Welcome to our tutorial on SAP foreign currency valuation. Here you will learn why and how foreign currency valuation is carried out in SAP. We will also explain how to configure valuation methods and areas, and teach you how to execute the valuation. This tutorial is part of our free SAP FI training.

SAP Foreign Currency Valuation

At the end of a financial period, users carry out closing activities before the preparation of financial statements. Foreign currency valuation is a necessary step in the closing process to create an accurate balance sheet. Valuation is required for the following scenarios:

- Non-open item managed balance sheet account balances, where the account currency is not the local currency

- Open items, including vendor and customer, posted in a foreign currency

When an SAP foreign currency valuation is done, all open items and balances in foreign currency will be converted to local currency using the current exchange rate maintained in the system. Therefore, the valuation must be done at the time of closing so the correct exchange rate is used. When open items and balances posted in foreign currency are valuated, the foreign currency program generates a document. It also automatically creates a reversal document with a posting date of the first day of the next period.

For non open item managed accounts, the valuation adjustment posts directly to the account itself. For open item managed accounts, since it is not possible to post directly to a reconciliation account for payables or receivables, the valuation is posted to an adjustment account. This is a special account that must be created for this purpose.

The accounting entry for open item managed accounts is as follows:

Dr/Cr Unrealized exchange gain/loss account

Cr/Dr GL account being valuated

The accounting entry for open item managed accounts is as follows:

Dr/Cr Unrealized exchange gain/loss account

Cr/Dr Balance sheet adjustment account

SAP Foreign Currency Valuation Configuration

The prerequisite to executing SAP foreign currency valuation is the definition of the valuation method and valuation area in customizing.

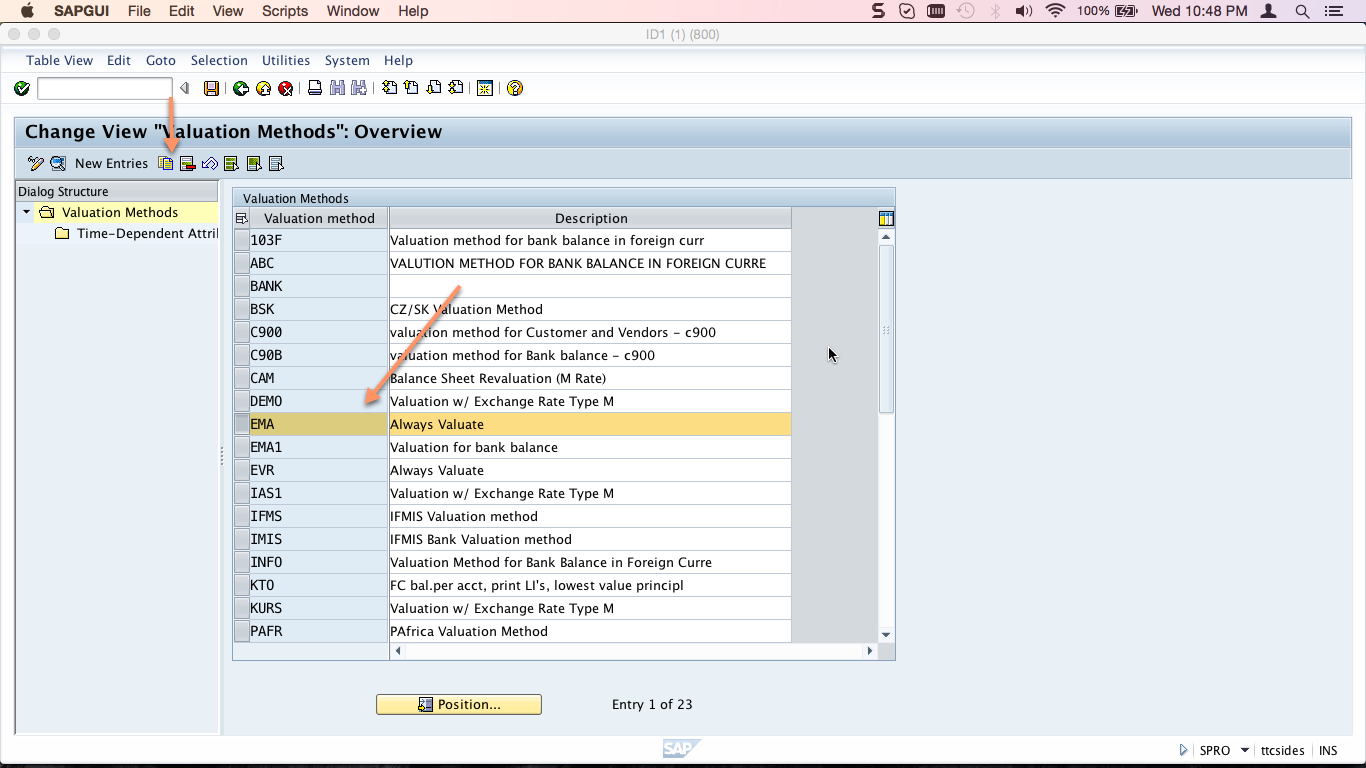

To define a valuation method, use the customizing path below in transaction code SPRO:

Financial Accounting (New) – General Ledger Accounting (New) – Periodic Processing – Valuate – Define Valuation Methods

Highlight the SAP standard valuation method that you want to copy and click the copy button as shown below:

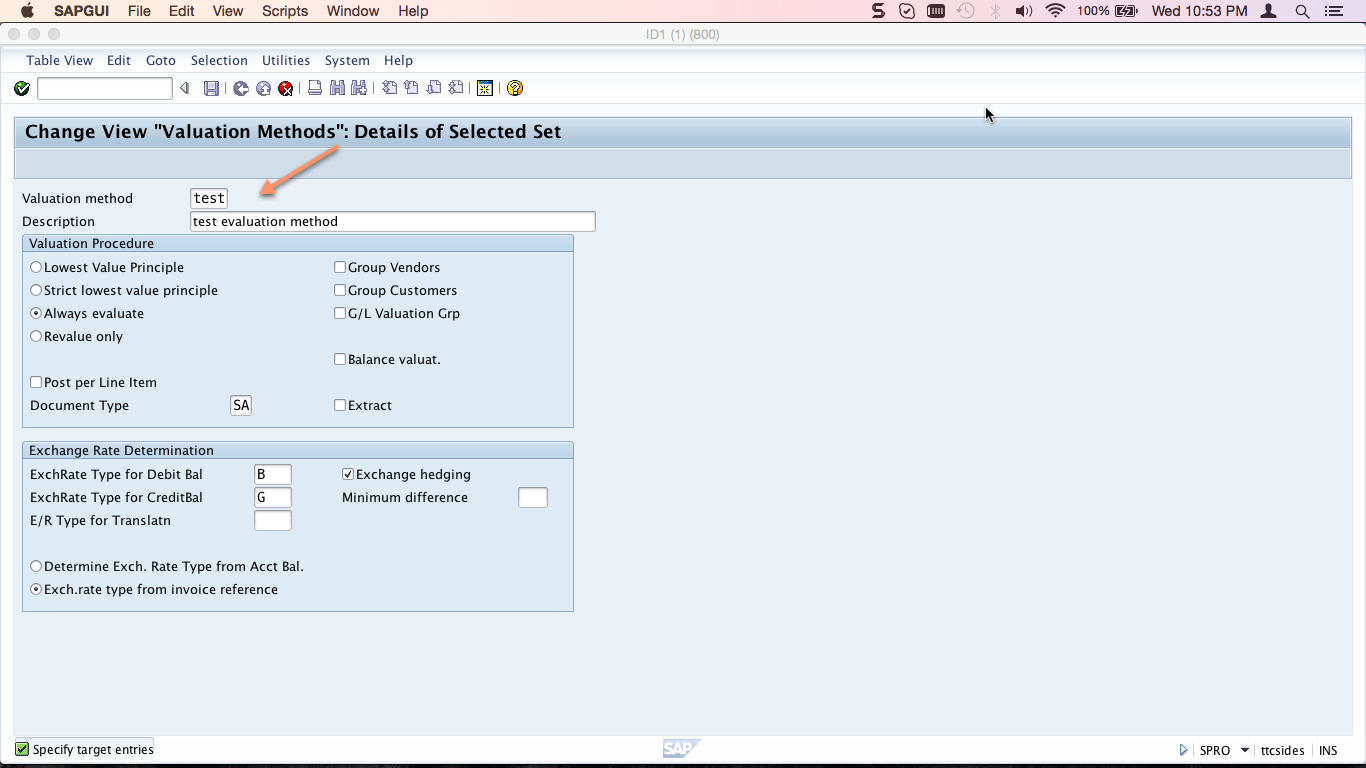

Enter a name and description for your valuation method:

Hit Enter then Save . The new valuation method will be created with a confirmation message:

The next configuration step is to define a valuation area. To define a valuation area, use the customizing path below in transaction code SPRO:

Financial Accounting (New) – Periodic Processing – Valuate – Define Valuation Areas

Highlight the SAP standard valuation area that you want to copy and click the copy button as shown below:

Enter a name for your new valuation area and assign your valuation method to the valuation area as shown below:

Hit Enter then Save .

Execute SAP Foreign Currency Valuation

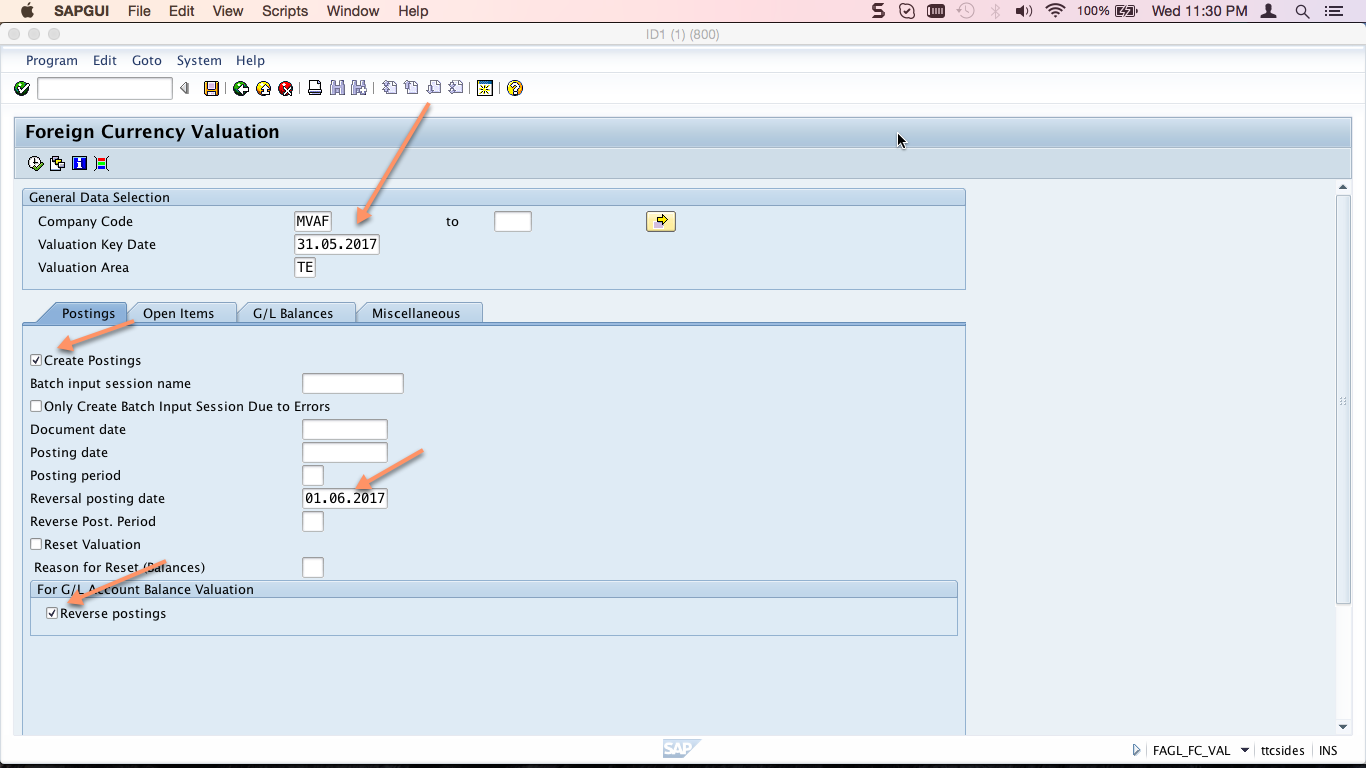

To execute the valuation process use transaction code FAGL_FC_VAL.

In the General Data Selection area of the selection screen, enter the following information:

- Company code

- Valuation date as the key date. The program will consider the documents that were posted before the key date and which have not yet been cleared by the key date. The specified key date also informs the posting period and fiscal year.

- Valuation area

In the Postings tab, enter the following information:

- Select the create postings tickbox. If you select this check box, postings are generated and these are either put into a batch or executed immediately. If you want to run the valuation in test mode first, deselect the tickbox.

- Enter the reversal posting date as the first day of the next period. This field contains the date that will be used as the posting date by the automatic reversal postings.

- Select the reverse postings tickbox to have the system automatically post the reversal on the specified date.

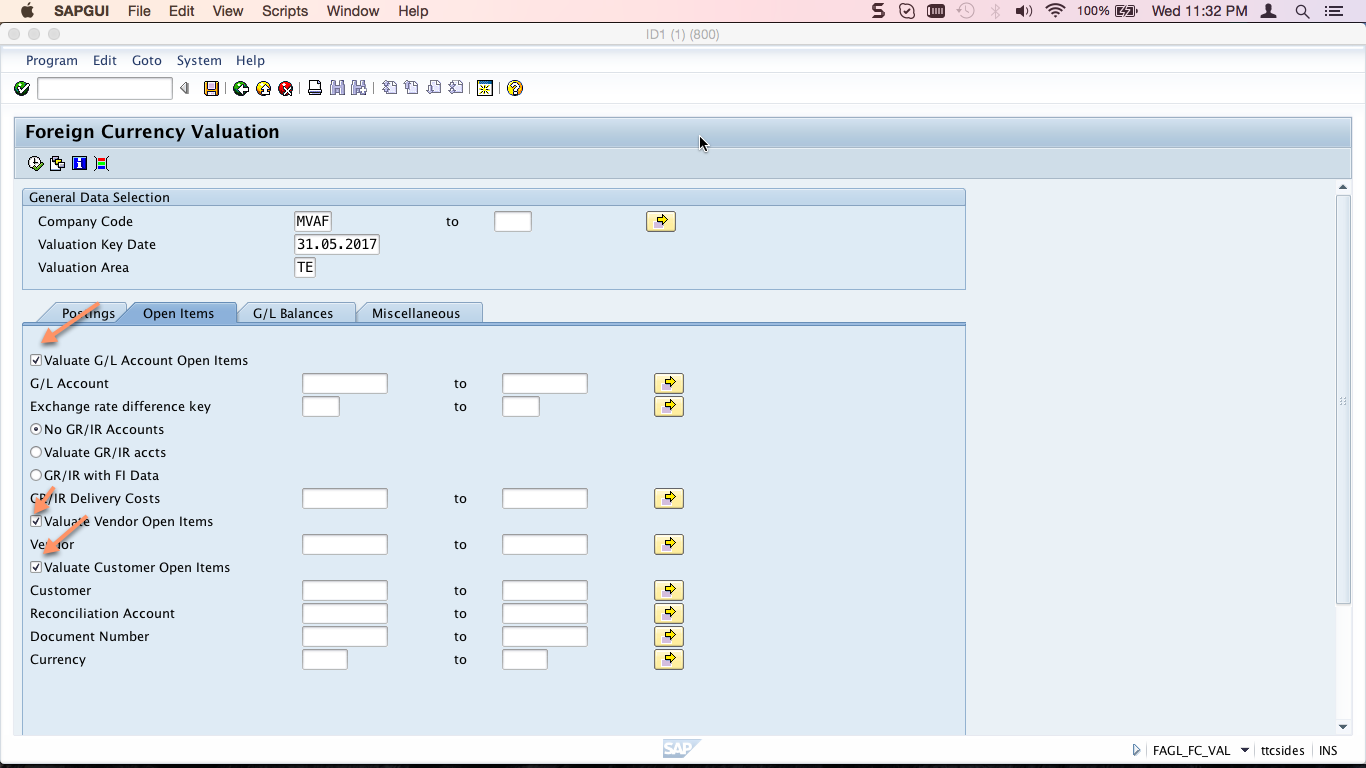

Click on Open Items tab and select the tickboxes to valuate the following types of open items:

- G/L account open items

- Vendor open items

- Customer open items

Click Execute .

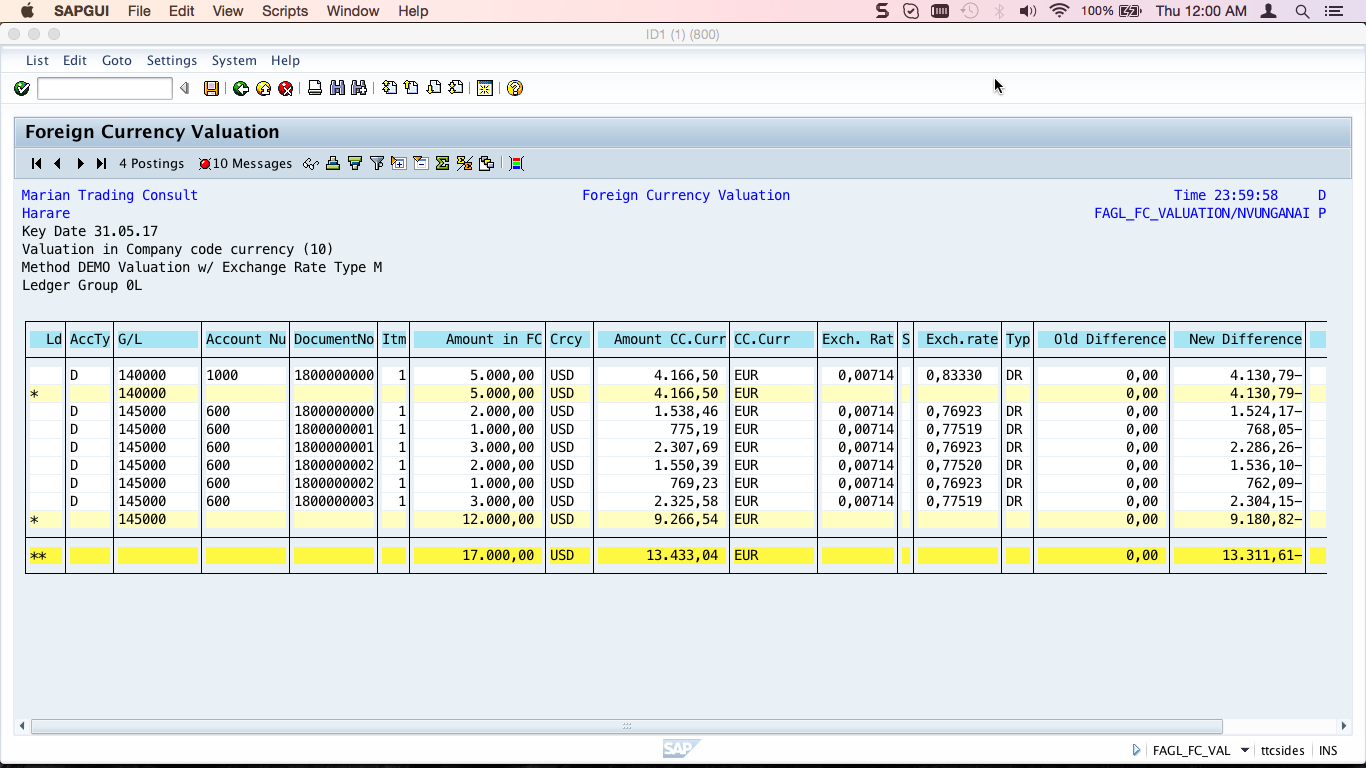

The system valuates the accounts and posts the differences to adjustment accounts. A report is generated as illustrated below:

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP Value Adjustments

Go to previous lesson: SAP Balance Confirmation

Go to overview of the course: SAP FI Training

Hi I think the first one i.e. accounting entry is for non open item managed account. Please have a loo. Appreciate your article. It is good

Regards

Krishna Mohan

The accounting entry for open item managed accounts is as follows:

Dr/Cr Unrealized exchange gain/loss account

Cr/Dr GL account being valuated

The accounting entry for open item managed accounts is as follows:

Dr/Cr Unrealized exchange gain/loss account

Cr/Dr Balance sheet adjustment account

Hi Krishna

Thank you so much for reading my article. The first accounting entry is for non open item managed accounts and the second one is for open item managed accounts.

Thank you for this article.

pls edit menu path :

SAP Foreign Currency Valuation Configuration

Financial Accounting (New) – Periodic Processing – Valuate – Define Valuation Methods

Financial Accounting (New) – General Ledger Accounting (New) - Periodic Processing – Valuate – Define Valuation Methods

Thanks for reporting this typo! The tutorials has been updated.

It is possible to retrieve the open items revaluated during a foreign currency revaluation?

It is possible to retrieve the open items included in a foreign currency valution?

How do you configure the field BSEG-SGTXT for currency valuation i have some problems with this fields

When i’m posting the documents the field BSEG-SGTXT is filled with the following value “&BUKRS - Valuation 20171001” but only in some cases, any help ?

You should check it with ABAP developer. It is possible that there is some custom development that modifies this field.

It is possible to retrieve the open items valuated during a foreign currency revaluation?i usually do a download of the postings and now i forgot.

thanks

Thank you for this article. Can you please let me know during the month end process what is the difference if the Group currency is translated from Company code currency or if it is translated based on Transaction currency( I am referring to Ob22 setting for local currency 2 ). I understand Foreign currency valuation is done in company code currency.

Very Helpfull Document Thank you so much for such document

It’s a great document.. very simple and easy to understand…

I am getting the below error whole running the Transaction - ” List does not contain any data “. Could you please help understanding this

Thank you for such a clear conceptual article on books closing process in sap.

Thanks in your shot of the report generated what is the purpose of the red 10 messages? Are they flagging items that could not be re-valued or such?