Welcome to the tutorial about SAP Accrual Calculation. This tutorial is part of our free SAP CO training. We will study what is the accrual concept in accounting and how it is implemented in SAP ERP. You will learn about ways to calculate accruals (FI vs CO) and accrual calculation methods in SAP CO (percentage, target=actual, and plan=actual).

Welcome to the tutorial about SAP Accrual Calculation. This tutorial is part of our free SAP CO training. We will study what is the accrual concept in accounting and how it is implemented in SAP ERP. You will learn about ways to calculate accruals (FI vs CO) and accrual calculation methods in SAP CO (percentage, target=actual, and plan=actual).

The accrual basis of accounting is important to produce accurate financial statements and reflect financial position of the company. It’s a principle of accounting which records expenses or revenues when they are consumed or earned and not when they are paid or received in cash.

GAAP (Generally Accepted Accounting Principles) allows only the accrual concept in preparing financial statements as this will result in accurate or correct reporting of income, liabilities, assets and retained earnings. It will in turn help in better understanding of the financial position of the company.

Examples of accruals are:

- Prepaid rent

- Prepaid wages and salaries

- Utilities expenses

In SAP ERP, allocation of operational expenses is different in financial accounting (FI) and in management accounting (CO). For example, prepaid rent for a year is recorded in external accounting (that is FI) as a current asset but in management accounting (CO) it has to be recorded as a cost proportionally divided to monthly intervals. This will result in accurate internal reporting and accounting, and is known as accrued costs. The evenly distributed cost is known as time-based accrual calculation.

The calculation of accruals can be performed in two ways:

- Posting of accruals in financial accounting (FI) by the use of recurring entries and moving the entries to the controlling module by the use of a cost element for accruals. The imputed cost or the accrued cost are calculated in FI and not in CO.

- Secondly, the cost can be accrued by an accrual calculation approach in the CO module.

There are the following approaches toward calculation of accruals in SAP CO:

- Accrual calculation using the percentage method

- Accrual calculation using the target=actual method

- Accrual calculation using the plan=actual method

SAP Accrual Calculation: Percentage Method

The percentage method involves usage of a percentage rate to determine the cost to be accrued in the accrual calculation. The benefit of using this method over the recurring entry method in financial accounting (FI) is that it is based on when the cost is actually posted. This method is normally used in non-wage labor cost (e.g., for vacation bonuses).

Example

The user plans a 10% rate on labor cost for the vacation bonus and the labor cost per month is $10000, so the planned cost for vacation bonus will be $1000 per month.

The amount accrued in cost accounting equals to $1000 / month = $12000 / year, the credit is posted to an order every month (in CO). The expenses are posted in financial accounting in the month of June for the whole year.

SAP Accrual Calculation: Target=Actual Method

Target=Actual method is normally used in activity dependent costs. The planning is done on an accrual cost element.

Example

Company expects the utility cost of $36000 in period 11 on the cost center 4520 (production). You should plan accruals for activities on the production cost center and the system will distribute them equally using the standard distribution key 1. The actual production hours are 1200 and the planned hours were 1000. This results in the rate of 1200/1000= 120%.

The SAP system calculates the values as follows:

Period 1

Planned value = $3000

Target value = $3000 *1.2 = $3600

Actual = $3600

The total accrual for 12 months = $3600 * 12 = $43200

The expense will be posted in financial accounting in the period 11 and the corresponding cost will be posted period-wise in CO. The difference of $7200 = $43200 – $36000 will be transferred to the operating profit.

SAP Accrual Calculation: Plan=Actual Method

Plan=Actual method is used for activity-independent cost. Target cost is not determined and the planned cost is used in the actual cost.

Example

Let’s imagine that we need to pay a certain insurance premium. The insurance premium is equally distributed using the distribution key 1 (equal distribution) which will distribute the cost equally between all the periods when we need the insurance. So, if the insurance premium is $1000 / month, it will be reflected like this in SAP CO. Whereas a posting of $12000 will be made in the period 11 in SAP FI module because the premium is paid once per year (12 months).

Posting SAP Accrual Calculation

Let’s briefly see the steps for calculation of accrual for cost centers.

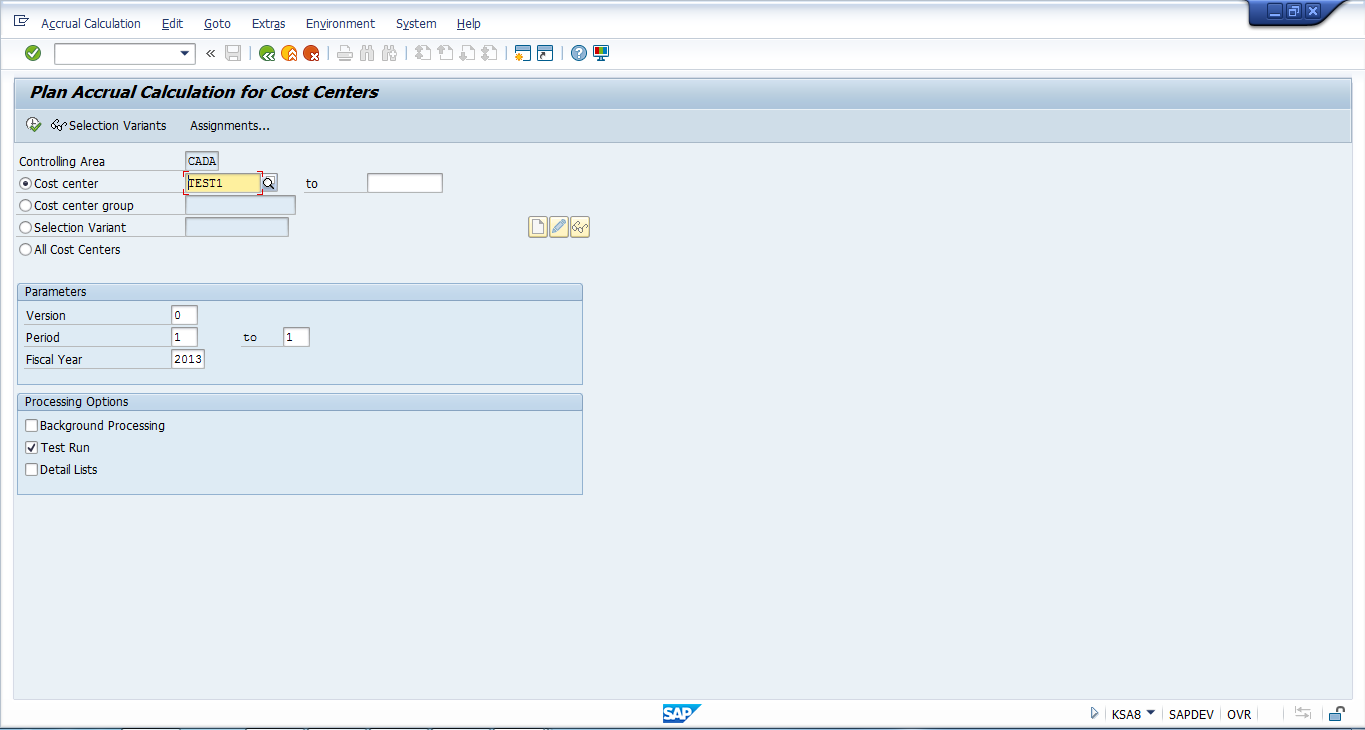

Step 1

Navigate to the following transaction is SAP Easy Access menu:

Accounting – Controlling – Cost Center Accounting – Planning – Planning Aids – Accrual calculation

Alternatively, you can directly start the transaction KSA8 from the command bar.

Step2

Enter the cost center or a group of cost centers for which you want the accruals to be calculated.

Version 0 is used for plan/actual method.

It is recommended to choose the Test Run option first and execute the transaction to see simulated accrual calculation. If everything is correct, then select Background Processing and execute the transaction in the normal mode.

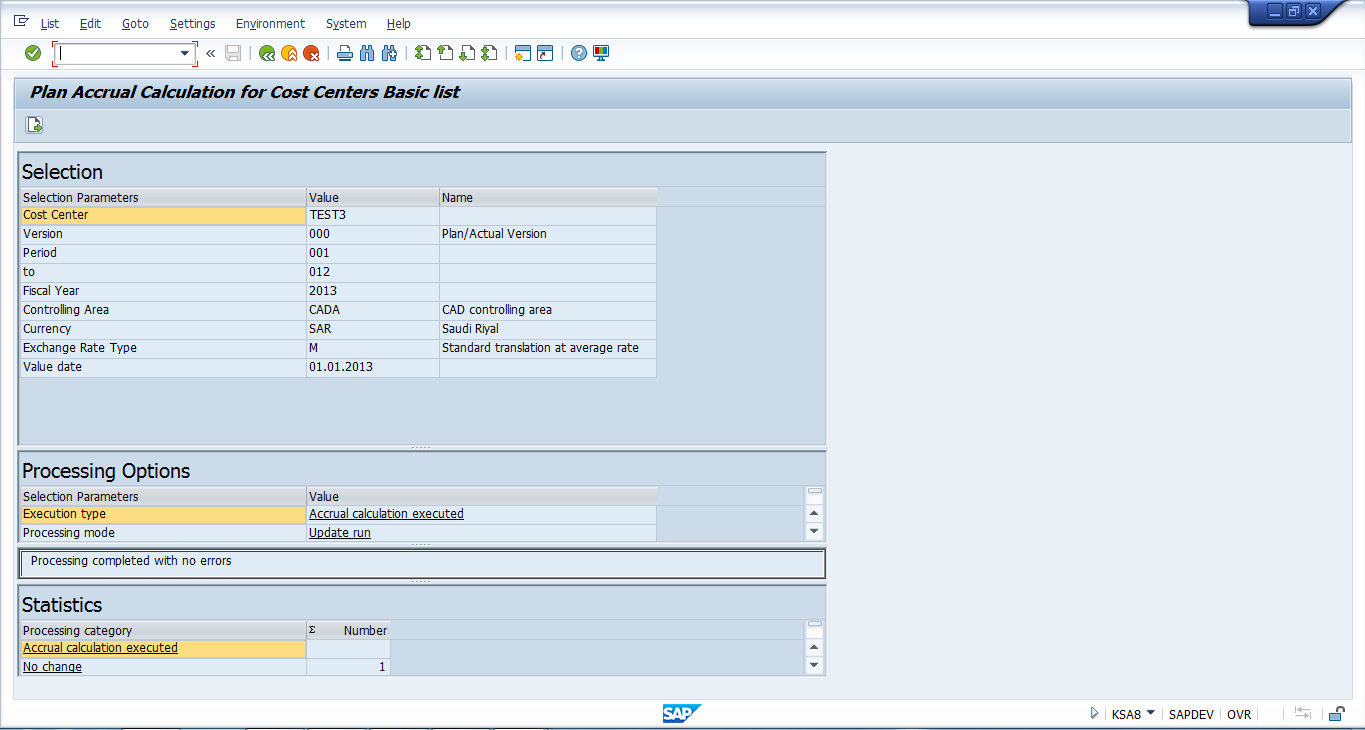

Step 3

On the next screen verify the displayed information and click on the arrow button ![]() .

.

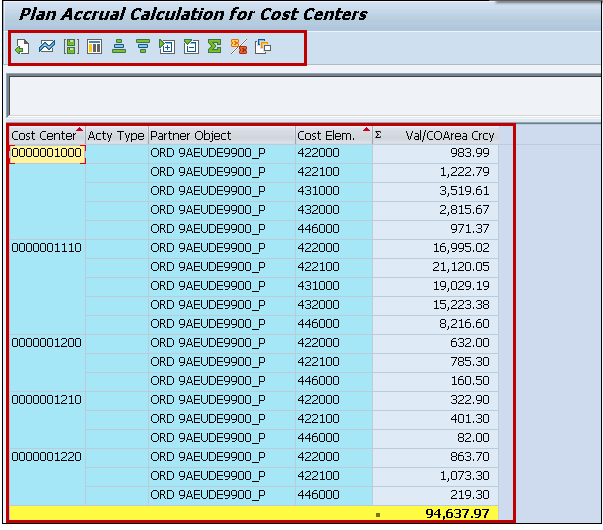

Step 4

You will see the posted accruals amounts.

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP CO tutorials.

Navigation Links

Go to next lesson: SAP Periodic Reposting

Go to previous lesson: SAP Direct Activity Allocation

Go to overview of the course: Free SAP CO Training

I do not agree with your definition of accruals.

Accrual in each Gaap is when a service or good is done/delivered but the invoice in not arrived yet.

The accruals examples you are taking of are called prepaid expenses which are totally different from accruals definition.

a) Dr legal cost @ Cr invoice to be receive: accrual;

b) Dr insurance cost (pl) (Jan)

Dr prepaid expense (B/s) (Feb – Dec)

Cr Cash (Full year)

By using recurring entries each month

Dr insurance

Cr Prepaid

From a cash flow point of view the increase of prepaid leads to cash decrease, accrual increase leads to cash increase.

Moreover it is not correct when you say accruals are done in FI only when submitting Financial statement. Nowadays Companies perform monthly, quarterly closing and accruals are done in FI and not in controlling

I do not agree when you make accruals for holidays not yet taken. Why should this HR accrual be posted in CO when these data are provided by the HR dept or by the external payroll provider on a monthly basis?

It is better to post accruals in Fi or in MM.

Br

Hello,

I am facing an issue while trying to perform the accrual calculation.

I see that in KSA3, after filling in with all the necessary information, the detailed list is showing that accruals have been calculated for all Cost Centers but when I am checking it in FAGLB03 and S_ALR_87013611, the documents are not being posted for some of the Cost Centers.

It is something wrong with the Cost Centers? Why do I see correctly in KSA3 but not in FAGLB03?

Many thanks!