As part of an organization’s SAP Financial Accounting closing process, there are two requirements to regroup accounts receivables (AR) and accounts payables (AP). The first requirement is to show receivables with a credit balance as payables and payables with a debit balance as receivables. The second requirement is to sort items based on remaining terms for balance sheet reporting. SAP has provided functionality to accommodate both requirements using report FAGL_CL_REGROUP. This tutorial will examine the basic configuration needed for SAP Regrouping Receivables Payables process as well as look at an example of the report execution to sort items and process transfer postings.

As part of an organization’s SAP Financial Accounting closing process, there are two requirements to regroup accounts receivables (AR) and accounts payables (AP). The first requirement is to show receivables with a credit balance as payables and payables with a debit balance as receivables. The second requirement is to sort items based on remaining terms for balance sheet reporting. SAP has provided functionality to accommodate both requirements using report FAGL_CL_REGROUP. This tutorial will examine the basic configuration needed for SAP Regrouping Receivables Payables process as well as look at an example of the report execution to sort items and process transfer postings.

SAP Regrouping Configuration

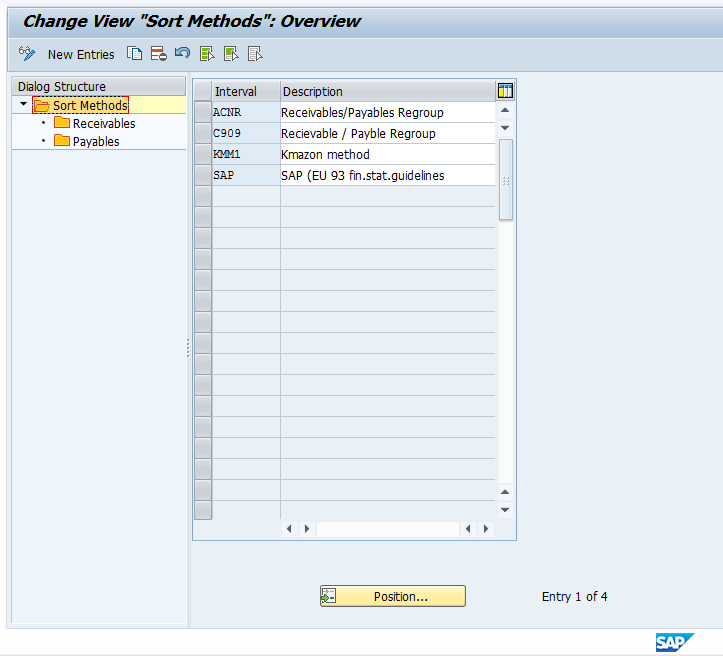

To use report FAGL_CL_REGROUP, also called the regrouping program, you must first define a sort method interval in customizing. Here you will create the sort method that will be used as the basis for executing the report along with its associated value keys. You will then define the reconciliation accounts to be selected, along with the adjustment account that will posted to and the transfer account used for the offset.

To view the configuration for sort method intervals, use transaction code OBBU or the following menu path.

SPRO > SAP Reference IMG > Financial Accounting (New) > General Ledger Accounting (New) > Periodic Processing > Reclassify > Transfer and Sort Receivables and Payables > Define Sort Methods and Adjustment Accts for Regrouping Receivables/Payables

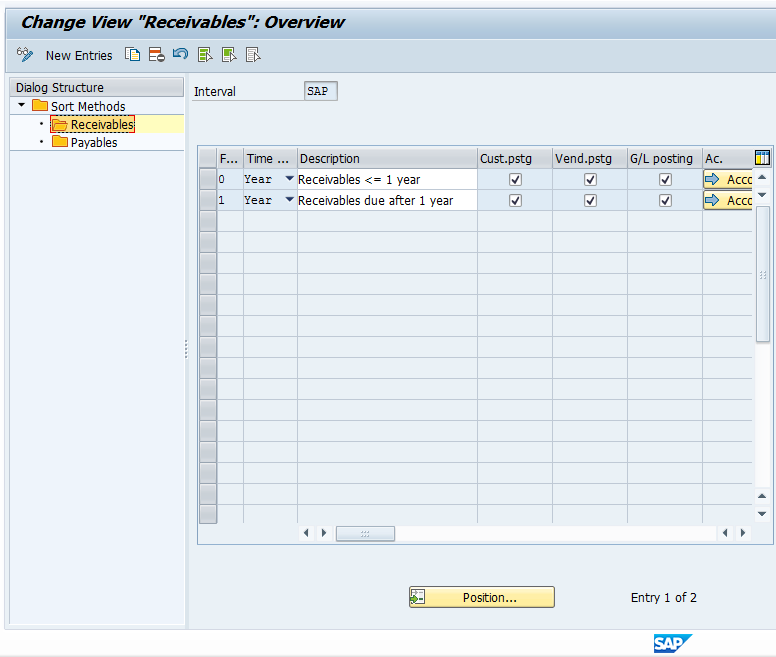

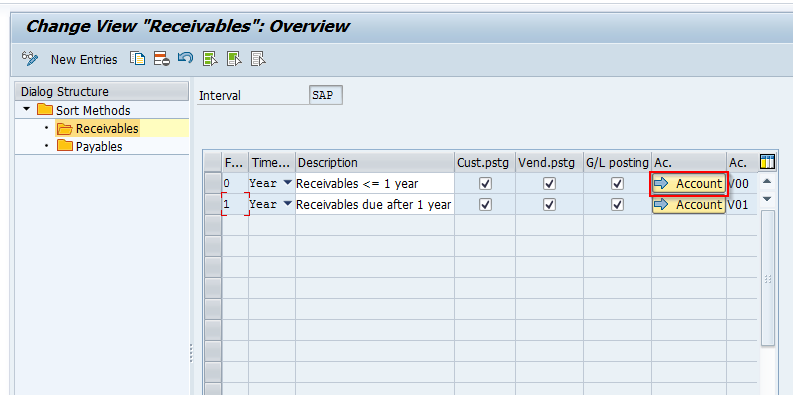

To take a look at one of the existing intervals, place your cursor on one of the existing sort methods to highlight the row and then double click on the receivables folder on the left. In this example, we will look at the sort method interval SAP. After opening the Receivables folder, you will come to the following screen.

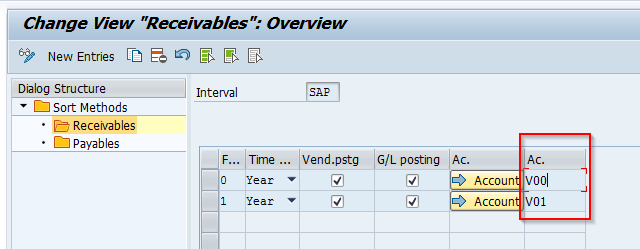

Here the configuration contains two account determination keys set up for this particular sort method. If you scroll a bit to the right, you’ll see the values (V00 and V01).

These keys represent time intervals for the sort method, the type of postings will be selected, and how they will be managed. They also are linked to the specific G/L accounts to be considered during processing.

The first key within the receivables folder, V00, is defined for customer postings, vendor postings, and G/L account postings with a receivable due date less than or equal to one year. The second key, V01, is for the same posting types but for items with a remaining due date of greater than a year.

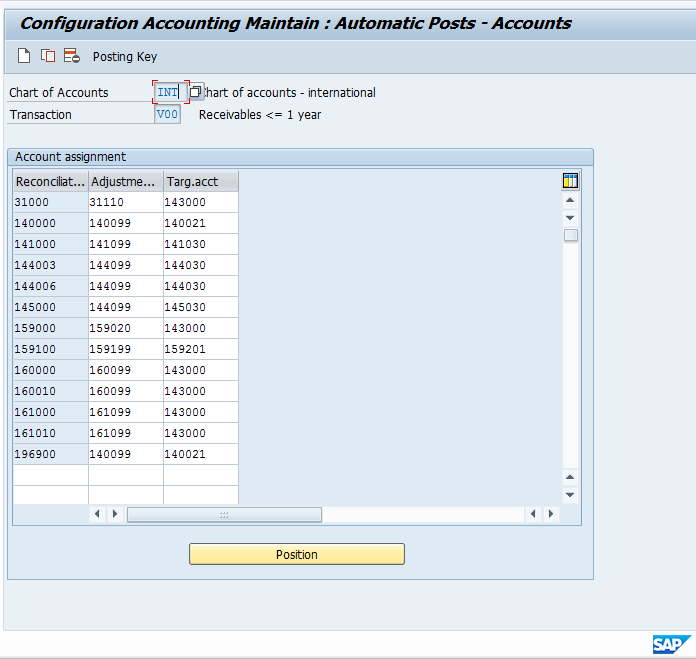

Now, click on the Account button for the first account key. You will be asked for chart of accounts. Enter the chart you are working with. This example looks at the INT chart of accounts.

Here you will see a list of accounts used for the key.

The left column is for reconciliation accounts that will be selected and considered for sorting and grouping. The middle column is for the adjustment account that will be posted to. The right column is for the target account in which the offset posting will occur.

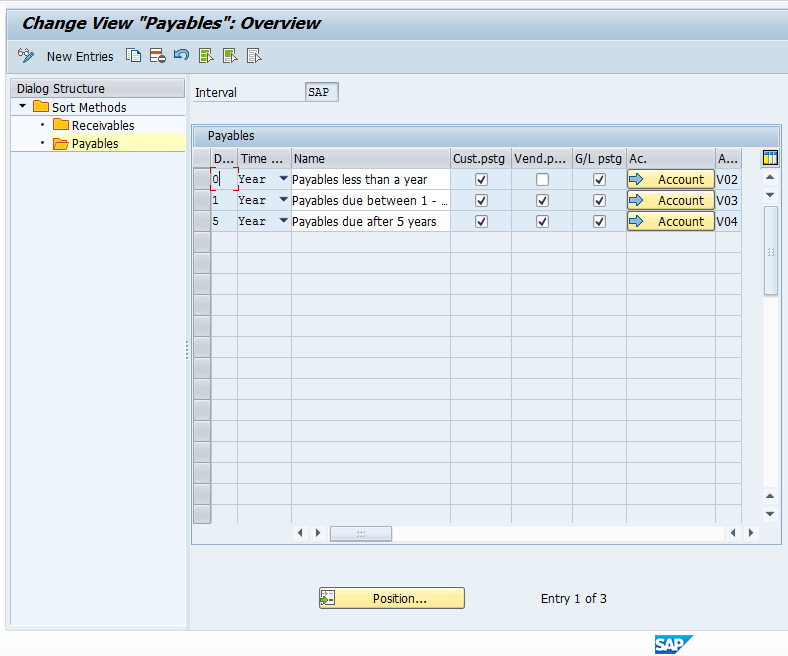

You can now click on the green arrow back and then double click on the Payables folder for the Sort Method.

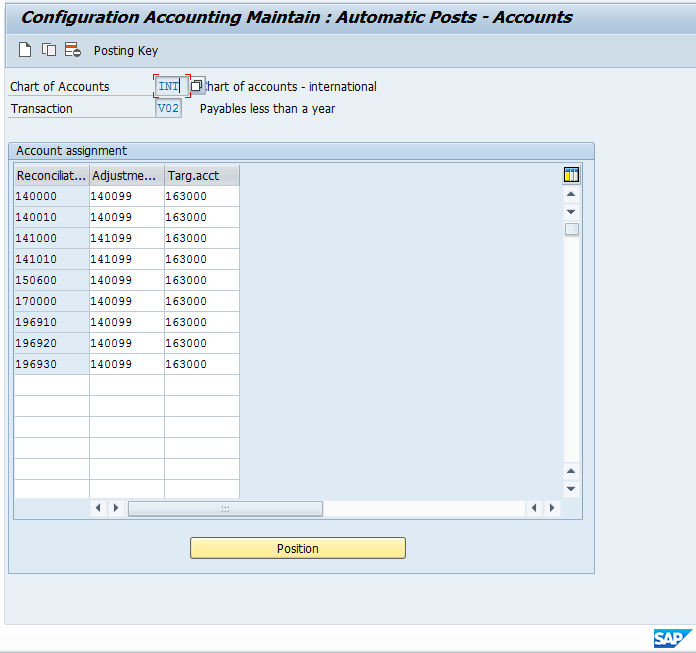

Here we have three account determination keys. The same logic applies here as explained for the Receivables folder. Click on the Accounts button for the first Account Determination key to view the automatic account configuration for V02.

Again, here we see the accounts that will be considered for sorting and grouping with offsetting target accounts.

Remember that this configuration for automatic postings is chart of accounts specific.

SAP Regrouping Processing

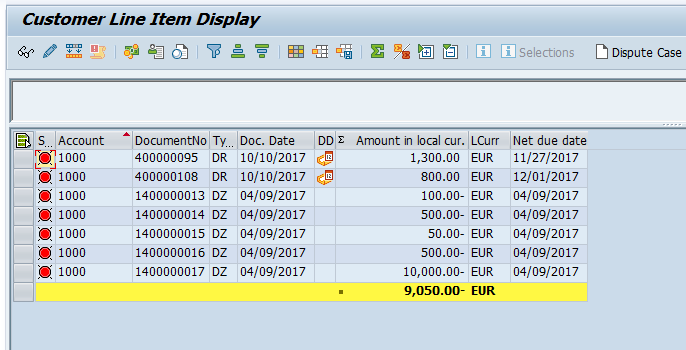

Now that you have seen the underlying configuration, we will review the processing of open items with the regrouping report. First, take a look at customer open items using transaction FBL5N for an example customer. In this example, we will use customer 1000 on company code 1000. Look at the open items as of the current date.

There are 12 open items in the list, including special G/L postings.

Now, let’s run the regrouping report. Use transaction code FAGLF101 (or F101 for the classic GL), or use the following menu path.

SAP Easy Access > Accounting > Financial Accounting > Accounts Receivable > Periodic Processing > Closing > Reclassify > Sorting/Reclassification (New)

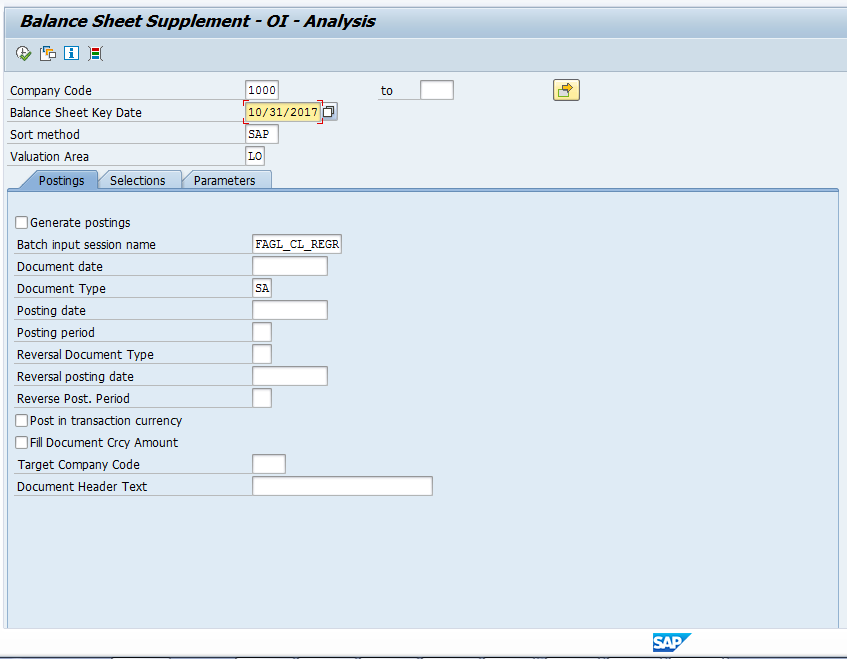

The screen will appear as follows.

Enter the company code, key date (normally this will be a period end date), sort method (we are using SAP here as we reviewed the configuration earlier), and a valuation area for the accounting principle. We are not clicking on Generate Postings at the stage in the tutorial because we are going to run the program and review sorting results before creating a posting session.

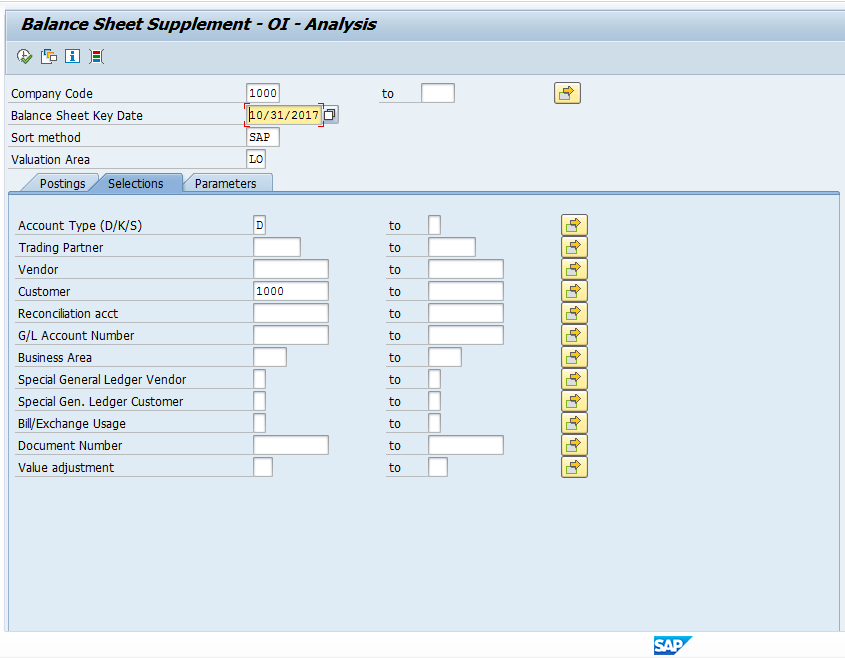

Now click on the Selections tab. Enter Account Type D (for customers) and Customer 1000. The screen will appear as follows.

For this example, nothing will be entered in the parameters tab, but you can explore the options available there for grouping, etc. on your own.

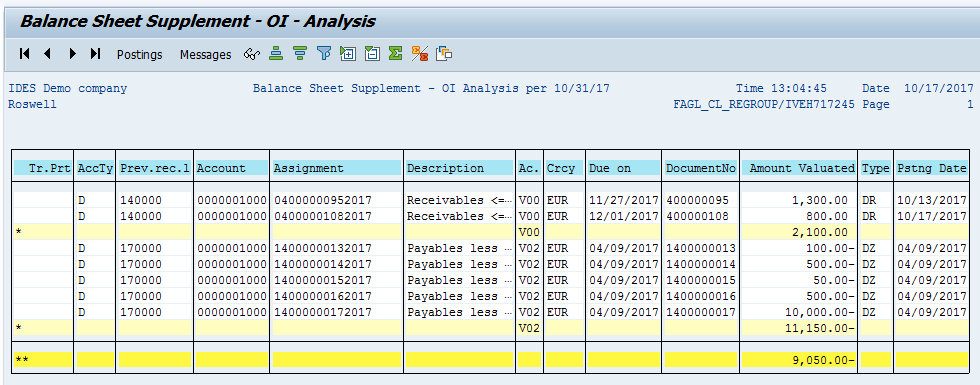

Now, execute the report in foreground. The results will appear as follows and should match the open items list for the customer that we viewed earlier. The report in this illustration has been grouped by account and summed on valuated amount.

Notice seven items were selected and sorted by Account Determination key that will be applied, per the configuration of the Sort Method Interval SAP, which we used as our selection. This matches our open items report. Notice the reconciliation accounts are contained within the configuration reviewed earlier. Also notice the items list the account determination keys (V00 and V02).

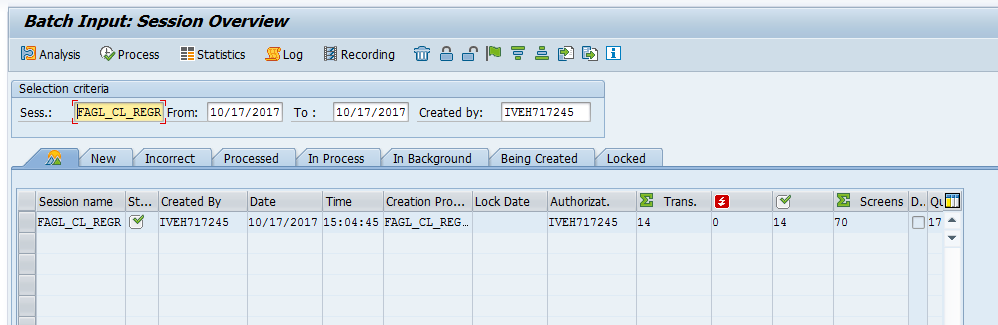

Now, click on the green arrow to go back. Select the Generate postings check box. Notice there is a batch input session default name of FAGL_CL_REGR. This batch input session will be created by the program to contain the postings to process. If you want to post immediately, remove this value. Click on execute when ready to generate postings. After executing, use transaction SM35 to review and process the batch input session.

Notice there are 14 transactions in the session. Seven for postings, and seven for reversals. This process is intended to post the balance sheet adjustments at period end, then reverse immediately in the following period.

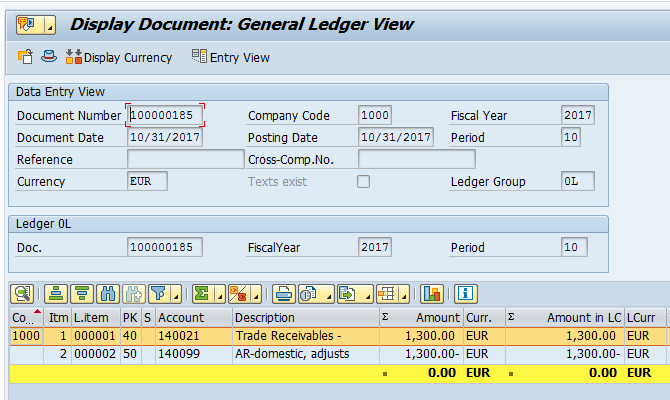

Now, let’s take a look at a couple of the postings generated. Here is an example posting of where automatic account assignment key V00 was applied.

Per the configuration, vendor reconciliation account 140000 was selected which had a debit balance for this item. Adjustment account 140099 was posted to, with the target offset going to 140021.

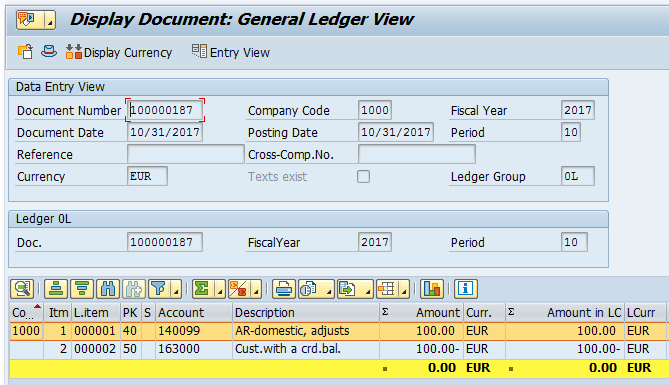

Now, let’s review an example posting of where automatic account assignment key V02 was applied.

Per the configuration, vendor reconciliation account 170000 was selected which had a credit balance for this item. Adjustment account 140099 was posted to, with the target offset to account 163000.

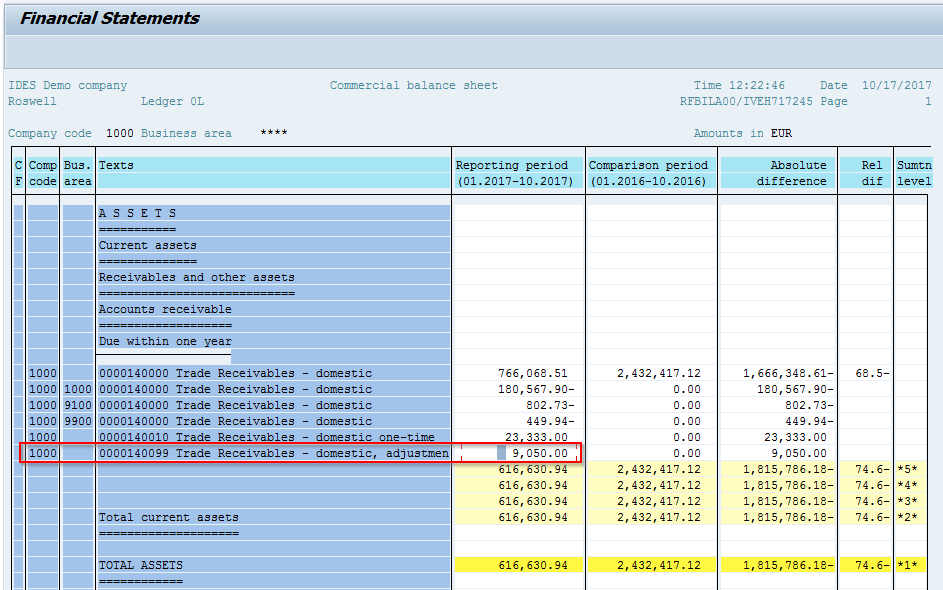

Now use transaction S_ALR_87012284 to view the effect on the adjustment account in the balance sheet.

Here we see the total amount reflected as expected in the regrouping adjustment account.

Conclusion

This tutorial reviewed the two purposes of SAP regrouping program, reviewed the basic configuration, and examined sample postings with impacts shown on the financial statement. In addition to what was discussed, keep in mind that if foreign currencies are to be taken into consideration for sorting and regrouping balances, you must first run the foreign currency conversion program prior to regrouping. Also remember that that items are selected by reconciliation account to ensure special G/L entries such as down payments can be reported separately if required.

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP Accrual Deferral Posting

Go to previous lesson: SAP Value Adjustments

Go to overview of the course: SAP FI Training

The tutorial was very useful and informative. It covered both the configuration and the process aspects of this functionality.

this document is so much informative

this session will be very informative and very useful To Us, can You provide AP and AR questions and answer to Us please.

Hi,

This explanation is very helpful.

However, I would like to know what would be the impact of you run FAGLF101 twice on the same period.

Will it post duplicate entry or reverse the first entry and repost the second run.

Rona

This Document is very useful to understand concept as well as SAP configuration

Hi, real nice example.

you are showing the 2 normal currencies. Transaction Currency and local currency.

If you have an additional currency like Group currency the FAGLF101 will not reclass. How can you customize, that the system will reclass also the Group currency?

Hi, everyone!

I would like to join your question about additional currency. I have some problem with FAGLF101 posting. The 3rd local currency amount is 0 in the leader ledger (0L). In the non-leader ledgers the docum.currency, local currency and the 2nd local currency amounts are 0 (or some of them are blanc). How can it should be customized that the system will reclass also the 3rd local currency and so on?

Hi Sir, if it’s possible can you please respond, how we can see the postings in Hard currency.

Hi,

Very nice example and easy to follow.

These postings should be backed out the beginning of the new month.

Maybe you could add how that happens to the instructions.

Sincerely,

Judy

P.S. I see that you did cover this in the section on the Batch Input Session. Thanks for the info!

Very informative and easily explained. Totally understood the concept and relevant configuration. Kudos to the team !