Welcome to the tutorial on SAP Value Adjustments. As part of an organizations close process, Accounts Receivable balances can be reviewed and analyzed to determine if items are deemed as doubtful. This is an International Financial Reporting Standards (IFRS) requirement to value outstanding receivables fairly when creating balance sheet statements. To meet this requirement, SAP has developed flat-rate individual SAP value adjustments functionality which will allow calculation and posting of a flat-rate amount as an adjustment to a special general ledger accounts receivable account on the balance sheet with an offset to a P&L account. This calculation is driven by the number of days overdue of the receivable item and is posted as a special correction. This will not change the open item amount against the customer. These postings will typically be reversed in the following period. This tutorial will look at the basic configuration for flat-rate value adjustments and review the value adjustment calculation and transfer program.

Welcome to the tutorial on SAP Value Adjustments. As part of an organizations close process, Accounts Receivable balances can be reviewed and analyzed to determine if items are deemed as doubtful. This is an International Financial Reporting Standards (IFRS) requirement to value outstanding receivables fairly when creating balance sheet statements. To meet this requirement, SAP has developed flat-rate individual SAP value adjustments functionality which will allow calculation and posting of a flat-rate amount as an adjustment to a special general ledger accounts receivable account on the balance sheet with an offset to a P&L account. This calculation is driven by the number of days overdue of the receivable item and is posted as a special correction. This will not change the open item amount against the customer. These postings will typically be reversed in the following period. This tutorial will look at the basic configuration for flat-rate value adjustments and review the value adjustment calculation and transfer program.

SAP Value Adjustments Configuration

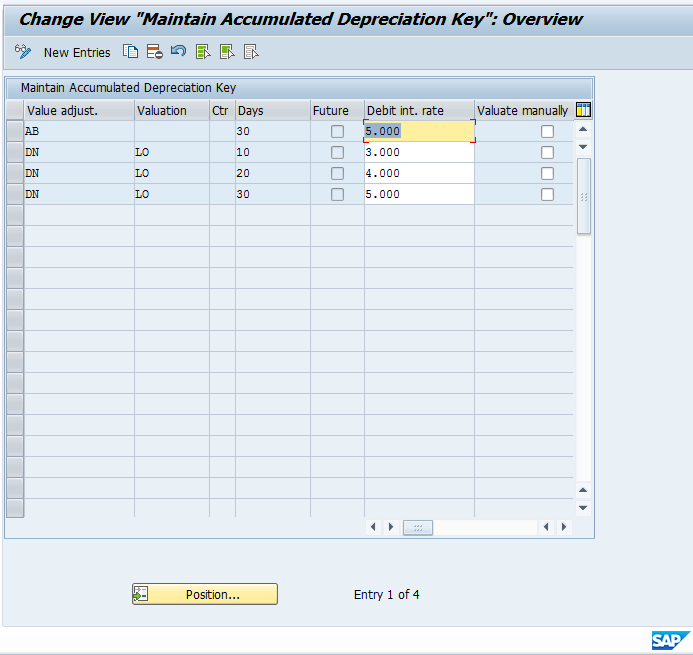

The first step of configuration is to set up the value adjustment key that will be used. The value adjustment key will be based off the country key and the due date as determined by the number of days defined for the key. Here you can also determine if a specific valuation area (valuation approaches for various accounting principles) should be used, the percentage of the item amount that will be posted, and what will be used to determine the posting amount (net, gross, etc.). Keep in mind that you can set multiple entries for a specific key. For example, key DN could be created to post 3 percent if 10 days old, 4 percent if 20 days old, and 5 percent if 30 days old, etc. Finally, if you want to post the provision manually, you can leave the percentage rate blank and check the “valuate manually” check box. In this case, the item will be picked up during valuation, but nothing will be calculated and you can enter the amount manually.

To configure the value adjustment key, use transaction code OB_7 or the following menu path.

SPRO > SAP Reference IMG > Financial Accounting (New) > Accounts Receivable and Accounts Payable > Business Transactions > Closing > Valuate > Valuations > Define Value Adjustment Key

The configuration shown here is not country specific but uses LO valuation area.

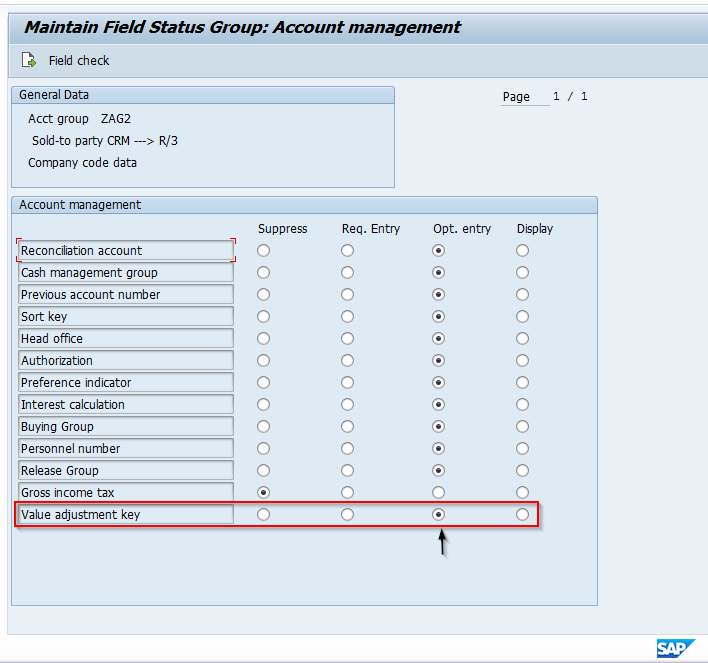

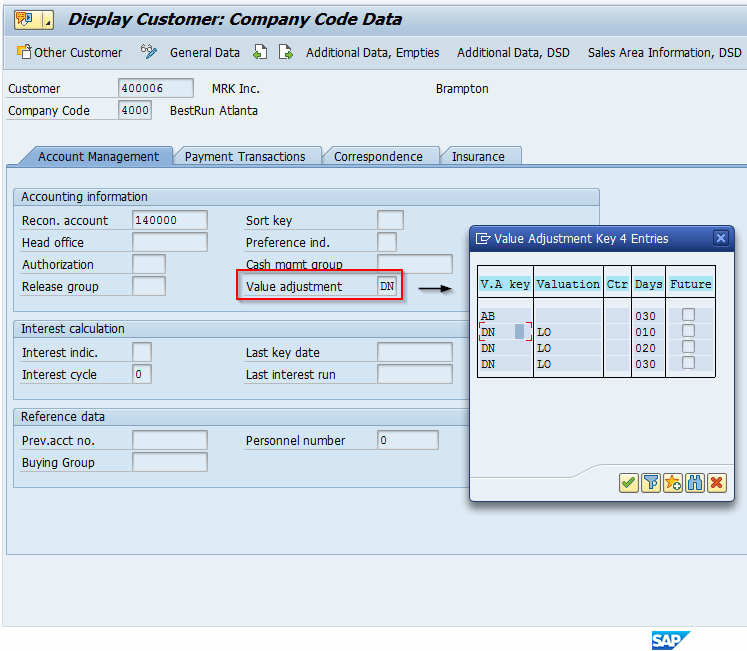

The next step is to enter the valuation adjustment key into the customer master records that will be subject to valuation. NOTE: Make sure you have the Valuation Key field set as optional in the account group configuration for the vendor master. This is under company code data:

Use transaction XD02 to enter the valuation key into the customer master.

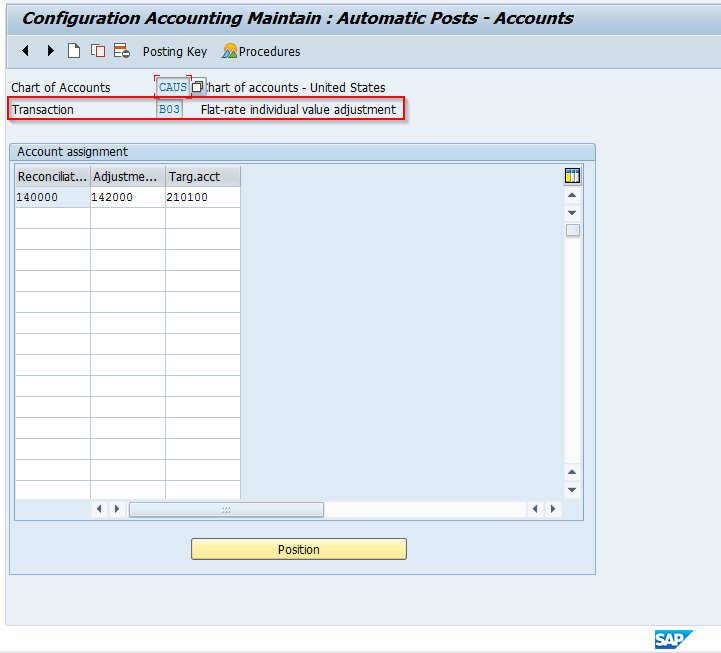

Finally, make sure the automatic account assignments are correctly configured with the applicable accounts for the adjustment postings. To make these settings, use transaction OBB0 or the following menu path.

SPRO > SAP Reference IMG > Financial Accounting (New) > Accounts Receivable and Accounts Payable > Business Transactions > Closing > Valuate > Valuations > Define Accounts

Processing SAP Value Adjustments

To demonstrate how to process flat-rate SAP value adjustments, use transaction code F107 or the following menu path.

SAP Easy Access Menu > Accounting > Financial Accounting > Accounts Receivable > Periodic Processing > Closing > Valuate > Further Valuations

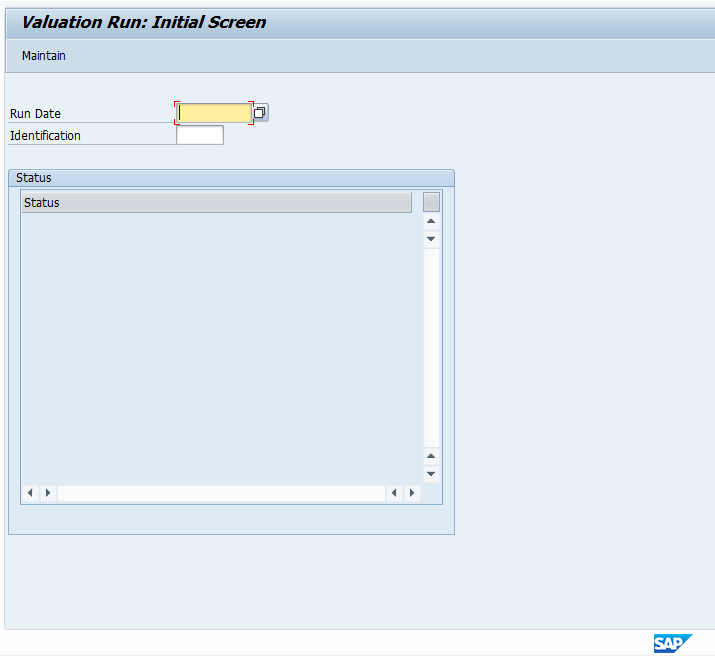

The initial screen will appear as follows.

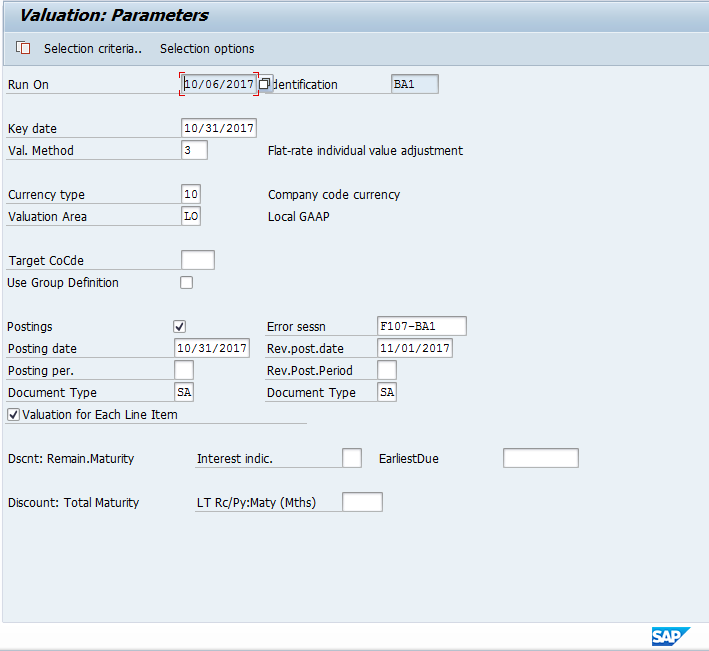

At this screen, enter the current date into the Run Date field and give it a unique Identification name. Next, go to edit parameters. Enter the selection parameters as follows.

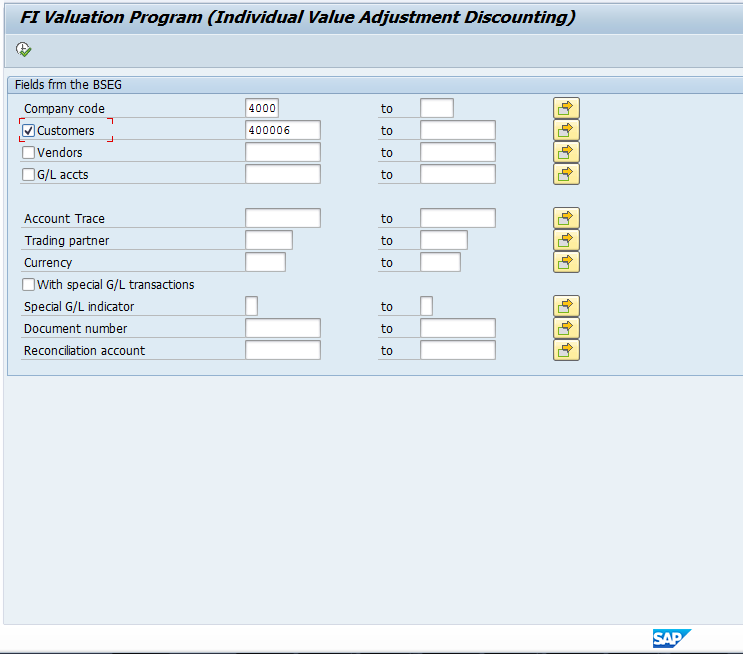

Next, click on the selection options button on the menu bar and enter the company code and customer master record we are processing. The screen will appear as follows.

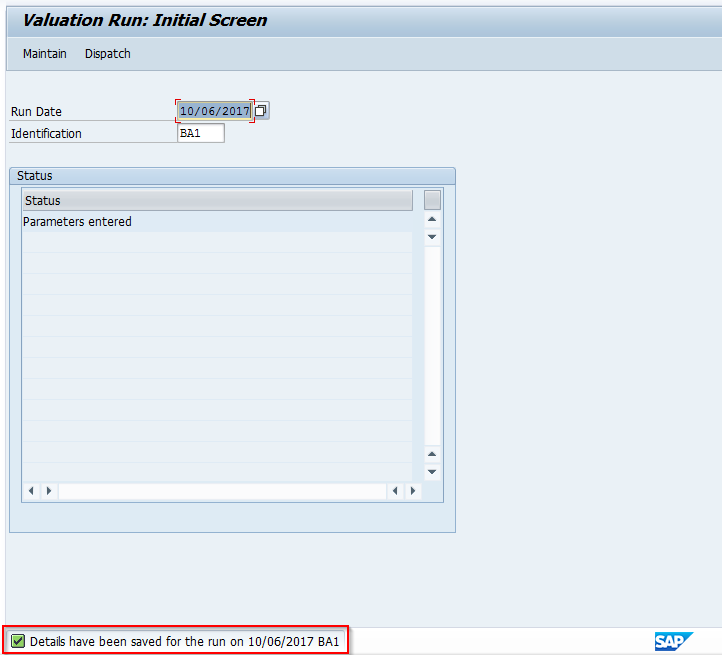

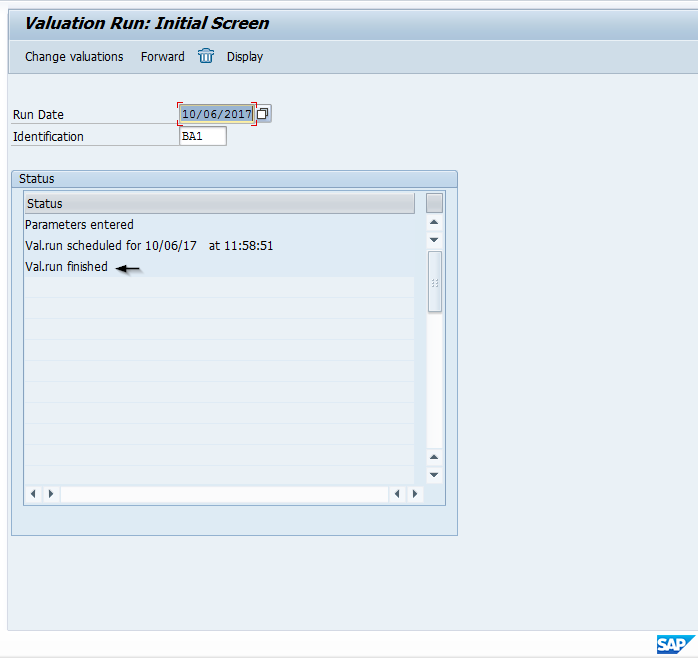

Click the execute icon and you will then return to the parameters screen. Click the save icon. You will see a status message that parameters have been entered and the screen will appear as follows.

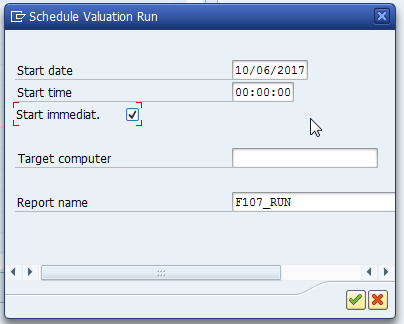

Next, from the menu bar click on Edit, then Valuation Run, then Dispatch. You will see a popup box, click on start immediately and then the green check to start the valuation run.

Once you start the valuation run, a background job is executed. You will see a status message in the initial screen indicating the valuation is running. Hit the enter key to refresh the status. Once complete, you will see a status message that the valuation run has finished.

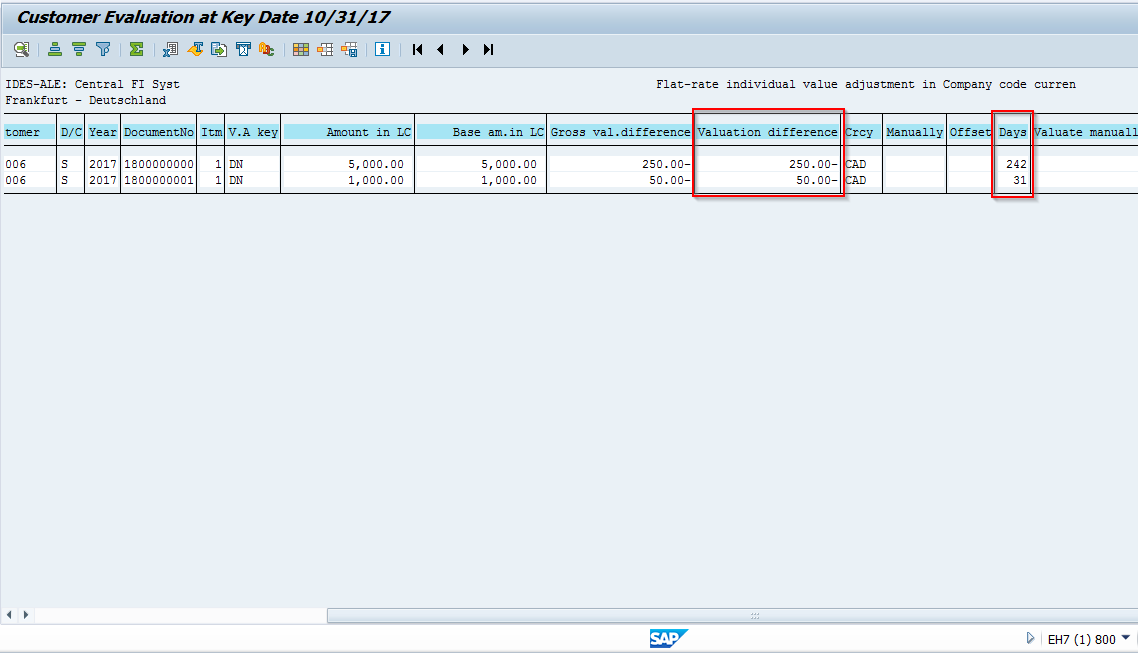

Now click on the display button on the menu bar to see the items that were analyzed by the valuation run and check for accuracy. In this example, 2 documents were analyzed.

Based on the due dates, both items are past 30 days due, so the third entry in our valuation key will be used for the calculation (five percent). See the correct amounts listed in the Valuation Difference column on the report.

Click the green arrow to go back.

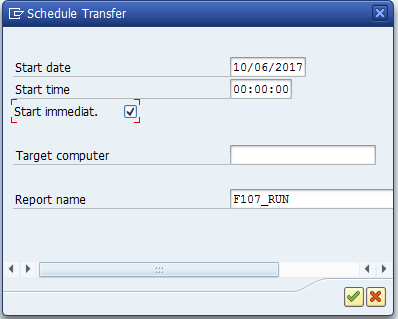

Once back at the initial screen, to make the postings, click on the Forward button. You will get a popup box again, click on start immediately and then the green check to start the transfer postings program.

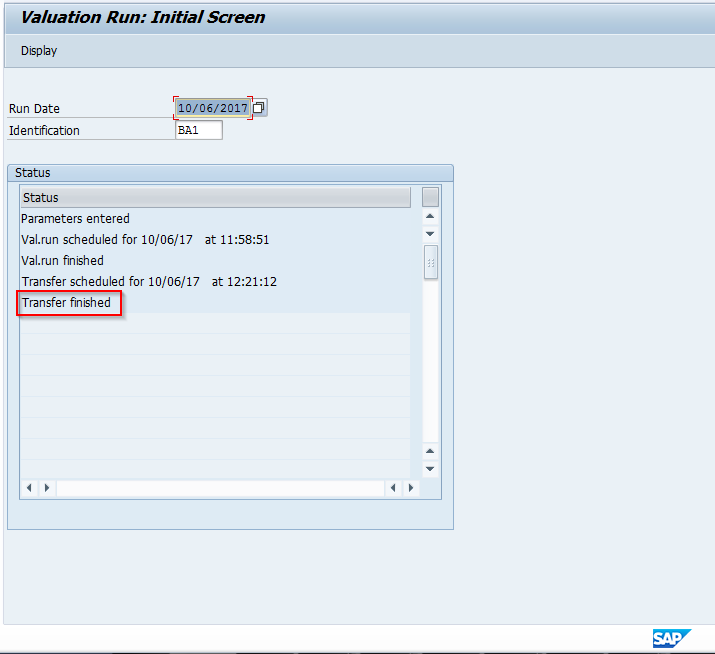

Once you start the transfer posting run, a background job is executed. You will see a status message in the initial screen indicating the transfer is running. Hit the enter key periodically to refresh the status. Once complete, you will see a status message that the transfer run has finished.

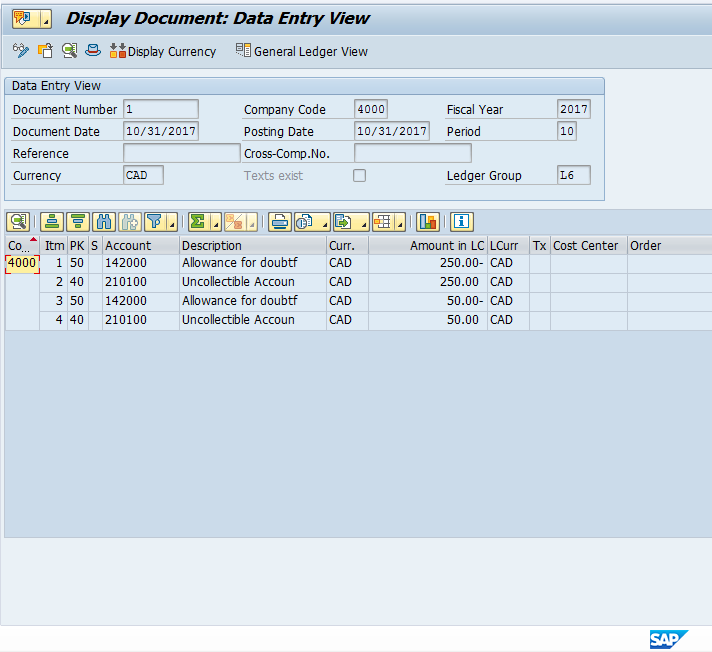

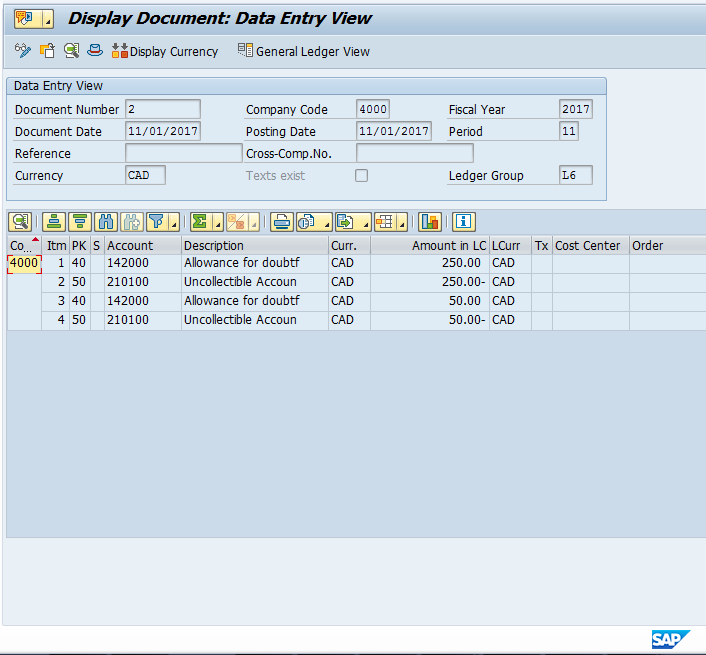

To view results, go to transaction FB03 and view the Financial Documents that were posted.

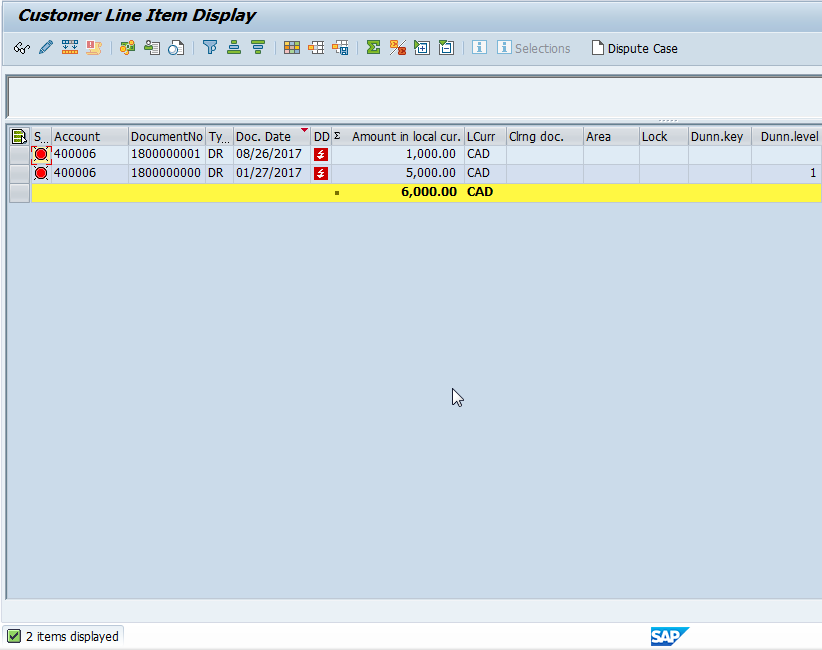

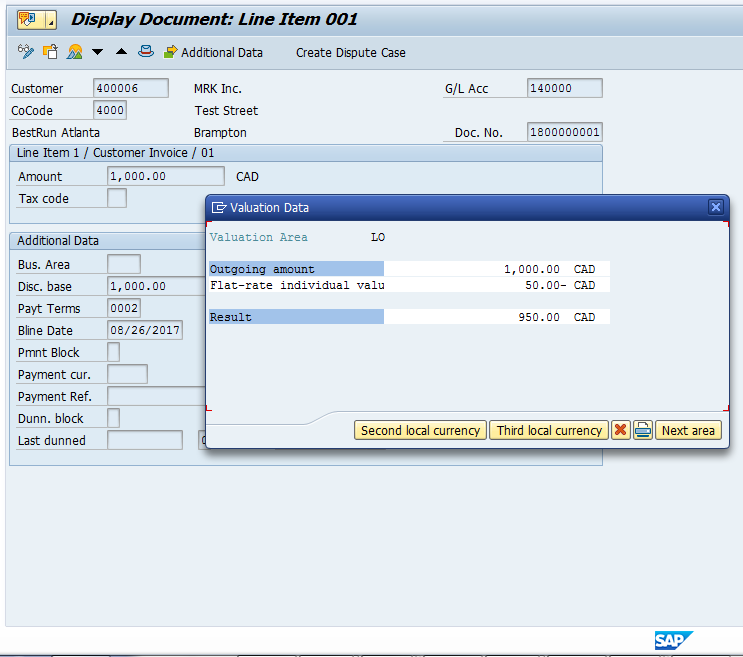

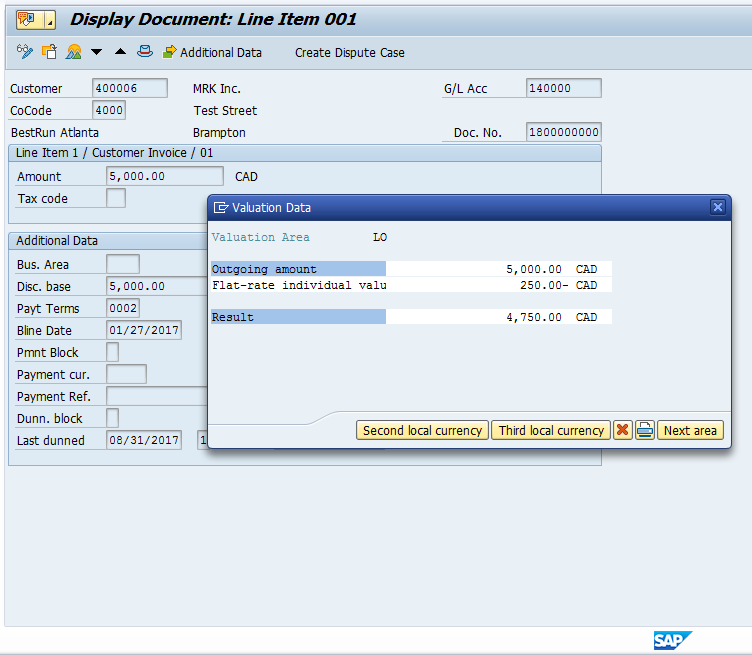

Additionally, you can use transaction FBL5N to review the customer line items and the associated valuations. Select open items for the customer and locate the two items that appeared on the valuation log. Drill down on each item, one at a time, then go to menu path Environment, Valuation, Display values.

Conclusion

The SAP Value Adjustments functionality is a useful tool to make adjustments related to doubtful receivables to meet IFRS balance sheet reporting requirements. This tutorial reviewed the basic functionality for flat-rate adjustments related to Accounts Receivables.

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP Regrouping Receivables Payables

Go to previous lesson: SAP Foreign Currency Valuation

Go to overview of the course: SAP FI Training

GREAT ARTICLE… SIMPLY GREAT. THANKS BRO