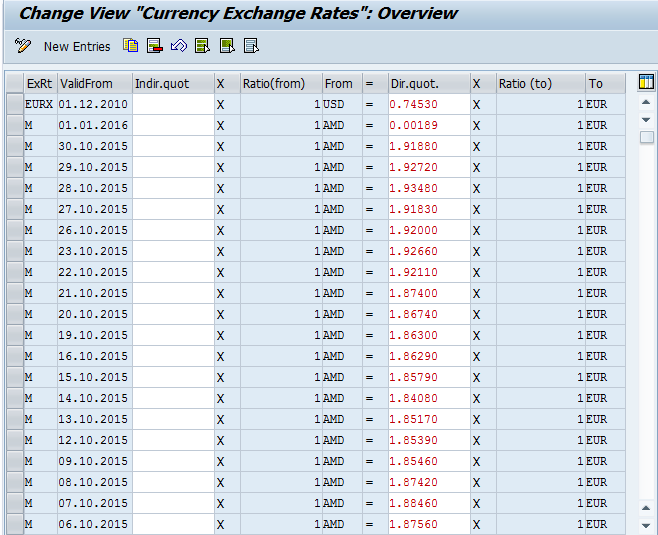

SAP has a dedicated table for maintaining exchange rates. The name of the table is TCURR.

The field ExRt of this table contains an exchange rate type. Exchange rate type M is provided by SAP which applicable to fetch an exchange rate for any foreign currency transactions. As per the client requirements, it is also possible to create new exchange rate types and it is not advisable to delete the standard exchange rate types.

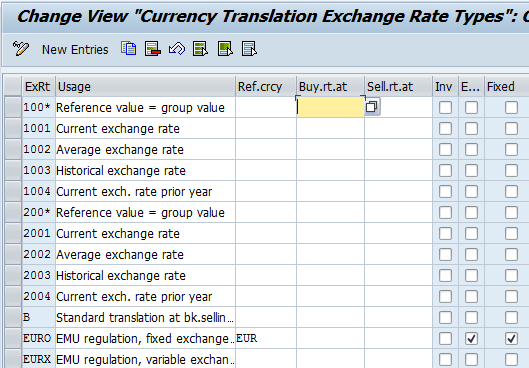

The table TCURV contains the information about currency translation exchange rate types. In this table, there are the following fields:

- Reference Currency: Foreign currency translation is vital for many different currencies. Through the reference currency we can simplify maintenance of exchange rates. In this case, exchange rates need to be maintained against the exchange rate type and the reference currency combination.

- Buying and Selling rate: Buying and selling exchange rate types are not mandatory. If we maintain the exchange rate type here, then the spread needs to be maintain for all the relevant currency pairs.

- Inverter exchange rate: Inverter exchange rate helps to fetch exchange rate in case of unavailability. For example, the exchange rate for INR/USD might not be maintained but if you select this option, the system will consider the exchange rate for USD/INR.

- Exchange rate type uses special translation model: By selecting this option SAP will internally call an algorithm for calculation. It is used to meet the European Monetary Union (EMU) statutory guidelines. A reference currency needs be maintained if we are selecting this check box as per the EMU guidelines.

- Fixed: Exchange rates are calculated from the manually entered currency.

Path: SPRO – SAP Reference IMG - SAP NetWeaver - General settings – Currencies - Check Exchange Rate Types

Transaction code: OB07

Table: TCURV (Exchange rate types for currency translation)

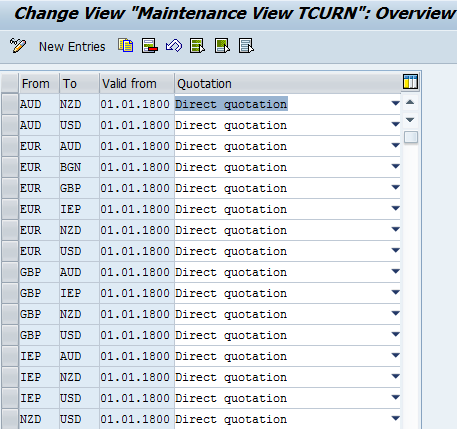

Furthermore, there is a table for defining quotations for exchange rates - TCURN. These table has the following fields:

- Valid from: The date from which the exchange rate needs to be considered. If there is no valid-to date, the system considers the latest date as valid-from and the previous date as valid-to. For example, if in the system exchange rates needs to be maintained for 13.10.2015 and 14.10.2015, for 13.10.2015 valid-to also belongs to same date. Another example is if exchange rates need to be maintained for 13.10.2015 and 15.10.2015. In this case, the exchange rate for 13.10.2015 is valid until 14.10.2015.

- Indirect or Direct quotation exchange rates: Here we configure whether an exchange rate for the currency pair is on direct or indirect quotation basis.

A direct quotation means that exchange rates are entered for From currency to To currency. An indirect quotation means that exchange rates are entered for To currency to From currency. On the above screenshot, the currency AUD/NZD exchange rate is considered to be maintained against AUD to NZD. This kind of currency combination is called a direct quotation. If an indirect quotation is chosen for the same combination of currencies, then the exchange rate needs to be maintained for the same currencies NZD/AUD as an indirect quotation.

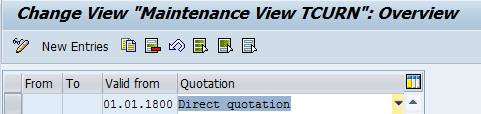

If a client wants to consider only direct quotations for all the currencies, then the quotations need to be maintained as shown below. By maintaining the currency quotation this way we can reduce the number of entries of each currency and their combinations.

Path: SPRO – SAP Reference IMG - SAP NetWeaver - General settings – Currencies - Define Standard Quotation for Exchange Rates

Table: TCURN (Quotations)

Prerequisites:

- Currency translation ratios to be maintain – Transaction code OBBS

- Currency exchange rates – Transaction code OBB8

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP Chart of Accounts

Go to previous lesson: SAP Exchange Rates

Go to overview of the course: Free SAP FI Training

Hi Cleo Isco,

I noticed on TCURR table valid from is not consistent as we have it in this order 2010, 2016 and 2015,

and my question is why is SAP TCURR this way. I was actually thinking that it should have been either in descending or ascending order.

It is first sorted by “ExRt” column. In our example, we have EURX and M exchange rate types in the first column. And then, within each exchange rate type, rows are sorted in descending order.

Thank you very much.

I would like to ask question. I want to add into our System conversion from USD -> CZK. How should I do this?

Which tables should be maintainend? Should I just add new entry into TCURR with those currencies or do I need something else to maintined?

Thank you very much.

Hi,

OBBS tcode for maintaining new currency translations.

OBBS>New entires> Provide all details.

Regards,

Madhu.

Where to get the information who change the table exchange rate?

Hi

Indeed, We have a topic called daily exchange(Eg: USO1) rates and have created a table( Z table) for maintaining them in the system years ago for too many translations.

I would like to Know here, If we remove the Currency translation ratio from US01, what would be the impact on the FI side?

Regards,

Madhu.

Thanks for the very good article

Hi there, wanted to check with all of you if it is recommended to have daily rates in place.

I heard there are organisations with rates updated only once a month. Not sure what’s the best practice here.

Appreciate your help. Thanks!