In this SAP FI tutorial, you will learn how to manage and maintain SAP bank master data, bank directories, customer bank accounts and vendor bank accounts. Before we look deeper into these topics, let’s start by understanding what SAP bank master data is. This tutorial is part of our free SAP FI training.

As you might know from previous SAP FI tutorials, master data in SAP refers to information that is maintained in the system and used for long time without being changed. For example, banks that are used by your company, your customer or vendors are not maintained each time when the company transacts with a bank but this data is maintained once and reused many times without being changed. This tutorial will focus on SAP bank master data.

SAP ERP system maintains a list of all the banks that are used by your company or customers and vendors of this company. The list of all banks is called bank directory and for each bank used in SAP system there is a corresponding master data record stored in the bank directory. Before using any bank in the system, you need to create this bank so that it is added to the bank directory. We are going to look into the following topics in more details:

- Managing SAP bank directory

- Managing SAP house banks

- Managing SAP vendor bank accounts

- Managing SAP customer bank accounts

Managing SAP Bank Directory

The bank directory contains addresses and general control data of banks. Each bank that is going to be used needs a master record in the bank directory. Bank master records can be created in the bank directory manually or automatically. In this tutorial, we will learn how to create SAP bank master data in the directory manually. Bank master data has three distinct characteristics which are:

- A bank’s country and a unique code called bank key. These two fields help to identify any bank in the SAP system.

- Address data and control data. For example, postal details and bank group.

- Every bank master record is stored centrally in the bank directory.

Now, I am going to illustrate how to manually maintain a new bank in the bank directory. Go to the SAP system and on the SAP Easy Access screen navigate to the following path:

Accounting - Financial Accounting – Banks - Master Data - Bank Master Record - Create

Alternatively, you can launch the same transaction using the transaction code FI01.

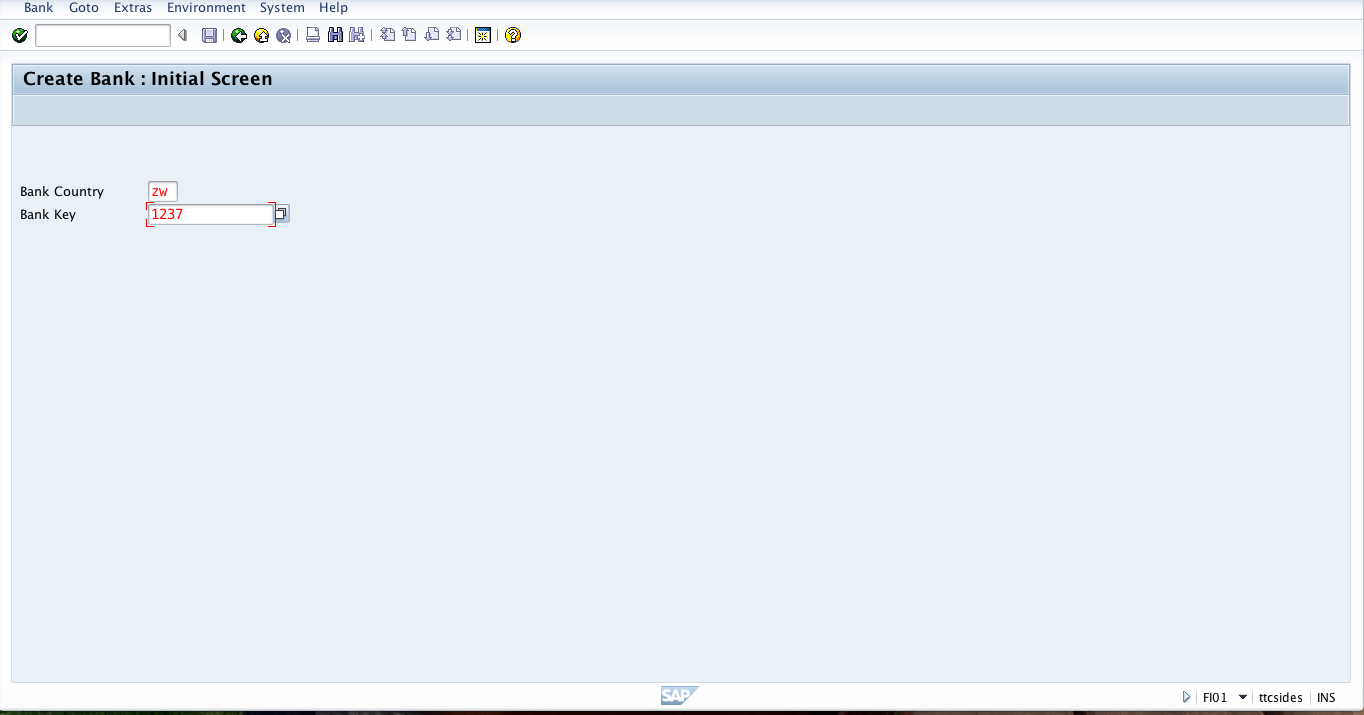

On the initial screen of create bank transaction, enter the bank’s country and the bank key. The bank country identifies the country in which the bank is located. The bank key specifies the key under which bank data from a respective country is stored. The bank key in the master data for the bank is then displayed twice, as a bank number and a bank key.

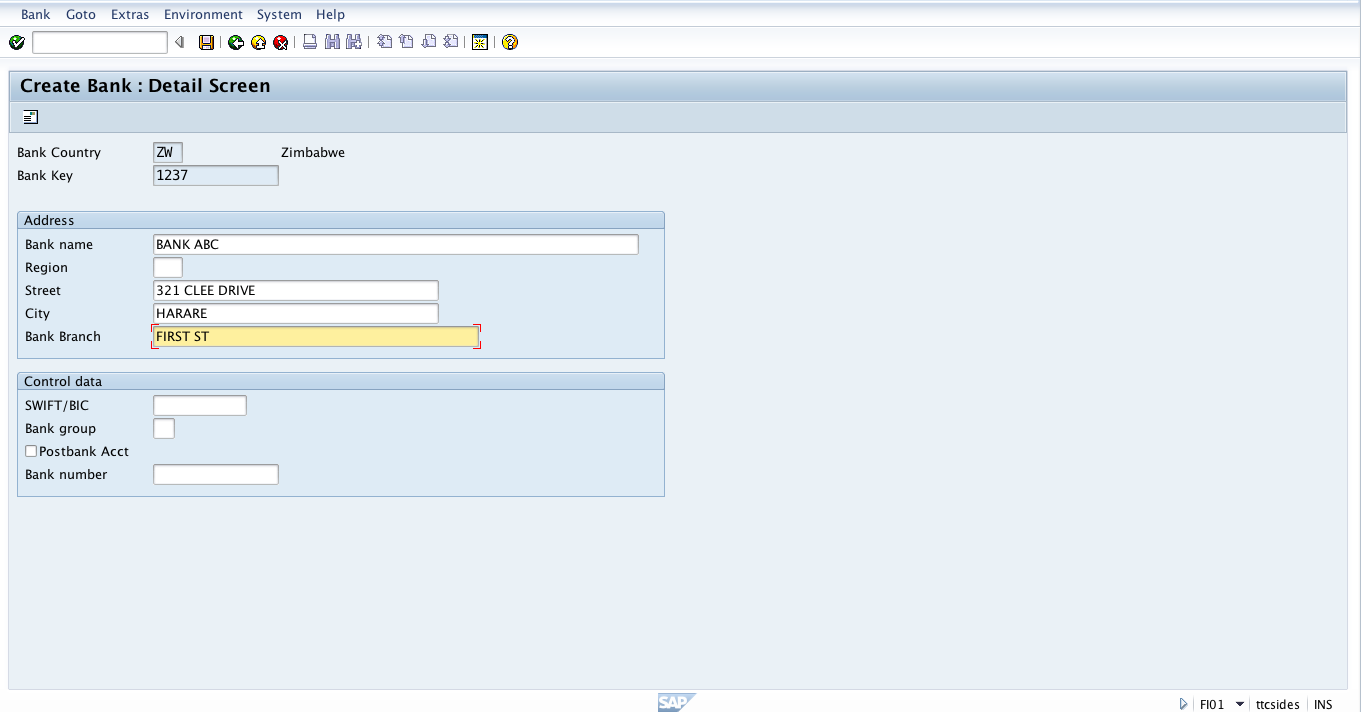

When you press Enter button, SAP system will take you to the next screen where we enter the address data for the bank including the name of the bank, branch and street address.

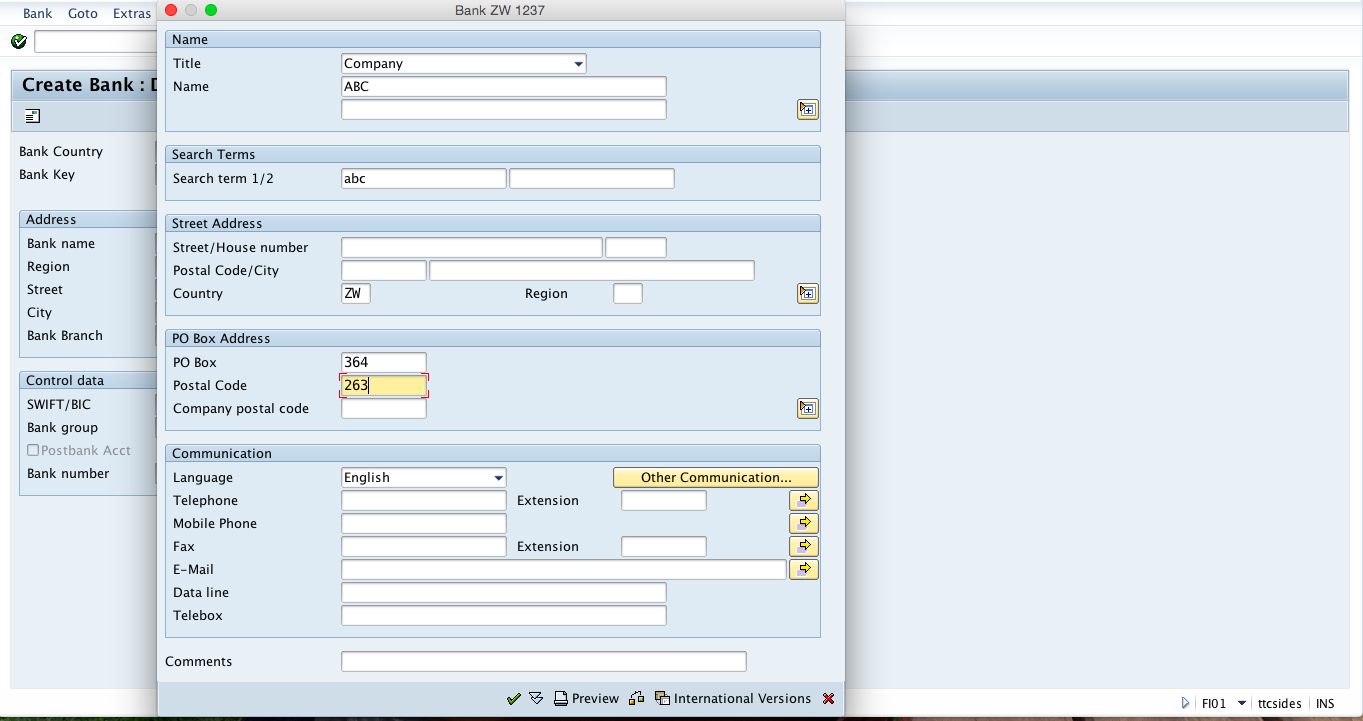

After populating this data, we need to click on the “envelope” icon in the top left corner to add more address details. SAP system will show a pop-up window where you can enter additional address data like fax number, phone number, postal code and email address.

After populating all the necessary additional data, you should press Enter for the SAP system to confirm if all the necessary data was included and then save SAP bank master data. After saving the new bank will be added to SAP bank directory.

Managing SAP House Banks

All the banks that your company uses are called house banks in SAP. SAP house banks contain bank master data, information for electronic payment transactions, bank accounts for each house bank and general ledger accounts for each bank account. Each account that your company holds with a bank is represented in SAP with an account ID. A combination of the house bank ID and an account ID represents the bank account in the general ledger. We are going to show how create a house bank in SAP.

To create a house bank in SAP, go to the customizing transaction SPRO. Then navigate to the following menu item:

Financial Accounting (New) - Bank Accounting - Bank Accounts - Define House Banks

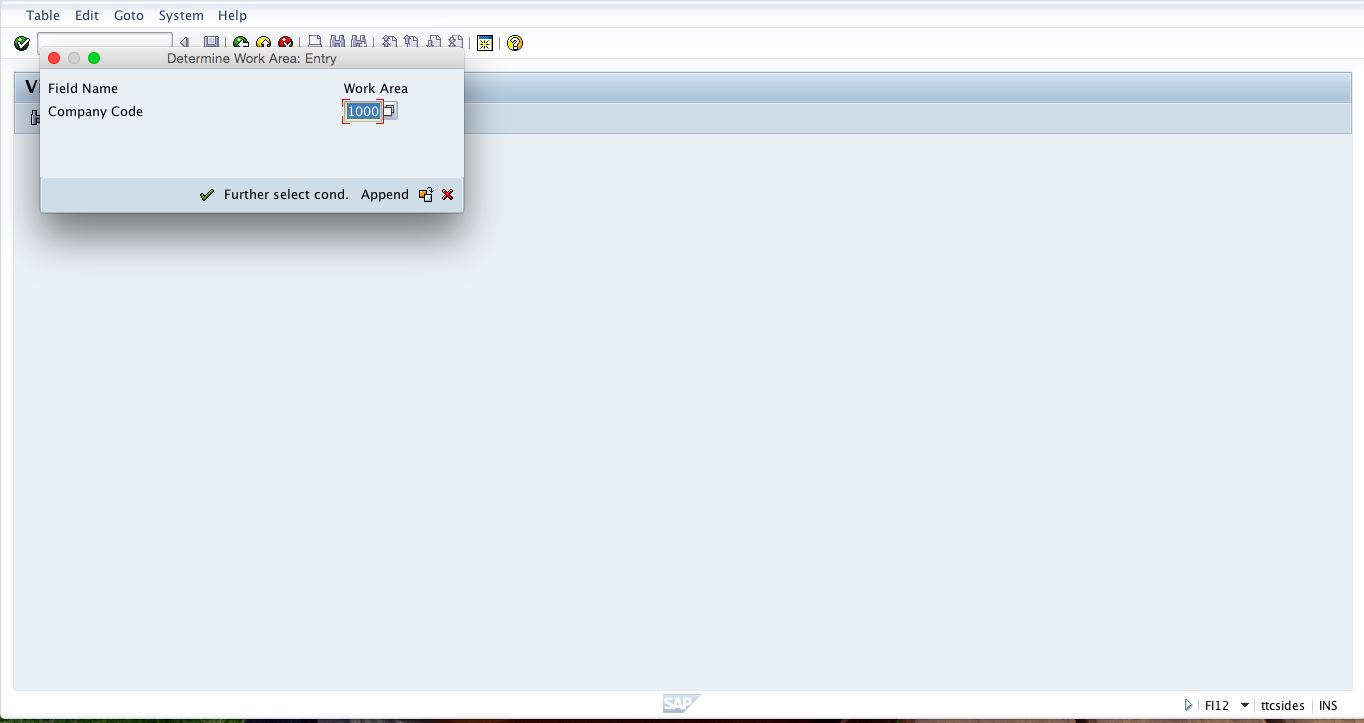

You will be prompted to enter the company code which represents your company.

When you press Enter button the system will take you to the next screen where we define our house banks. Here, you enter the code that you will use to identify the bank in the system and enter the bank’s country and key as shown below.

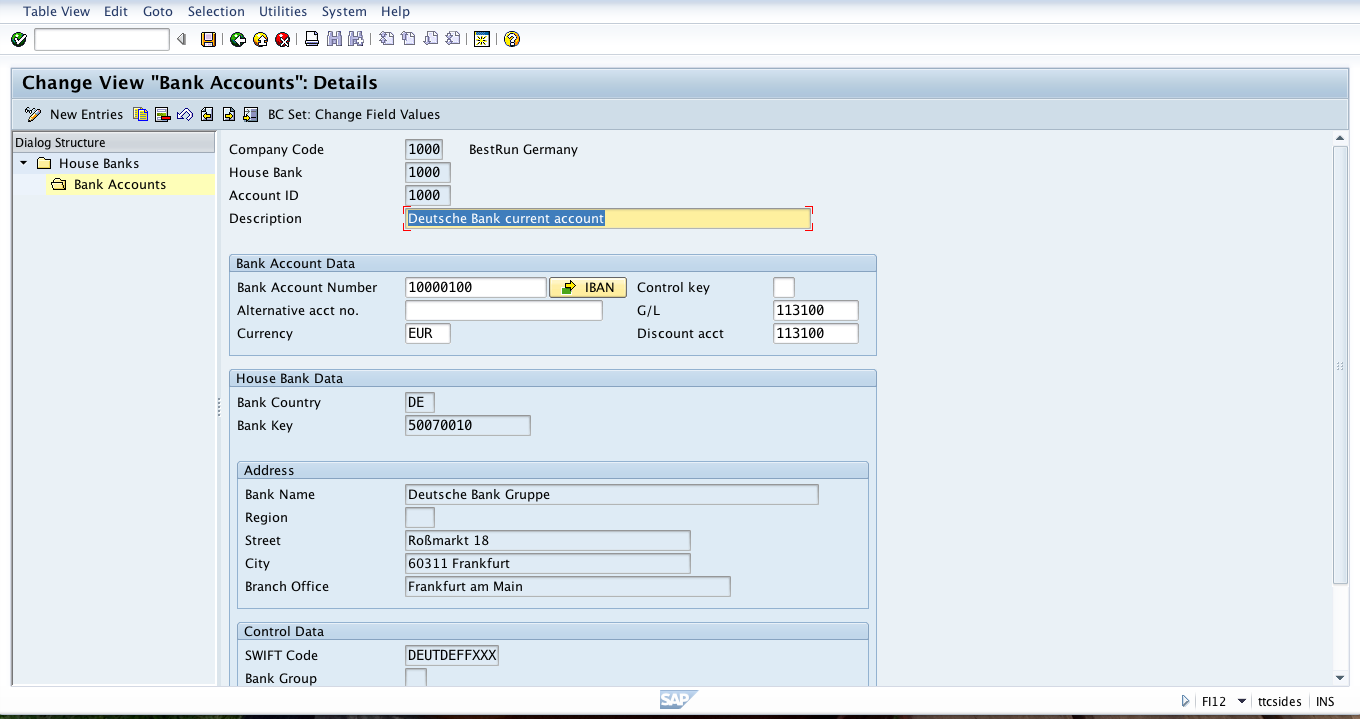

Next, you should click on bank accounts folder on the left sidebar to link the house bank with the general ledger account that you created for that bank. The picture below shows how to link the house bank with the general ledger (G/L) account.

On this screen, you select the general ledger account, currency, the bank account number and also the account ID. And then you should save the data. The SAP system will create an SAP house bank.

Managing SAP Vendors Bank Accounts

When maintaining vendor master records, one of the details that you need to specify is the bank account for the vendor. You can either pick a bank record that is already stored in the bank directory or add a new record in the directory.

Let’s see how to do it. You should go to SAP Easy Access menu and follow the following menu path:

Accounting - Accounts Payable - Master Records - Change

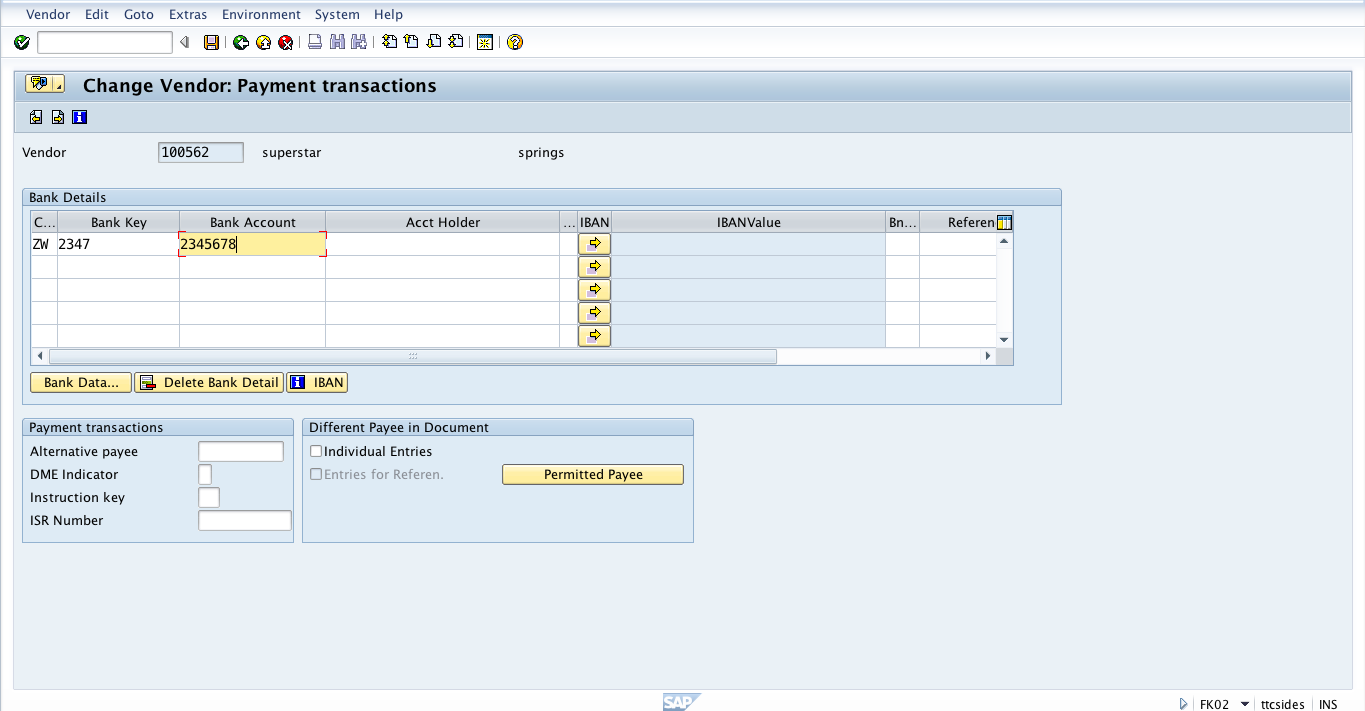

The transaction code for this activity is FK02. The SAP system will take you to a screen where you can create or change a vendor master record. Here, you have to tick Payment transactions checkbox on General data tab and select the vendor and the company code.

Then, press Enter button for the SAP system to take you to the screen where we maintain bank data.

After selecting bank country, bank key and bank account we should click Save. By doing this we have maintained bank data for the vendor.

Managing SAP Customers Bank Accounts

When maintaining customer master record one of the details that you need to specify is the bank account for the customer. You can either pick a bank record that is already stored in the bank directory or add a new record in the directory. Let’s see how to do it. You should go to SAP Easy Access menu and follow the following menu path:

Accounting - Accounts Receivable - Master Records – Change

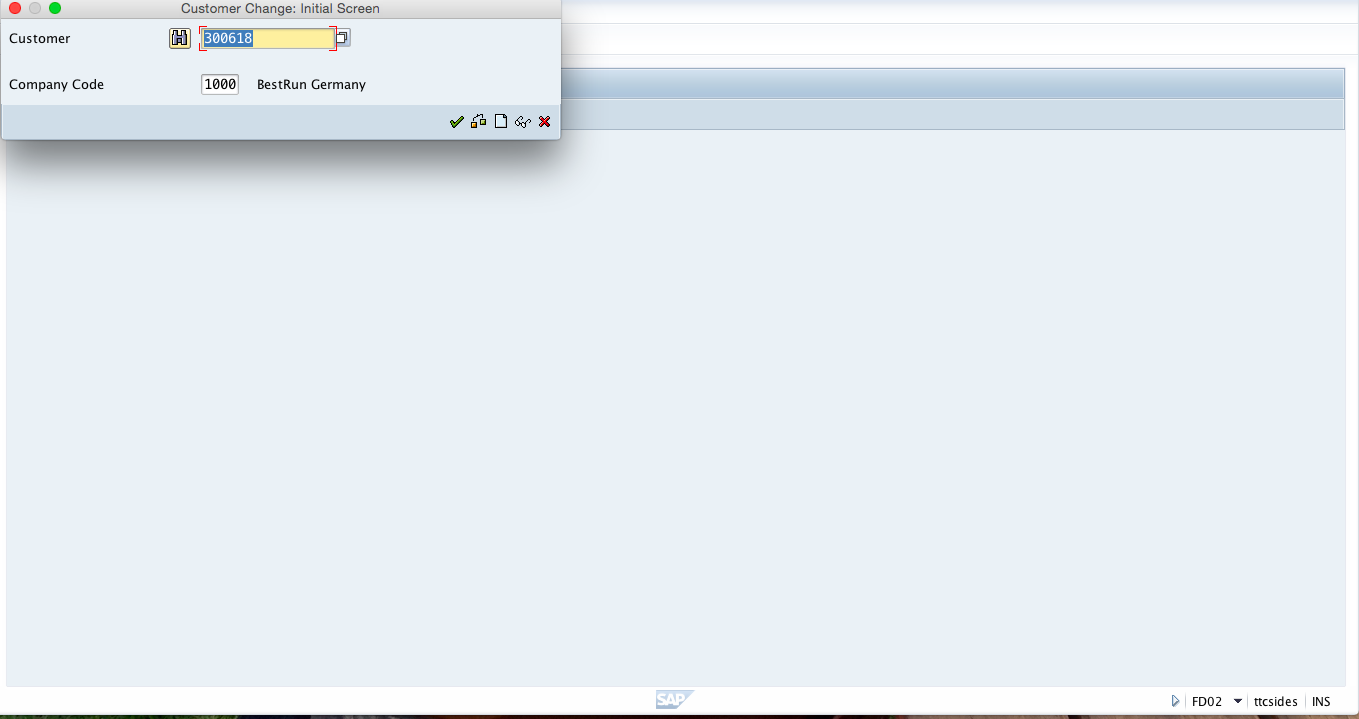

The transaction code for this activity is FD02. The SAP system will take you to the screen where you have to select the customer and the company code.

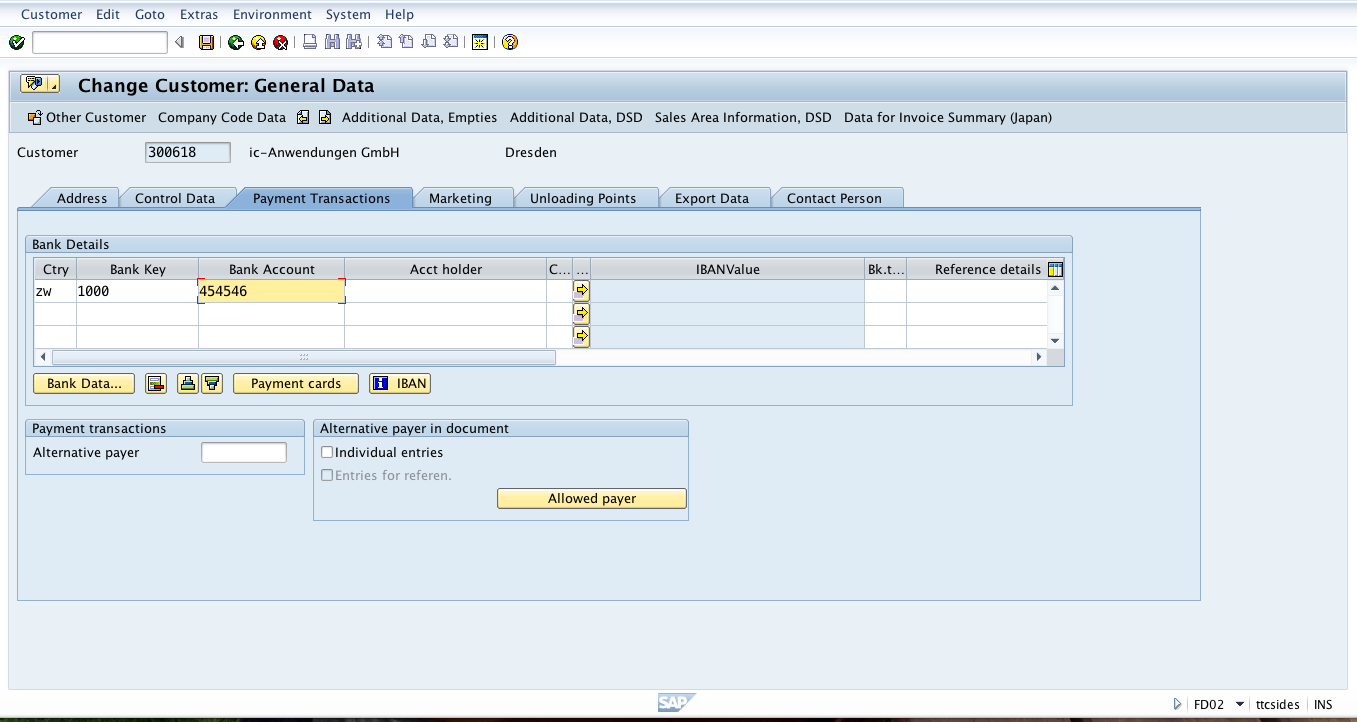

Then, press Enter and choose Payment Transactions tab for the system to take you to the screen where we maintain bank account details for the customer.

Similarly to the process with vendor master records, after selecting bank country, bank key and bank account we should click Save button. This way, we have maintained bank data for the customer.

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP FI Document Types

Go to previous lesson: SAP Vendor Account

Go to overview of the course: Free SAP FI Training

very informative

The author is always methodical and covers the subject comprehensively. This makes the reader comfortable and he truly appreciate the content and approach.

This tutorial is very informative . i hope you will continue posting good material like this. well done

How do we get in touch with the writer of this excellent tutorial

Very useful and explanatory content

Dear

Please suggust me which book is best for sap fico real time configration and also suggest for sap fico error and retifiction book.

Thanks and regards

Kishore chauhan

Please check here: SAP FI Books.

Hi,

May I know how many bank account numbers can be added in FD02. Is there a limit to add the bank details?

No, there is no limit.

Thank you very much for your help

How do we check the Bank Master data change history

There is “Change documents” button in FI02 and FI03 transactions. You can use this button to see change history.

How To create reconciliation Account?

Hi,

Very Nice article. Can you please throw some light on the payment methods? I am struggling to change the payment method at the master level(atleast that is what my payables team is telling me?) due to which lot of customer refunds are pending.

Hi all,

Very informativ, i really appreciate. I have a question, How can i maintain in vendor master data, Bank details different transit number/ Bank branch accordling to vendor bank information, that are in the same bank. Since the bank branch represent in this case the succursale of the bank and need to be define for the EFT file.

Thank you for any hint you can gevi me.

What’s the name of table where customer and vendor bank accounts reside.

Thanks.

Thank you and its very easy way to understand.

very much useful article. Thanks to the Author and his team members.

Is there any configuration that needs to be enabled which automatically creates a Bank Master record when creating a Vendor Master? For example, in current ECC environment for us, say we are creating a new Vendor with a Bank that doesnt exist in BNKA table today. The current config is set up such that, even if it is bank that doesnt exist in BNKA, the vendor creation doesnt throw any error, but creates the bank master automatically and lets us add the bank details on the vendor and create it successfully. So there is something that is triggering FI01 through XK01 or XK02. We are moving to S4 and need this to happen the same way in S4 and not sure where that config is. Any help is greatly appreciated.

I would like to say simply awesome.