This tutorial which is part of our SAP FI course talks about SAP FI Document Types in Financial Accounting. You will learn what is a document type in SAP FI and how to customize them in SPRO transaction. We will mention the SAP transactions and tables that are relevant for this process.

This tutorial which is part of our SAP FI course talks about SAP FI Document Types in Financial Accounting. You will learn what is a document type in SAP FI and how to customize them in SPRO transaction. We will mention the SAP transactions and tables that are relevant for this process.

If you have questions about this topics, please ask them using the comments section at the bottom of this page.

About SAP FI Document Types

SAP FI document types are used to record various business transactions in SAP FI. SAP has delivered many standard document types but new document types can also be created as per the requirement of a company. Document types help organizations in identifying and analyzing business transactions. For example, a document type DZ indicates customer payment, D is the account type of the customer and Z indicates payment.

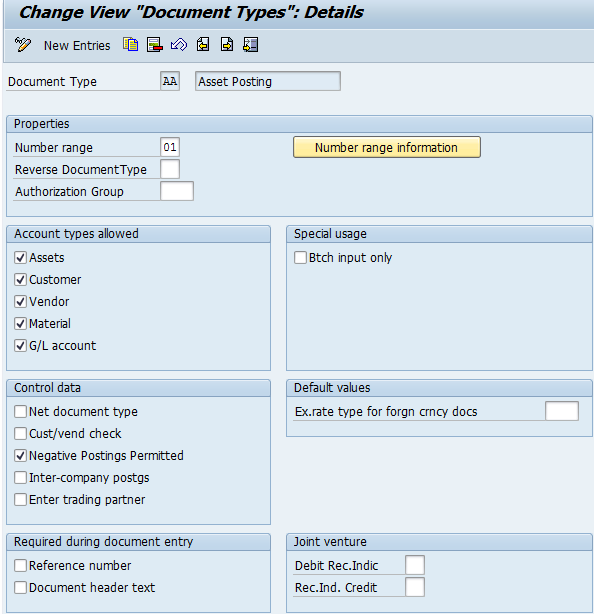

By applying the configuration settings (as we explain below), we can define and limit transactions to a particular document type. Please see the screenshot with document type customizing enclosed below.

Configuration of SAP FI Document Types

Configuration path: SPRO – Financial Accounting (New) – Financial Accounting Global Settings (New) – Document – Document Types – Define Document Types for Entry View

Transaction code: OBA7

Table: T003 (SAP FI Document Types)

The configuration screen contains a number of fields and we will discuss them one by one.

Properties

Number range objects, reverse document type and authorization group configured in the properties section as explained below.

Number range

Number range object will be maintained at the document type level. Number ranges will be maintained at the company code, fiscal year and number range object level. If number ranges are maintained at the company code level, then it is not possible to use the document type.

Reverse document type

Reverse document type maintenance is optional. If no document type maintained, then the posting and reversal document types will be the same. If a different document type required for reversals, then this field to be maintained and number ranges also to be maintained at the company code level.

Authorisation group

It allows to restrict the document type for specific objects.

Account Types Allowed

Restriction of account types mentioned below are at the client level.

Assets

By selecting this checkbox, a document type allows asset transactions.

Customer

By selecting this checkbox, a document type allows customer transactions.

Vendor

By selecting this checkbox, a document type allows vendor transactions.

Material

By selecting this checkbox, a document type allows material transactions.

G/L account

By selecting this checkbox, a document type allows G/L account transactions.

It is not mandatory to choose all the account types or specific account types. As per the requirements of a company you should choose respective account types.

Control Data

It helps to restrict or apply the following checks.

Net document type

This checkbox is applicable only for accounts payable to deduct cash discounts while booking invoices. It is optional.

Customer/vendor check

To restrict either multiple vendors or multiple customers in a document this checkbox to be selected. It is also possible to post multiple line items to the same vendor.

Negative postings permitted

By selecting this checkbox, the SAP systems helps to reverse incorrect postings for each item to remove the effect on transaction figures.

Inter-company postings

To be selected to allow intercompany postings.

Enter trading partner

To be selected to allow manual input of a trading partner while booking transactions.

Required during Document Entry

Fields enclosed below can be marked as mandatory at the document type level.

Reference number and Document header text

By selecting these checkboxes, reference number and document header texts fields will become mandatory fields. It is also possible to maintain these fields as either optional or required at the G/L account field status group level.

Special usage

Batch input only

To restrict document type only for batch input postings, this checkbox to be selected. For example, if a document to be restricted for manual postings and to allow only batch input postings, then this check box to be selected.

Default Values

Exchange rate type for foreign currency documents

Exchange rate type ‘M’ fetches automatically while booking any transaction. To overwrite this, we can specify the exchange rate type at the document type level, so the SAP system will not use ‘M’. If the exchange rate type is not maintained, then the SAP system fetches the exchange rates maintained at ‘M’ level by default.

Joint Venture

Debit Rec.Indic and Rec.Ind. Credit

These checkboxes are applicable for joint venture accounting only. To share incurred costs, these indicators to be defined at the document type level. The costs will be settled through periodic settlement.

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP FI Document Structure

Go to previous lesson:

Go to overview of the course: Free SAP FI Training

Hi Cleo,

Thanks for all the SAP FI Training mails!! I havened received any mails after this lesson 3.1.

Regards,

Christoff

When we do the postings in G/L, document type automatically changes,

like if we do the postings in SA document type it changes to SB after posting. Why and can we control it?

It’s a valuable information.

Thanks a lot.

i have got an error of F5092 ” document type AB must have internal number assignment for reversal”

Please Suggest

Thanks