Welcome to the tutorial about SAP Dunning Process. This tutorial is part of our free SAP FI training course. An organization that sells goods or services will send invoices to its customers as a method of requesting payment. These invoices are required to be paid by the customer according to preset rules agreed upon by both the organization and its customers. To ensure payment is made according to these rules, an organization may need to remind its customers that invoices are due or payment is late. The reminders typically start gently and grow in severity as invoices continue to age. In addition, an organization may require this reminder process to charge its customers for both the payment reminders as well as interest on unpaid invoices. To satisfy this business requirement, an organization can use the Dunning process within SAP Financial Accounting’s Accounts Receivable sub module (FI-AR).

Welcome to the tutorial about SAP Dunning Process. This tutorial is part of our free SAP FI training course. An organization that sells goods or services will send invoices to its customers as a method of requesting payment. These invoices are required to be paid by the customer according to preset rules agreed upon by both the organization and its customers. To ensure payment is made according to these rules, an organization may need to remind its customers that invoices are due or payment is late. The reminders typically start gently and grow in severity as invoices continue to age. In addition, an organization may require this reminder process to charge its customers for both the payment reminders as well as interest on unpaid invoices. To satisfy this business requirement, an organization can use the Dunning process within SAP Financial Accounting’s Accounts Receivable sub module (FI-AR).

SAP Dunning Process Flow

To understand the process that leads to Dunning, let’s review a typical AR invoice cycle and look at a few key elements that play a role.

1. Payment Terms

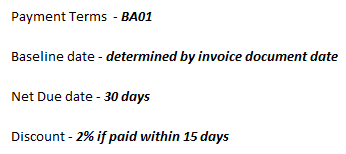

Payment terms will ultimately determine which invoices are subject to Dunning. Each customer master record is assigned a customer payment terms code. The preconfigured terms code will dictate the rules in which the customer is required to pay invoices. There are various settings and combinations that can be used in configuring a payment terms code (see separate tutorials), but a typical terms code may be set up as shown below.

When this terms code is assigned, the customer must pay invoices within 30 days from the document date, and it will receive a 2 percent discount if paid within 15 days.

2. Customer Invoice

Invoices are entered into the SAP Accounts Receivable sub ledger to record receivables against a customer for goods and services.

Standard FI document type DR is typically used for this purpose. This will record a debit entry against the customer master record and it’s linked FI-AR general ledger reconciliation account.

The customer master record contains the payment terms explained in the first step, and again, this is what will determine when the payment for the invoice is due.

3. Customer Payment

Customer payments are entered into the SAP Financial Accounting sub ledger to pay for goods and services provided.

Standard FI document type DZ is typically used for this purpose. This will post a credit entry against the customer master record and the linked FI-AR general ledger reconciliation account.

4. Invoice Clearing

Invoices can be cleared against payments in the in FI-AR sub ledger using a variety of methods. This can either be done manually using an online dialog transaction or automatically using background batch jobs. Either way, each customer invoice is matched against a customer payment to clear the open items against one another. Remaining items that are deemed to be in arrears based on the terms code previously mentioned will be addressed using the Dunning program.

5. Dunning Program

SAP Dunning program is periodically executed to review open (uncleared) items. If you are familiar with the payment program in FI-AP, you will notice that some similar features exist in this program in terms of user screens, processing steps, etc. For purposes of this document, execution of the Dunning program is the last step in the AR process and is simply a communication to customers to comply with the payment terms as agreed on.

This “reminder notice” to the customer will accomplish several things. First, it will simply remind the customer in writing that there are open invoices that are required to be paid. Second, it has the ability to charge a fee for sending the reminder notice, as no reminder would have been required if payment was made on time. Thirdly, the program can charge the customer interest on unpaid invoices.

Key Elements in SAP Dunning Process

The Dunning program can be executed either as a batch job or using an online dialog transaction. The program will review open customer invoices based on the criteria entered into the program’s selection screens. A separate tutorial will explain more detail on how to execute the Dunning program, but here we will discuss some of the main settings and features behind the Dunning process.

1. SAP Dunning Area

The Dunning area is the starting point for understanding SAP Dunning process. A Dunning area is configured in the IMG and assigned to a company code. This is the first step in configuring the Dunning process and is used as an overall grouping level when executing the Dunning program. Details of Dunning configuration will be discussed in separate posts, but to gain an initial understanding of the overall process, be aware that the Dunning area is the high level organizational unit for processing Dunning for individual units within a company code. This is an optional step and is only needed if the organization requires separate Dunning processes within a company code.

2. SAP Dunning Procedure

SAP Dunning procedure is where most of the control of SAP Dunning process takes place. The procedure is configured to hold Dunning level interval days, number of levels that apply to a particular procedure, Dunning charges (cost of the reminder to the customer), minimum charges, whether or not interest is charged and if so at what level, etc. SAP Dunning Procedure is assigned to each customer in the company code correspondence tab in the customer master record (only one Dunning procedure can be applied to a customer at a time).

3.Dunning Levels

The dunning levels are a key fundamental in understanding SAP Dunning process. Dunning Levels are an element within the Dunning procedure that control which invoices are subject to Dunning based on how late they are. Each level within a Dunning procedure can treat invoices uniquely based on the settings assigned. For example, as an invoice reaches each level based on the number of days in arrears, the severity of SAP Dunning procedure can intensify. An example could be early in the process, such as level 1, no Dunning letter may occur, but instead a report is generated to list all items at this level. Level 2 could be defined to produce the Dunning letter only as a gentle reminder but no charges. Level 3 could be set to produce a firmer letter and a charge. Level 4 could produce a demanding letter, a Dunning charge, and an interest amount.

4. Dunning Forms

The main intent of SAP Dunning procedure is to communicate the status of overdue invoices to customers. Dunning forms are usually the final product of SAP Dunning process. Within the Dunning procedure levels, you can assign form letters that will have unique texts indicating what the status of the invoice is, instructions on payment, etc. Each level will contain a unique form with escalating level of severity. SAP delivers standards forms; however, it is common practice for organizations to develop their own forms with customized verbiage, logos, etc.

5. Additional Features Allowing Bypass of Dunning

There are many details that can be configured and utilized within the Dunning process based on an organization’s requirements, but a few features worth noting early in your understanding are Dunning Key, Dunning Block, and Grace Periods. Dunning Key is used to allow specific levels of a Dunning procedure to be bypassed. Dunning Blocks are used simply to exclude items from Dunning. These blocks can be placed on the customer record to completely exclude it from the process, or they can be applied to individual invoices to prevent them from being considered for Dunning. Again, you may find this to be similar to AP when thinking of payment blocks. Line item grace period is an important feature within the configuration of the Dunning procedure that allows line items to be bypassed that are less than or equal to a specified number of days.

Conclusion

SAP Dunning process is a very useful tool that organizations can utilize within FI-AR that will help them with their unpaid invoice collections. This tutorial was intended as a brief introduction of some of the major points of understanding. Future tutorials will explore more details on the configuration, execution, and modification of the Dunning program.

—

Navigation Links

Go to next lesson: SAP Dunning Configuration

Go to previous lesson: SAP Debit Balance Check

Go to overview of the course: SAP FI Training