This tutorial which is the part of the free SAP FI course talks about SAP Accrual Deferral Posting.

This tutorial which is the part of the free SAP FI course talks about SAP Accrual Deferral Posting.

Accrual of an expense is reporting an expense in the period in which they occur irrespective of the payment made. Expenses are reported in the period in which they occur, and that period is prior to the period in which the payment is made.

Deferral of expenses means that a payment is made in one period, but the expense itself will be reported as an expense in a later period.

In Accrual/Deferral document method, provisions are made on a month’s end and the same are reversed on the next month’s first working day.

Accounting of Accrual Deferral Posting

Accounting implication of accrual of expenses can be seen on the following example. Suppose that we make a provision for rent on 23.11.2017 and reverse the same on 01.12.2017.

On 23.11.2017:

Provision for rent

Rent a/c dr 50000

to outstanding expenses a/c 50000

On 01.12.2017:

Reversal of provision

Outstanding expenses a/c dr 50000

to rent a/c 50000

Now, suppose the actual rent is paid on 05.12.2017.

On 05.12.2017:

Rent Payment

Rent a/c dr 50000

to bank a/c 50000

SAP Accrual Deferral Posting

In this tutorial, we are going to explain how these accounting postings are done in SAP FI. Here are the steps involved in SAP accrual deferral posting:

- Define reversal reason

- Enter accrual/deferral document

- Reverse accrual/deferral document

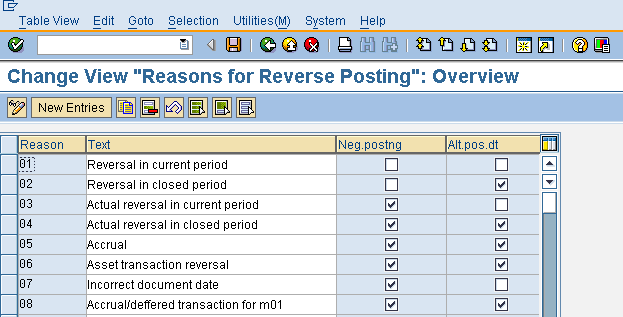

Step 1: Define Reversal Reason

Path: SPRO -> Financial Accounting -> G/L Accounts -> Business Transactions -> Adjustment Posting/Reversal -> Define Reason for Reversal

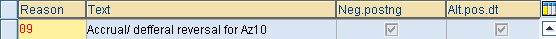

Click New Entries button and define Reason 09 with the following parameters:

- Text: Accrual/deferral reversal for AZ10

- Negative posting: Check this indicator. When we reverse a transaction, it will be shown at the same side instead of being shown on the other side. For example, if we reverse rent provision on 01.12.2017, it will be shown as the negative balance on the debit side instead of credit side, so that the net effect is zero.

- Alternative posting date: Check this indicator. If we do not select this, the system allows us to reverse document only on the original posting date. If this check is selected, it allows reversal entry on any date.

Now save it.

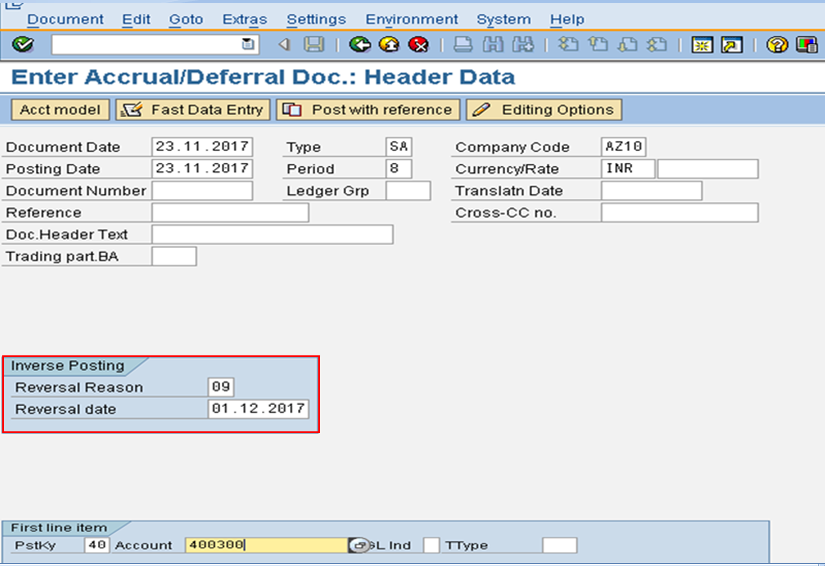

Step 2: Enter Accrual/Deferral Document

Path: Accounting -> Financial Accounting -> General Ledger -> Periodic Posting -> Closing -> Valuate -> Enter Accrual/Deferral Document

Transaction code: FBS1

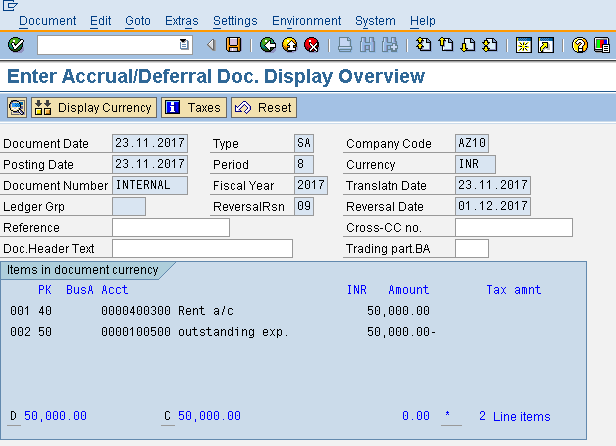

We will post a normal provision for rent by using FBS1 transaction and we will give a reversal reason and a reversal date. Document is posted on 23.11.2017 and is reversed on 01.12.2017. It means that provision of rent is made on 23.11.2017 and the same is reversed on 01.12.2017. This activity is a part of month end provisions in any company.

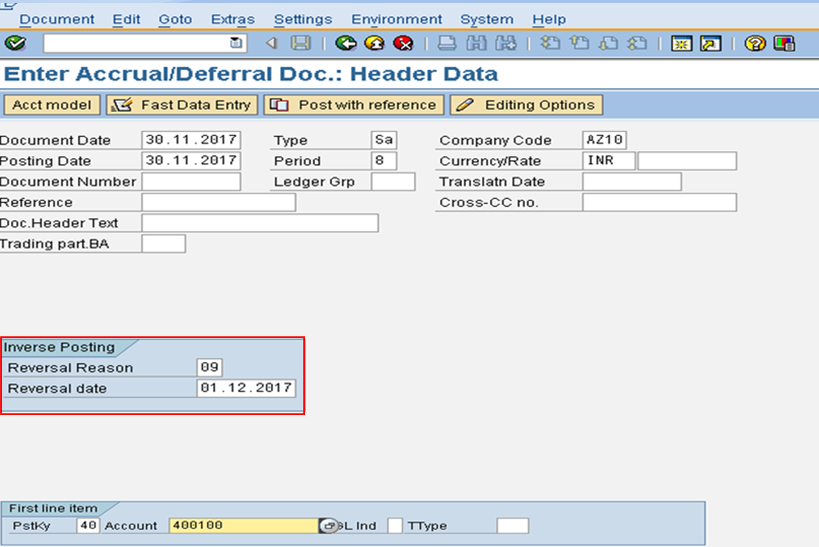

Enter Reversal Reason as 09.

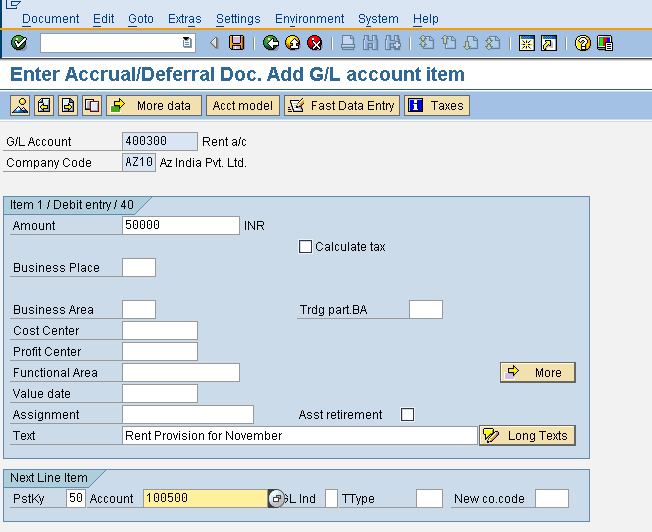

In the next screen, enter the amount of provision to be made and text.

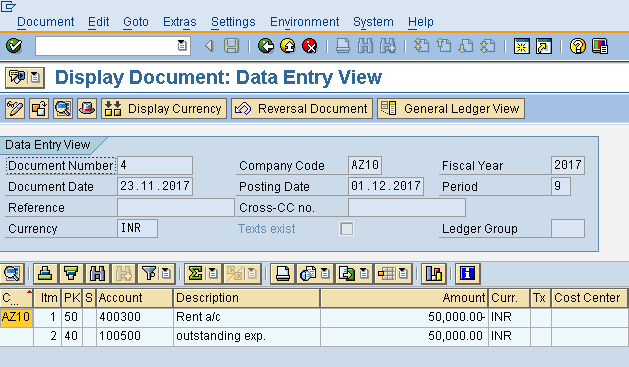

Now, post the transaction. Below is the document posted. Rent account will be debited and outstanding expenses account will be credited.

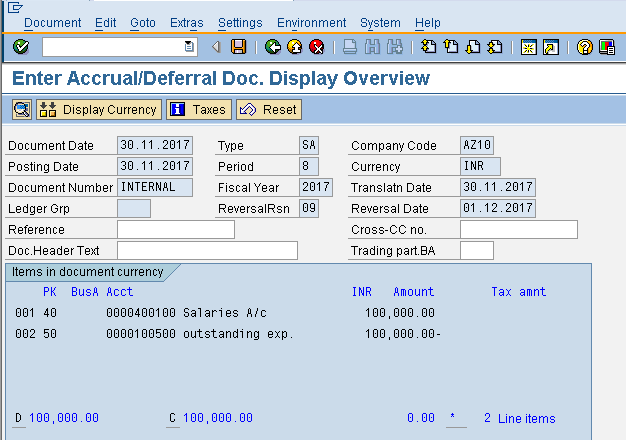

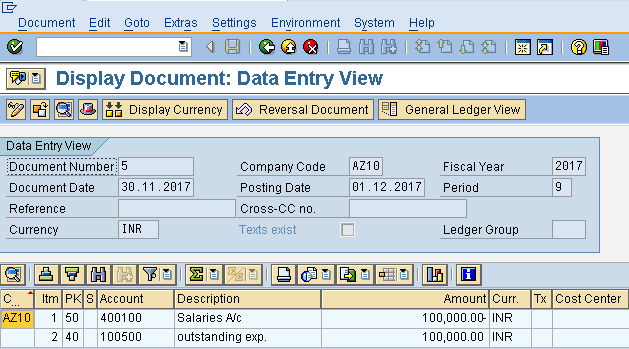

We will post one more transaction for provision of salaries on 30.11.2017.

Salaries account is debited and outstanding expenses account is credited.

Step 3: Reversal of Accrual/Deferral Document

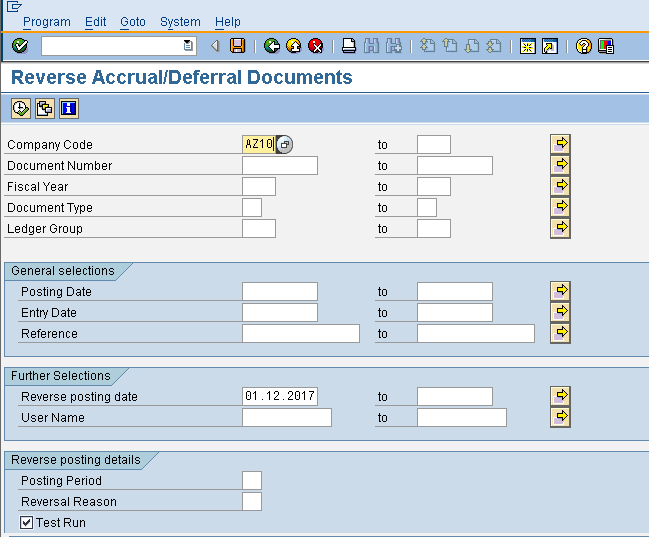

Path: Accounting -> Financial Accounting -> General Ledger -> Periodic Posting -> Closing -> Valuate -> Reverse Accrual/Deferral Document

Transaction code: F.81

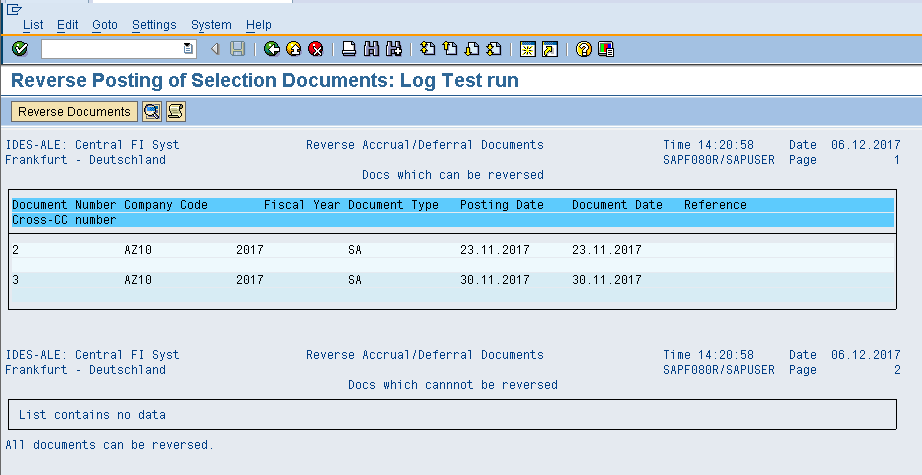

Now, we will reverse the rent provision and salaries provision by entering transaction F.81 in the command field. Then, we will enter company code, reverse posting date, check test run and click on execute button.

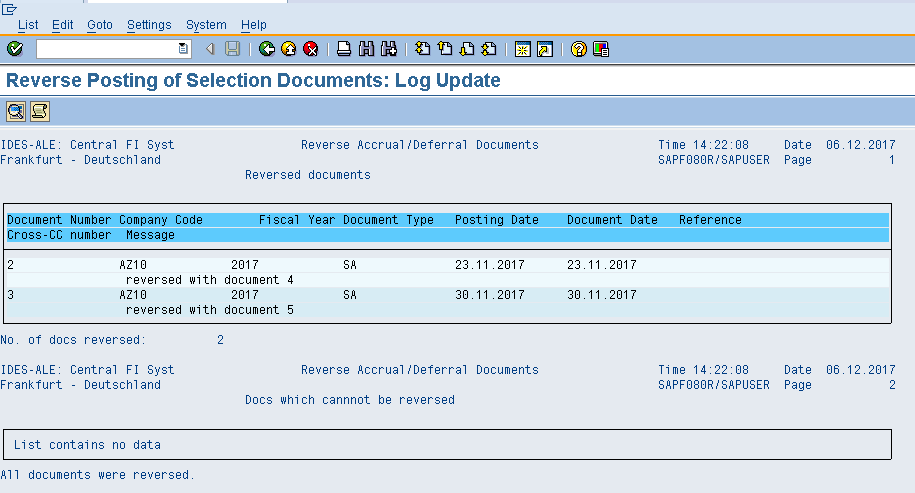

After this, we will click on ![]() button and the SAP system will show a message that the document has been reversed like shown below.

button and the SAP system will show a message that the document has been reversed like shown below.

Document #2 (rent provision) is reversed with document #4, and document #3 (salaries provision) is reversed with document #5.

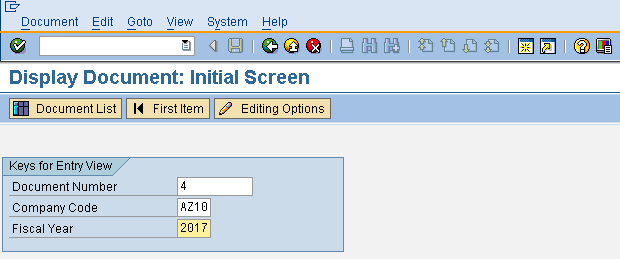

We can also view the reversed document by using transaction FB03 (Display Document).

The rent account is credited and the outstanding expenses account is debited.

Similarly, the salaries account is credited and the outstanding expenses account is credited.

I hope this tutorial gives you a good understanding of the concept of SAP accrual deferral posting.

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson:

Go to previous lesson: SAP Regrouping Receivables Payables

Go to overview of the course: SAP FI Training

Its simply superb. Thank you .And if possible give more explanation on FI month end activities.

Closing Checklist:

Hi

please check this out for year-end closing activities check list

Check List for FI Year End Closing

1 Execute Report for InterCompany Activity & Journal Entries

2 Open posting period for next yr

3 Run Business Area’s Assignment report.

4 Review list of recurring journal entries

5 Execute Recurring Entries for A/R, A/P, G/L

6 Process Parked A/R, A/P, G/L accounting documents

7 Final Cutoff for the Maintenance of Fixed Asset- Add Transfer and Retire

8 Run Depreciation in Test Run and post

9 Verify Display Log for Depreciation Test Run

10 Capitalize AUC Assets if needed

11 Enter Payroll Data to SAP

12 Verify Depreciation Balances with GL balances

13 Post Depreciation

14 Execute Asset History Report, and retire assets if needed

15 Adjust specific depreciation areas if necessary

16 Reconcile AM subledger with GL

17 Check Bank Data

18 Review AR Open Items

19 Review AP Open Items

20 Execute Pending Invoices

21 Clear Open Item for GRIR, freight

22 Reconciliation of Financial Documents and transactional figures

23 Open new CO Posting Period

24 Compare current (cost estimates) with last current price (Moving Avg)

25 Update current cost price to material master price field.

26 Process Freight charges, Match SD freight to actual

27 Review Internal Order Postings

28 Settle All Orders

29 Verify All Post Goods Issue have been Invoiced (Billing Due List)

30 Review SD Billng Doc from prior mth that have not yet been released to accounting

31 Reconciliation of MM movements in Transit Intra-SAP to NonSAP

32 Reconcile PI Inventory with SAP

33 Perform Manual Adjustment if needed

34 Verify balance of the GR/IR account

35 Post Accruals and Deferrals

36 Clearing of Cancelled Documents

37 Check Profitability Segment Adjustment

38 Aging Report-Reconcile GL balances with subledger balances AP

39 Check the check run numbers

40 Bank reconciliation Data

41 Enter Tax Journal Entry

42 Reconcile GL balances with subledger balances AR/MM/AP

43 Display Balance Sheet Adjustments

44 Post Balance Sheet Adjustments

45 Post Foreign Currency Valuation (foreign exchange)

46 Check generic cost centers for posting with wrong accounts

47 Correct wrong postings on generic cost centers

48 Check Validation dates for Cost Centers, Cost Elements, CO area

49 Check COGI–for both month end and year end

50 Doubtful receiviables

51 Verify In-transist Inventory

52 Reconcile PA to G/L

53 Post Cost Centre Assessments and Distributions

54 Run CO-FI Reconciliation to balance

55 Run BW reports P&L and Balance Sheet

56 Maintain CO yr variant

57 Fiscal Yr Balance carryforward AP/AR/AM

58 Fiscal Yr Balance carryforward CO

59 Fiscal Yr balance carryforward FI

60 Fiscal Yr balance carryforward PCA

61 Set Document number ranges – FI – new year

62 Set Document number ranges AP/AR – new year

63 Generate Financial statement Reports

64 Change Fiscal Year For Assets

65 Year end Closing– Asset Accounting–final for year end

66 Close CO Posting Period

67 Close Prior A/R Posting Period

68 Close Prior A/P Posting Period

69 Close Prior MM Posting Period

70 Reverse accruals and deferrals for the new month

71 Reconciliation of Financial Documents from old fiscal year and new fiscal year

72 Load Balances, Budget Data for Cost centers, sales

73 Update Retained Earning Account , balance carry fwd

Accounting implication of accrual of expenses can be seen on the following example. Suppose that we make a provision for rent on 23.11.2017 and reverse the same on 01.12.2017.

On 23.11.2017:

Provision for rent

Rent a/c dr 50000

to outstanding expenses a/c 50000

On 01.12.2017:

Reversal of provision

Outstanding expenses a/c dr 50000

to rent a/c 50000

Now, suppose the actual rent is paid on 05.12.2017.

On 05.12.2017:

Rent Payment

Rent a/c dr 50000

to bank a/c 50000

Don’t understand this example. in this example the rent expense is booked in financial statements in november as well as december..?? why.. According to me it should be:

in Nov-

Rent 50,0000 (Dr)

To Outstanding Expense 50,000 (Cr)

And in Dec.

Outstanding Expense 50,000 (Dr)

To Bank 50,000 (Cr).

In this way we are not charging the rent in December.. Please correct me if i’m wrong.

Thanks

To make my above question simple. is it compulsory to make a reversal of accrual and deferral expenses in SAP or we can use the method that i mentioned in above Question?

Hi there

Accrual is accumulation of expense items until it becomes due for payment. Mere creation of provision will not help…as it comes under operating costs. Thus we need to reverse it and thereafter it is paid in the next month December.

Rashid,

SAP Accrual Deferral Posting, are part of period end Activities. Few Cases are as :

Rent for the Month of Dec 2018, will be paid on or before 15 Jan 2019. The Entry will be executed in the books on Jan 15, 2019 (Actual Payment) But as the said rent is for the Month of Dec 2018, it is due to be payable on 31 DEC 2018. As part of Period end closing. An entry is executed on 31st Dec & the same is Reversed on 01st Jan 2019. Actual Payout is posted, as on when basis.

This example is related to the expense for november. You will have to do the same accrual for December.

I think they are using outstanding expenses GL account with out maintaining open item management so that current month can be closed

regarding the above example what will happen rent paid on 5.12.2017

actual rent entry will be posted , rent a/c ( 40)

cash a/c (50)

Harmeet

many thanks for your efforts, just i have an inquiry

is it available reverse the original entry automatically via the same entry t-code , i mean without use F.81

Automatic reversal is not possible. However using FBS1 and F.81 can be used for that purpose.

Is there a way to use a mass upload function with FBS1? Or to add a reversal date and reason to ZFJ1 (transaction code we currently use to mass upload journals)? Thanks!

Accruals deferral is a mandatory double posting. In an accruals deferral settlement, usually posted with the last day of the month as the posting date, the system calculates the same amount as the amount for the final settlement. The associated clearing posting with side-inverted accounts is usually created with the first day of the following month as the posting date. With a view of the two-month period, both postings have zero balance. Currency rate differences between settlement and other currencies, such as home currencies, do not zero out automatically through this settlement run.

Hi

Want to know about Batch Input Session ( T Code: F.14)

Will it Create actual entries for all recurring documents?

Why Document Header shows FBD5 instead of F.14?

Great explanation. Thank you!