In this SAP FI tutorial, we will talk about SAP exchange rates in SAP Financial Accounting. You will learn what is an exchange rate in SAP FI and what are the configuration steps for foreign currency valuation in SAP system. We will mention the SAP transactions and tables that are relevant for this process.

Exchange Rates in SAP

SAP exchange rates are to be maintained to allow transactions in other than the company code currency or to book foreign currency transactions and update values in parallel currencies in the New G/L accounting.

For example:

A company code currency is INR but it purchased material in USD currency, so in this case first translation ratios are to be maintained for INR/USD and USD/INR combination. After that SAP system will allow to specify an exchange rate against INR/USD and USD/INR combinations.

Exchange rates fluctuate every day and for this reason exchange rates are to be maintained on a daily basis. In the real time scenario, an organization receives a daily exchange rate file through banks or third party team that uploads it to the SAP system.

In New GL accounting, SAP has provided a functionality called parallel accounting, i.e. for a company code an additional two parallel currencies can be maintained. With the help of the exchange rate the SAP system will update values in additional currencies so it is helpful for management to view different reports at company code currency and group currencies levels.

Prerequisites

- Currency translation ratios to be maintain – Transaction code OBBS

- Currency exchange rates – Transaction code OB08

Month End Activities

To prepare financial statements of an organization the foreign currency valuation is to be performed. Through this step foreign currency transactions will convert to company code currency and exchange rate loss or gain will be determined. It is possible to reverse foreign currency postings.

Prerequisites for Foreign Currency Valuation

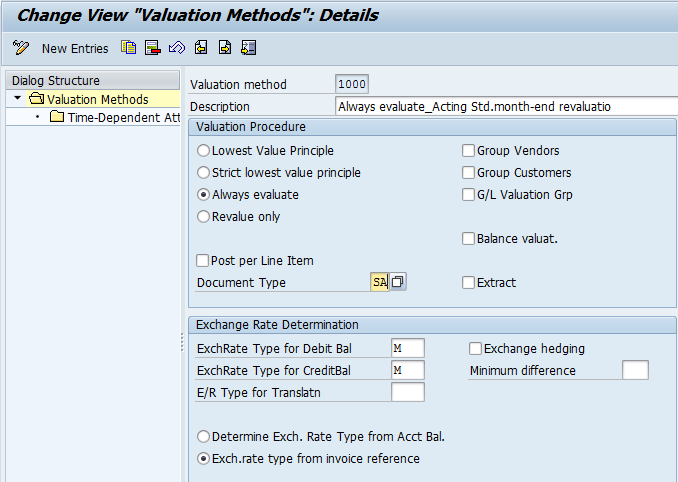

Valuation Method

It is necessary to define the valuation approach to perform foreign currency valuation for open items and balances.

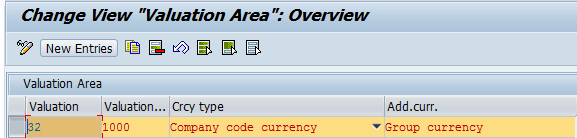

Valuation Area

A valuation area is necessary to report different valuation approaches and post to different accounts. It is assigned to a valuation method.

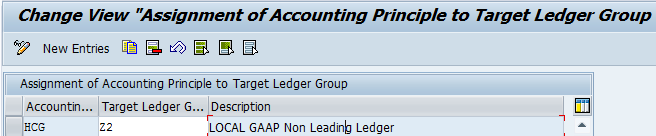

Assignment of Accounting Principle of Target Ledger Group

A ledger group will be assigned to an accounting principle. For example, the accounting principle GAAP is assigned to the leading ledger Z2.

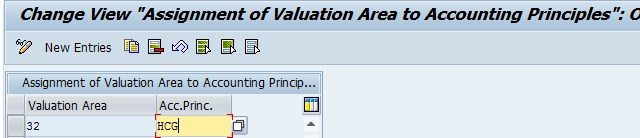

Assign Valuation Areas and Account Principles

An accounting principle needs to be assigned to a valuation area.

Prepare Automatic Postings for Foreign Currency Valuation

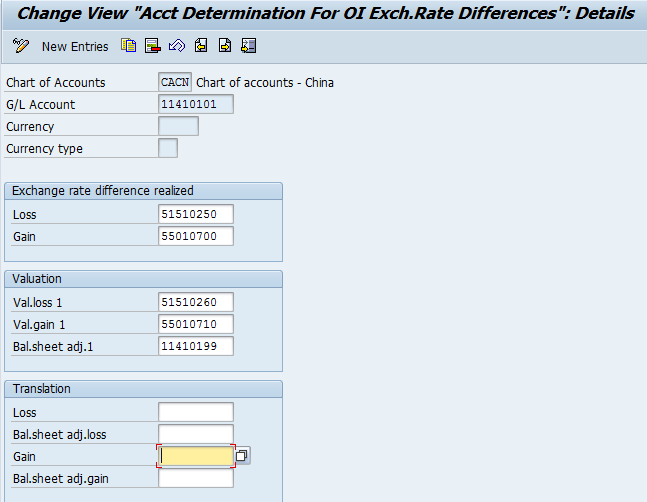

Here G/L accounts need to be maintained to post exchange rate gain or loss for each G/L account.

Path: SPRO – SAP reference IMG - Financial Accounting (New) - General Ledger Accounting (New) - Periodic Processing – Valuate - Define Valuation Methods, Define Valuation Areas, Check Assignment of Accounting Principle to Ledger Group, Assign Valuation Areas and Accounting Principles and Prepare Automatic Postings for Foreign Currency Valuation

Transaction: FAGL_FC_VAL

Tables: T030H (Acct Determ.for Open Item Exch.Rate Differences)

T030HB (Acct Determ.for Open Item Exch.Rate Differences)

FAGL_BSBW_HISTRY (Valuation History for Documents)

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP Exchange Rate Table

Go to previous lesson: Currencies in SAP

Go to overview of the course: Free SAP FI Training

Just be careful of some minor gramatical errors throughout the course. For example:

- “Exchange rates fluctuate every day and for this reason exchange rates are to be maintain[ed] on [a] daily basis.”

- “for a company code [an] additional two parallel currencies can be maintained.”

Overall a very helpful learning guide though 🙂

Thank you for pointing out these typos! We’ve updated the tutorial.

why two loss and gain GLs what is the difference?

Dear ERProof Team,

I think the transaction code as mentioned in this post for maintenance of exchange rate should be OB08 and not OBB8. OBB8 is for maintenance of payment terms.

Refer the heading Prerequisite (in the post above)

Thanks for spotting this error! We’ve updated the tutorial.

Hello please refer the sales system table for BW Business warehouse Which is

Thanks

in 1.6 module 1 T030H and T030HB are refered for the same. please clear the difference between both of them.

thanks

regards