Welcome to the tutorial about SAP Partial and Residual Payments. This tutorial is part of SAP FI training. You will learn about partial and residual payments in SAP as well as difference between them. We will show you how to post partial and residual payments in the transaction for entering incoming payments.

Welcome to the tutorial about SAP Partial and Residual Payments. This tutorial is part of SAP FI training. You will learn about partial and residual payments in SAP as well as difference between them. We will show you how to post partial and residual payments in the transaction for entering incoming payments.

SAP partial and residual payments are useful methods of processing partial incoming payments and partial outgoing payments. These methods have the same effect to the balances of vendor or customer accounts but they have different effects on line items in financial documents. For a partial payment, the initial invoice and the payment items remain on the account. On the other hand, a residual payment results in new document with a reference to the original document.

SAP Partial Payment vs. Residual Payment

Partial Payment Scenario

Let’s assume your company offers services to a customer X and produced an outgoing invoice of $500. Now, when the customer is making a payment, the payment is not made in full. The customer is paying only $200. This transaction, when a customer is not making payment for the full invoice amount, is what we call a partial payment. When a partial payment of $200 is done, it does not cancel the initial invoice of $500 but the system adds a new line item of $200 which will reduce the amount the customer owes the company to $300.

Residual Payment Scenario

Let’s assume your company offers services to a customer Y and produced an outgoing invoice of $500. Now when the customer is making a payment, the payment is not made in full. The customer is paying only $200. When the customer is making a payment of $200 and the residual payment method is used, the system will cancel the original line item of $500 and create a new invoice line item of $300 which is the residual after the payment of $200.

So, in both cases the customer still owes the company $300, but what is different are the line items.

This tutorial is going to illustrate how to post an incoming partial payment and an incoming residual payment.

Posting SAP Partial Payment

In case of a partial payment, the original invoice and the partial payment are managed as open items. Both carry the same assignment. If you double click the partial payment, the system shows that the payment is for the invoice. The invoice and the partial payment are not cleared until the payment is cleared by the vendor or customer.

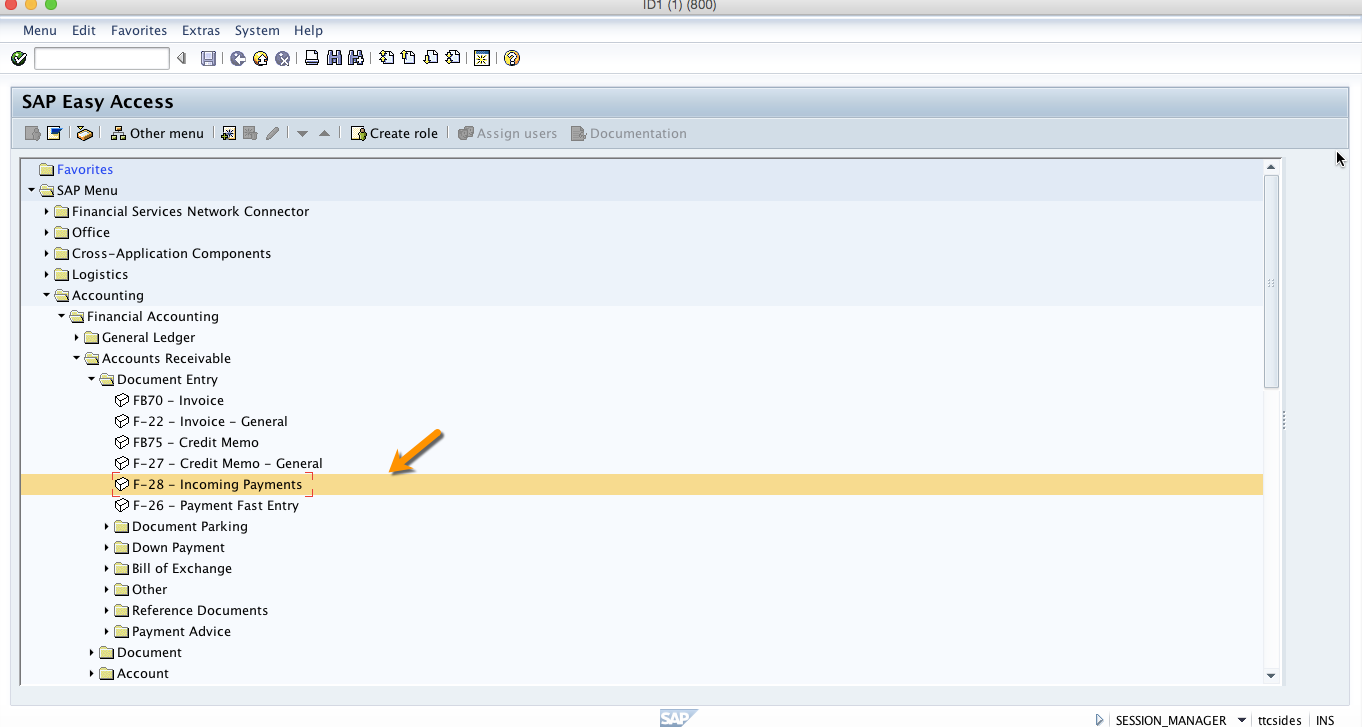

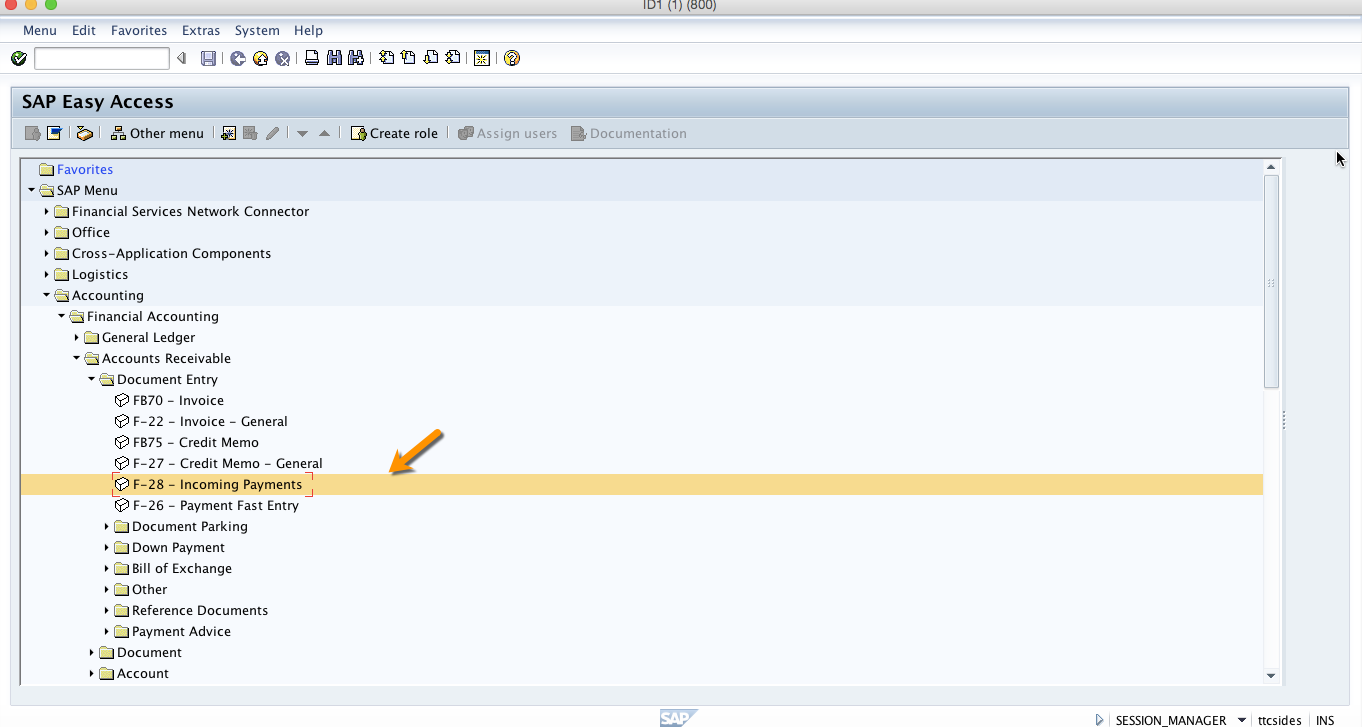

To post an incoming partial payment enter the transaction code F-28 or follow the menu path as shown on the screenshot below.

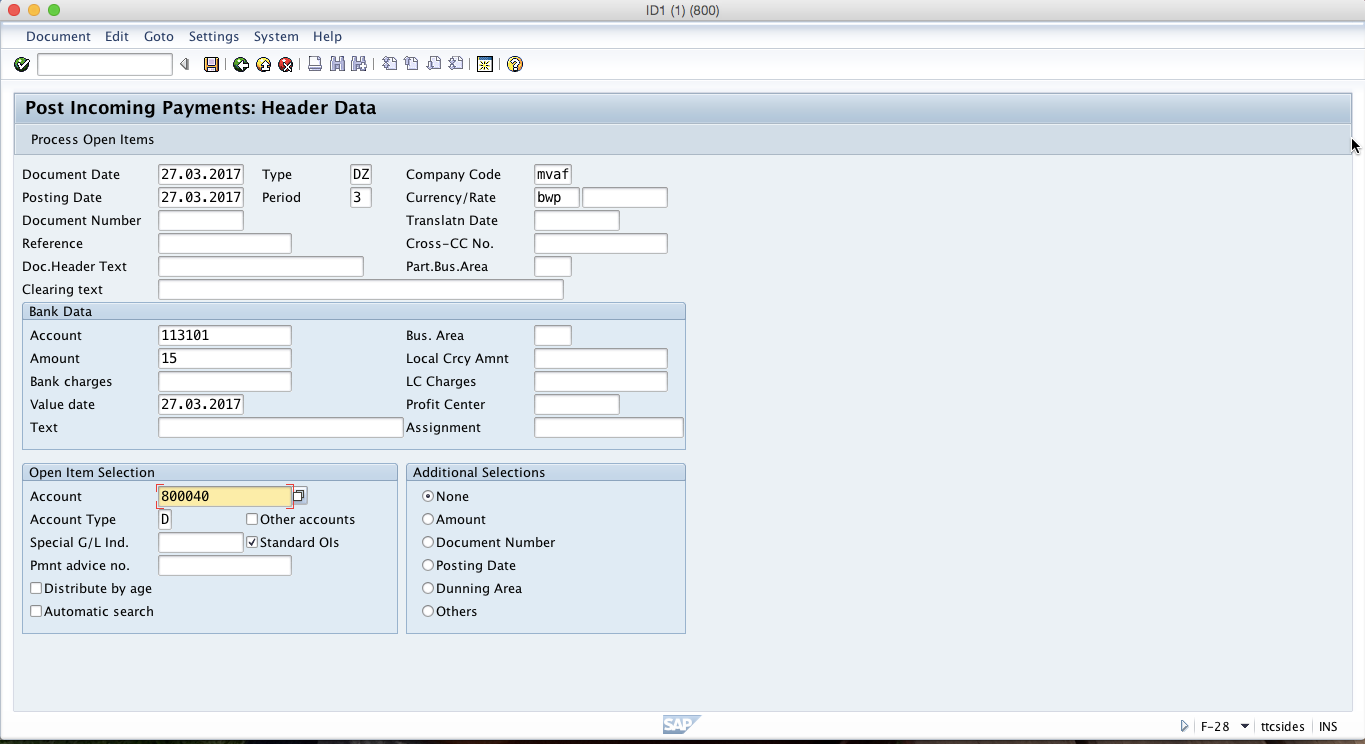

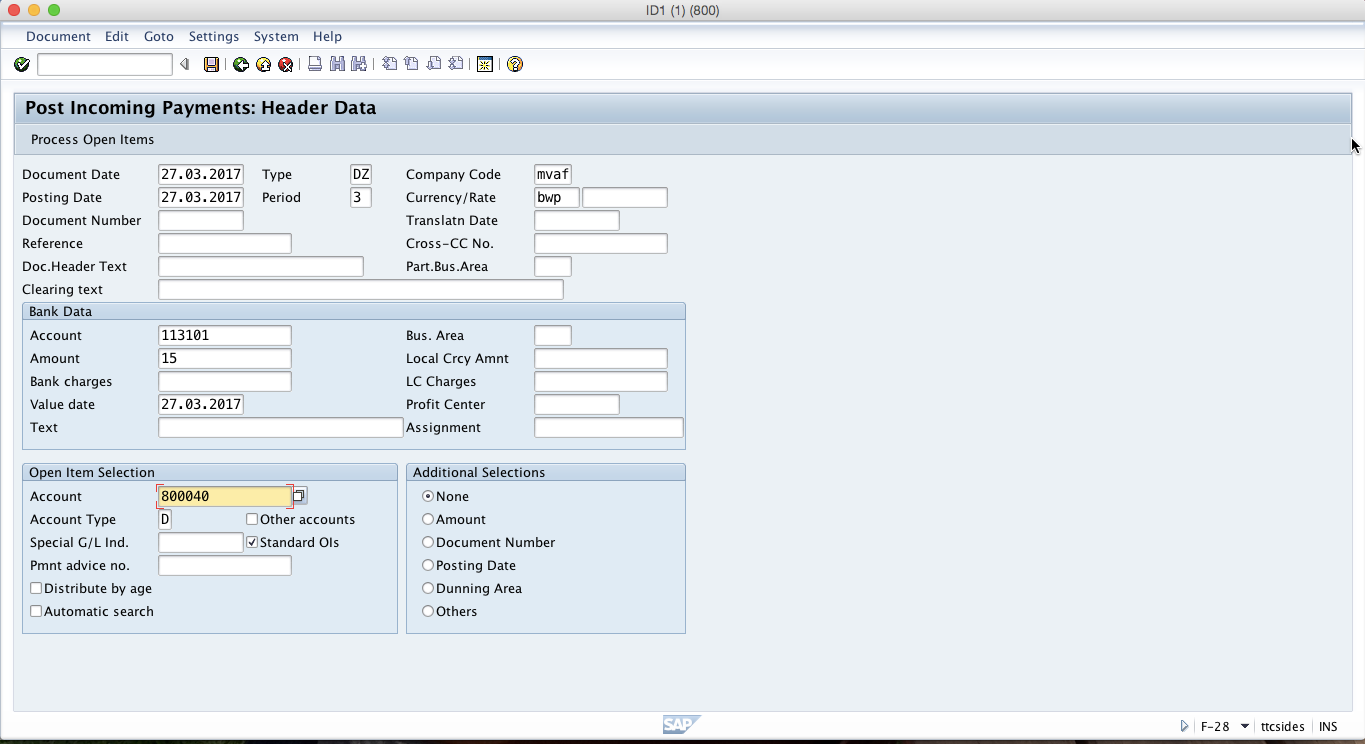

Enter the following information on the initial screen:

- Document date;

- Company code;

- Posting date;

- Currency;

- Bank account;

- Amount;

- Customer account;

- Account type = D.

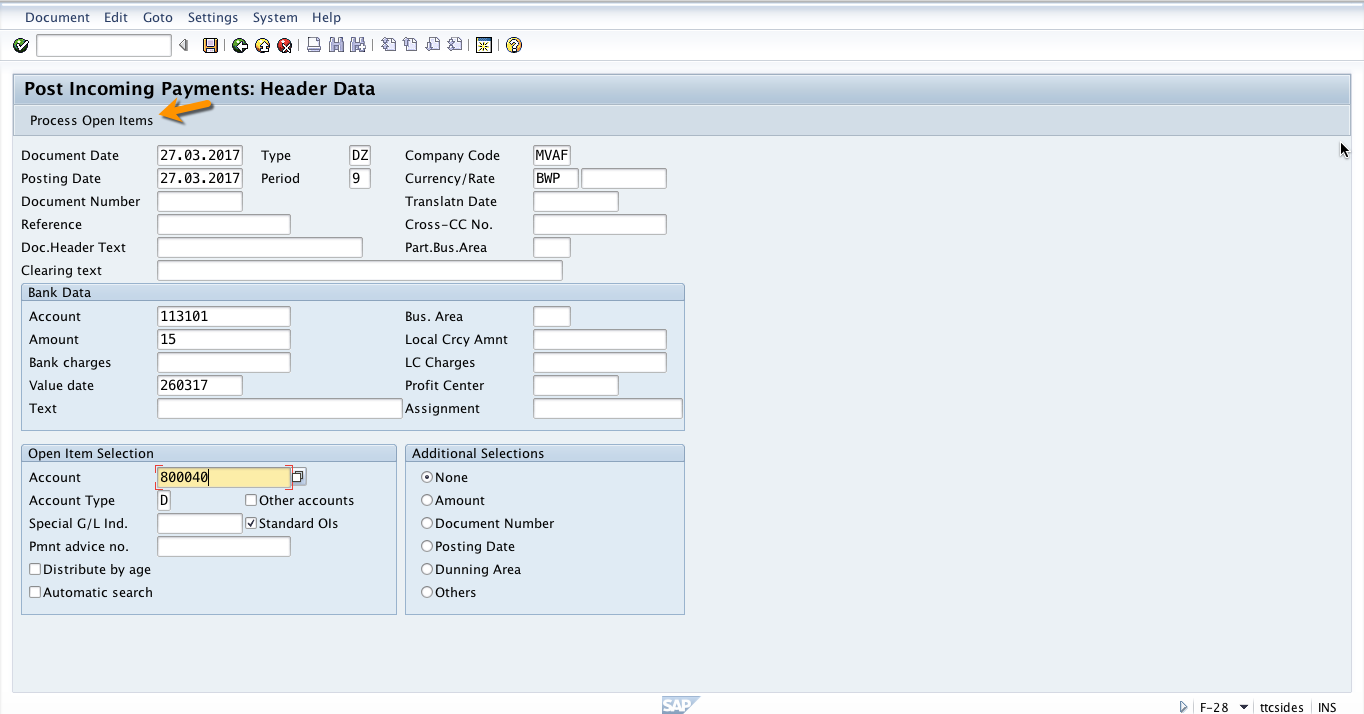

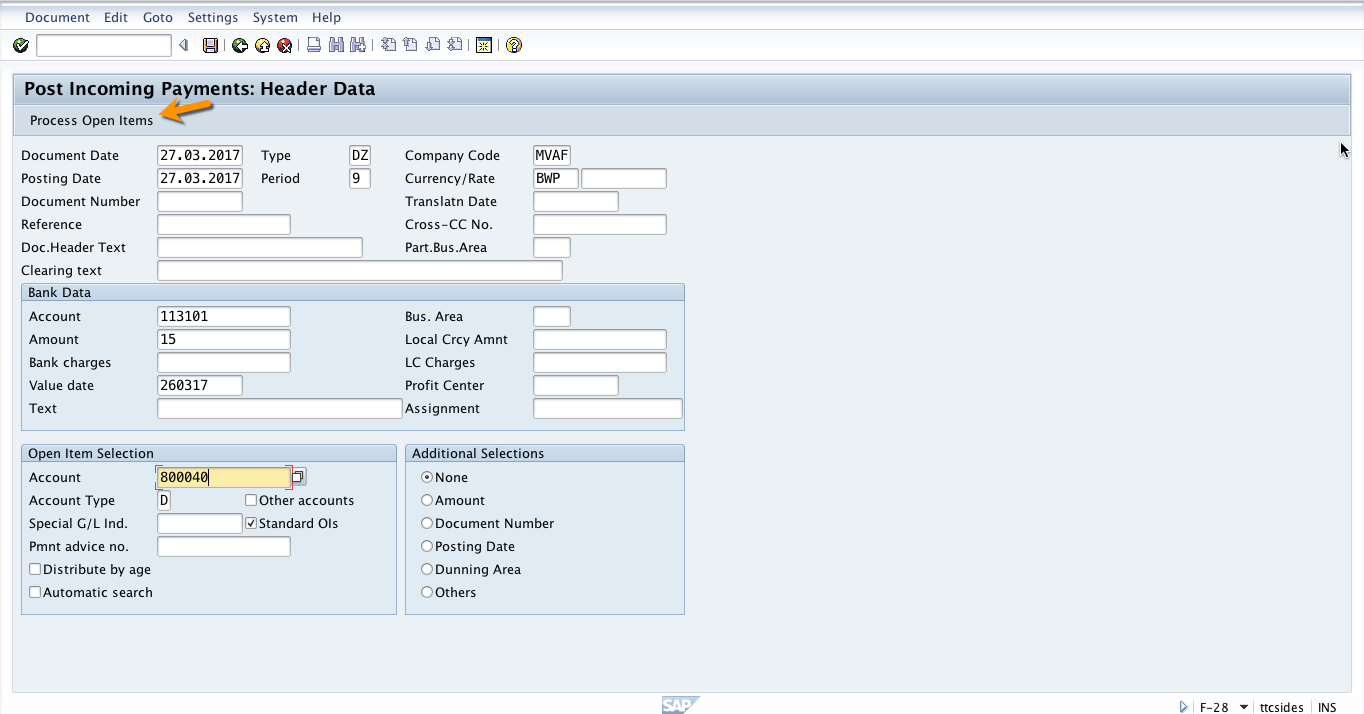

Information entered on this page is divided into three sections which are Document Header, Bank Data and Open Item Selection. To go to the next page, click on Enter button on the keyboard or on Process Open Items button on the toolbar.

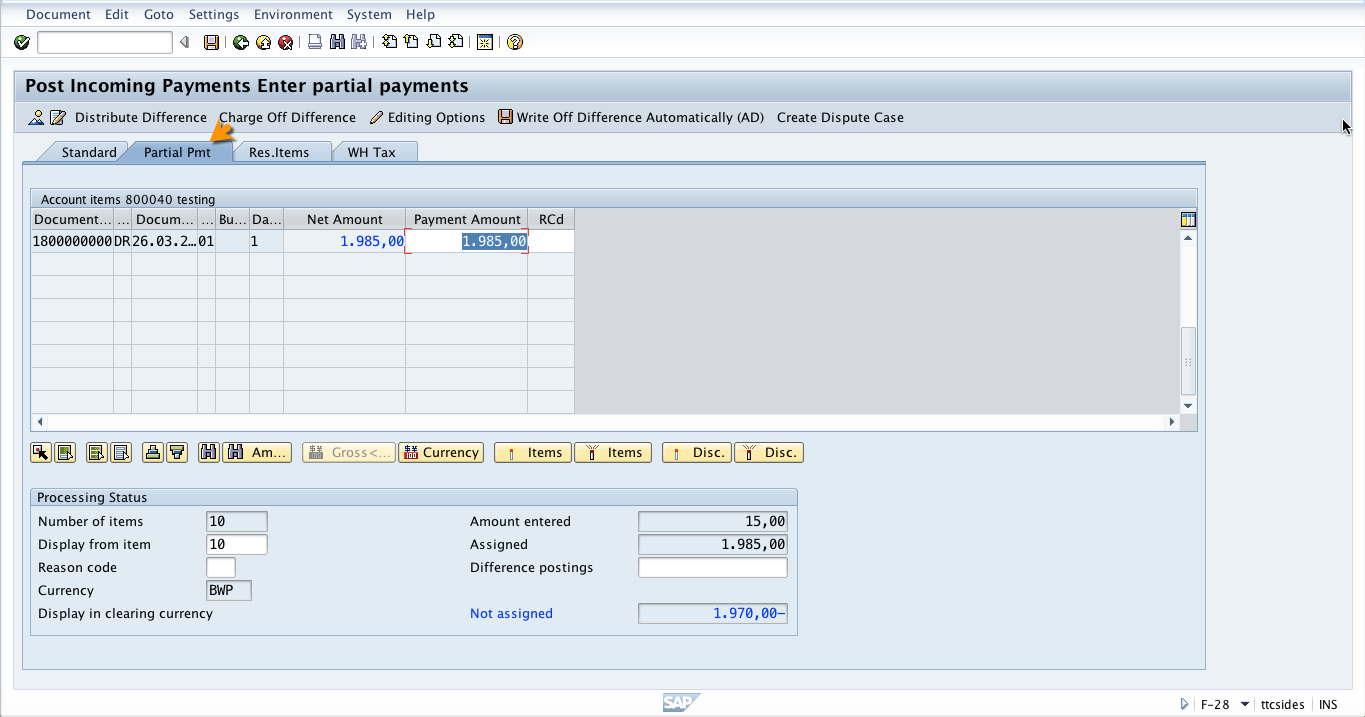

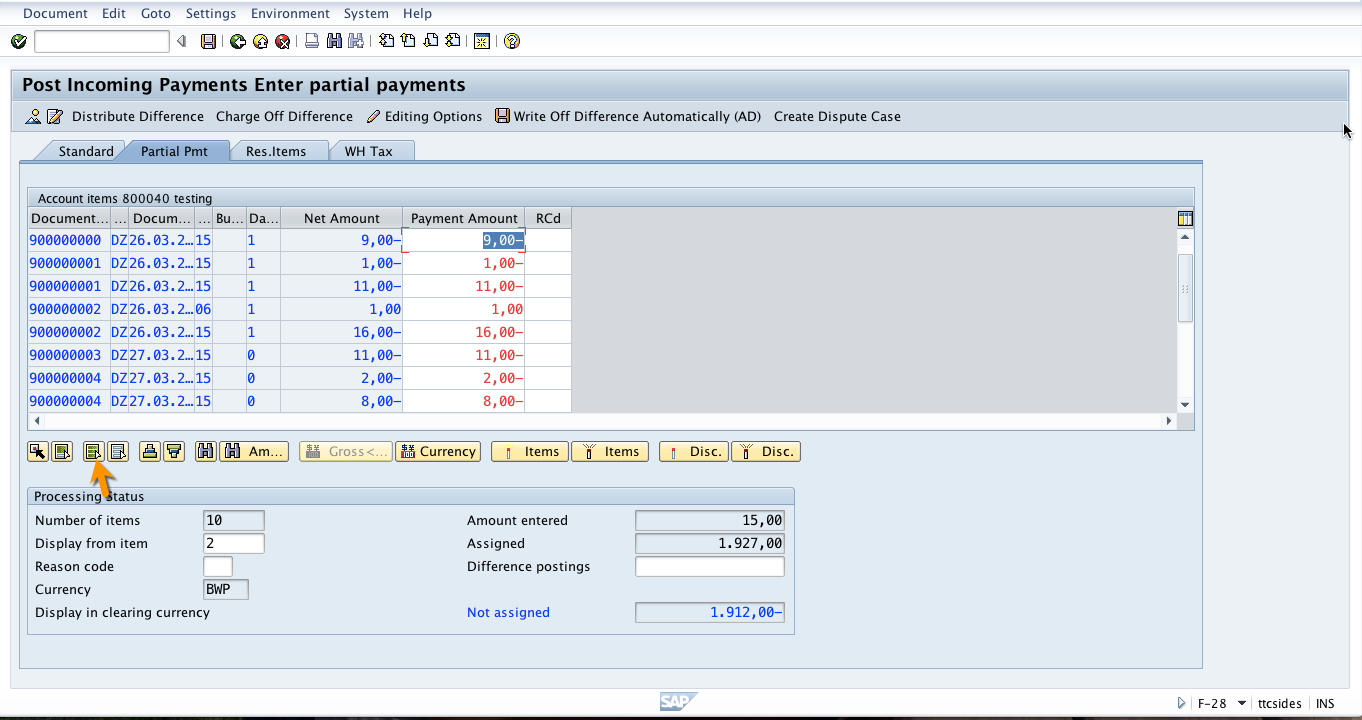

After clicking on Process Open Items the system will show the open items for the selected account and now to make a partial payment you have to select Partial Payment tab.

Next, click on Select All icon to select all the open items.

Now, click on Deactivate All button to deactivate all open items.

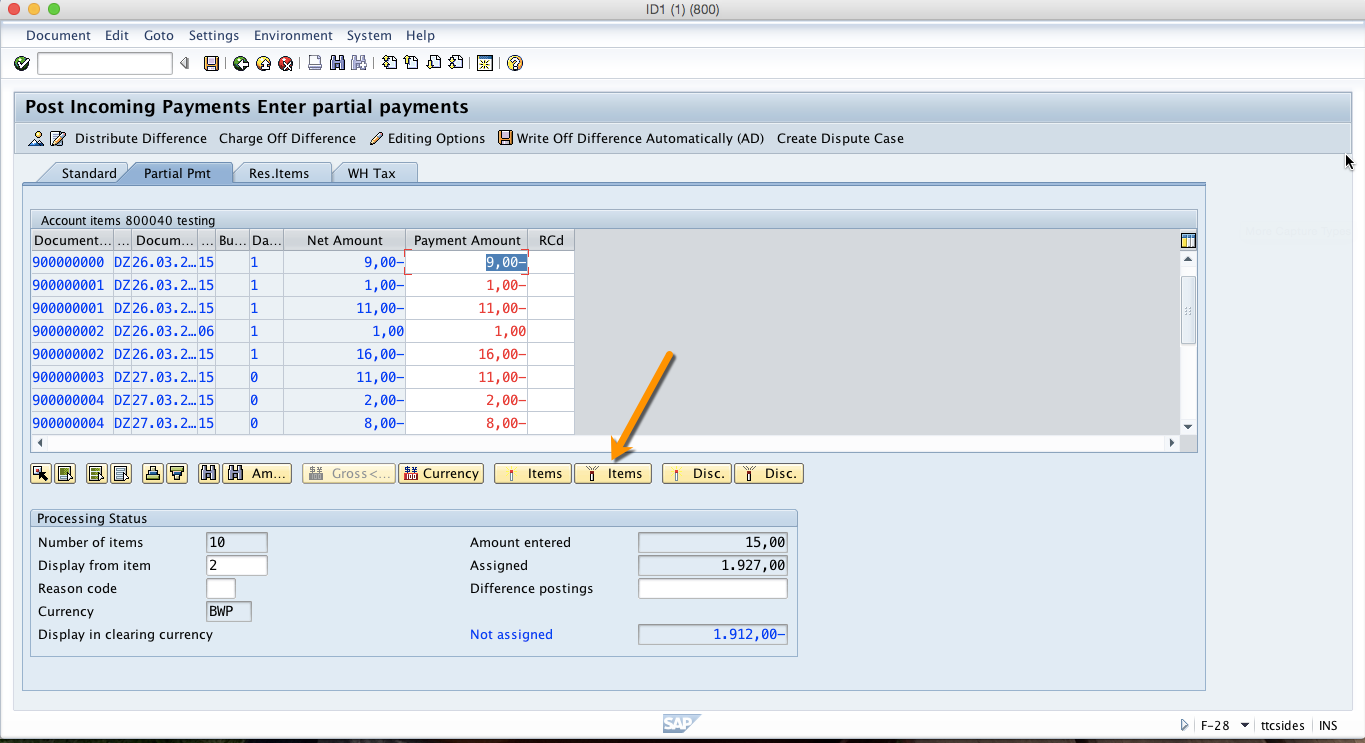

Next, you should double click on the item that you want to make partial payment for to activate it. All other items will be deactivated and only the item or items that you select for payment will be active. Now, for the item that you’ve activated enter the amount you are paying in the Payment Amount field. In this field, you put the payment amount that is apportioned to the item. The payment amount is specified if a partial payment has been made for the invoice. The invoice partially paid is not cleared. The partial payment is posted to the account and a link to the related invoice is created in the line item. If the Consider Invoice function is activated in the processing option Accounting, the payment amount is displayed on the standard screen and the withholding tax screen. Now, to post the payment click on Save button and a document number will be generated.

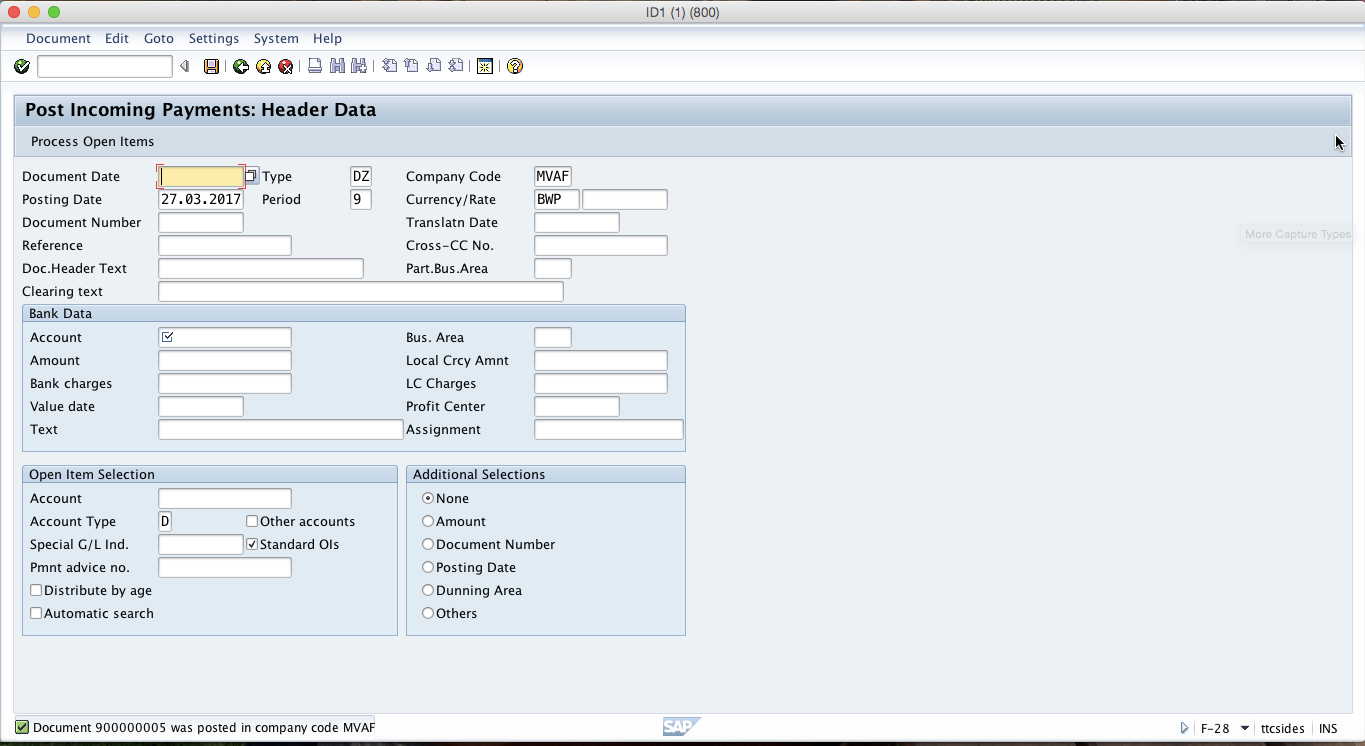

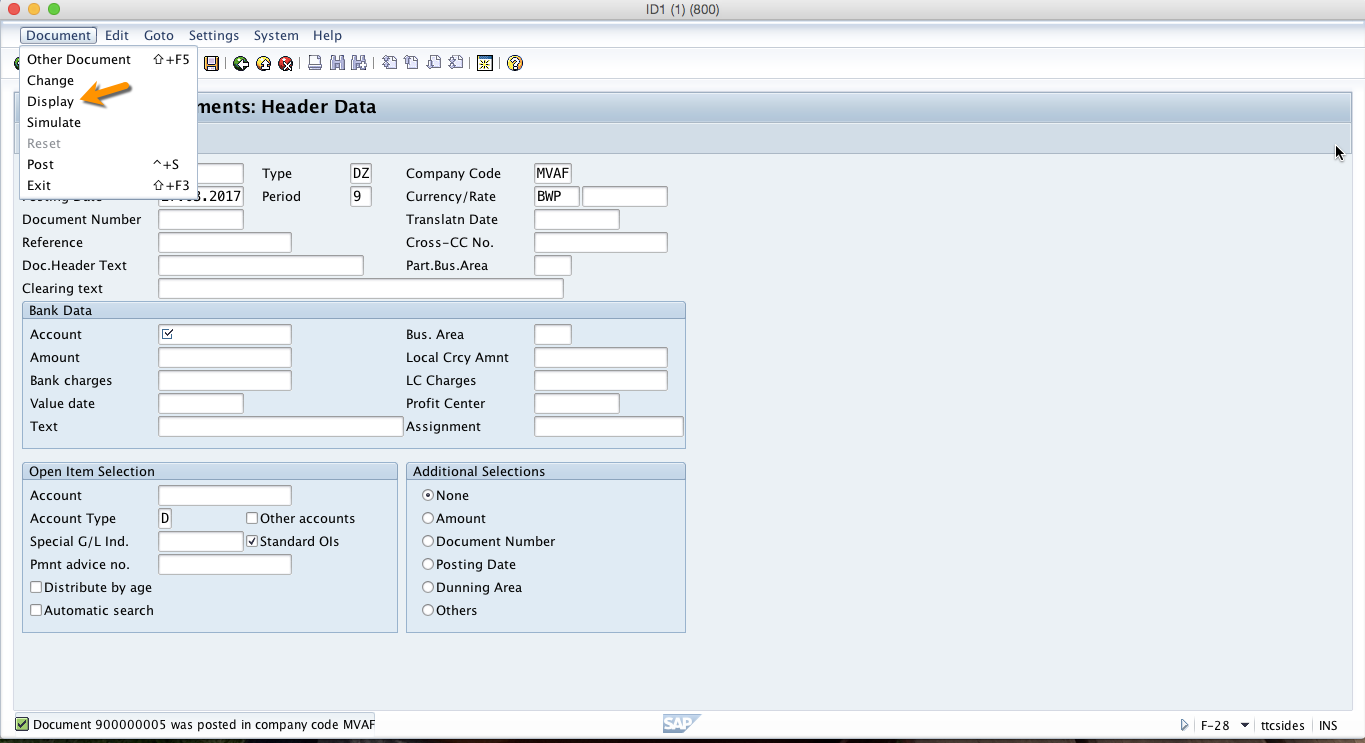

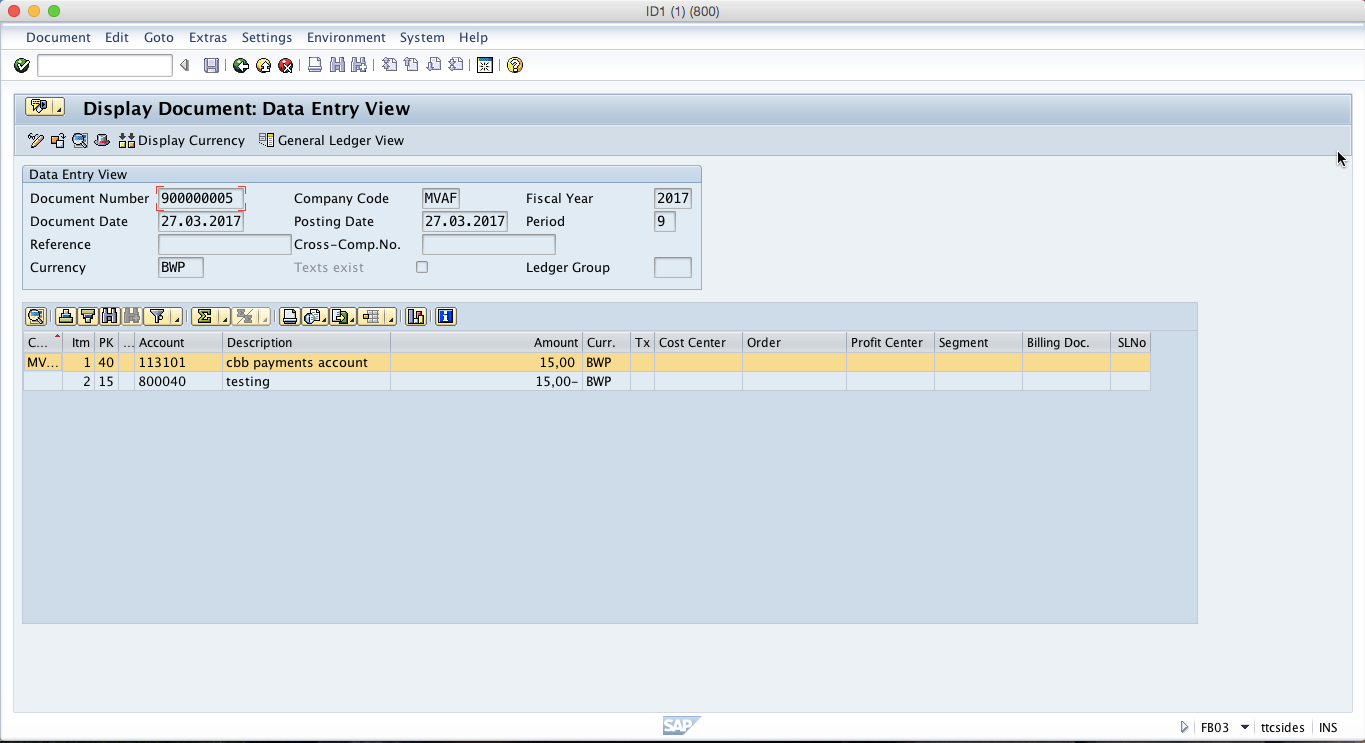

To display the just posted document click on Document menu on the top left corner and select Display.

Now, you will see the generated line items in that document.

Posting SAP Residual Payment

To post an incoming residual payment, enter the transaction code F-28 or follow the menu path shown on the screenshot below.

Enter the following information in the first screen (similar as we did with the partial payment):

- Document date;

- Company code;

- Posting date;

- Currency;

- Bank account;

- Amount;

- Customer account;

- Account type = D.

Information entered on this page is divided into three sections which are Document Header, Bank Data and Open Item Selection. To go to the next page, click on Enter button on the keyboard or on Process Open Items button on the toolbar.

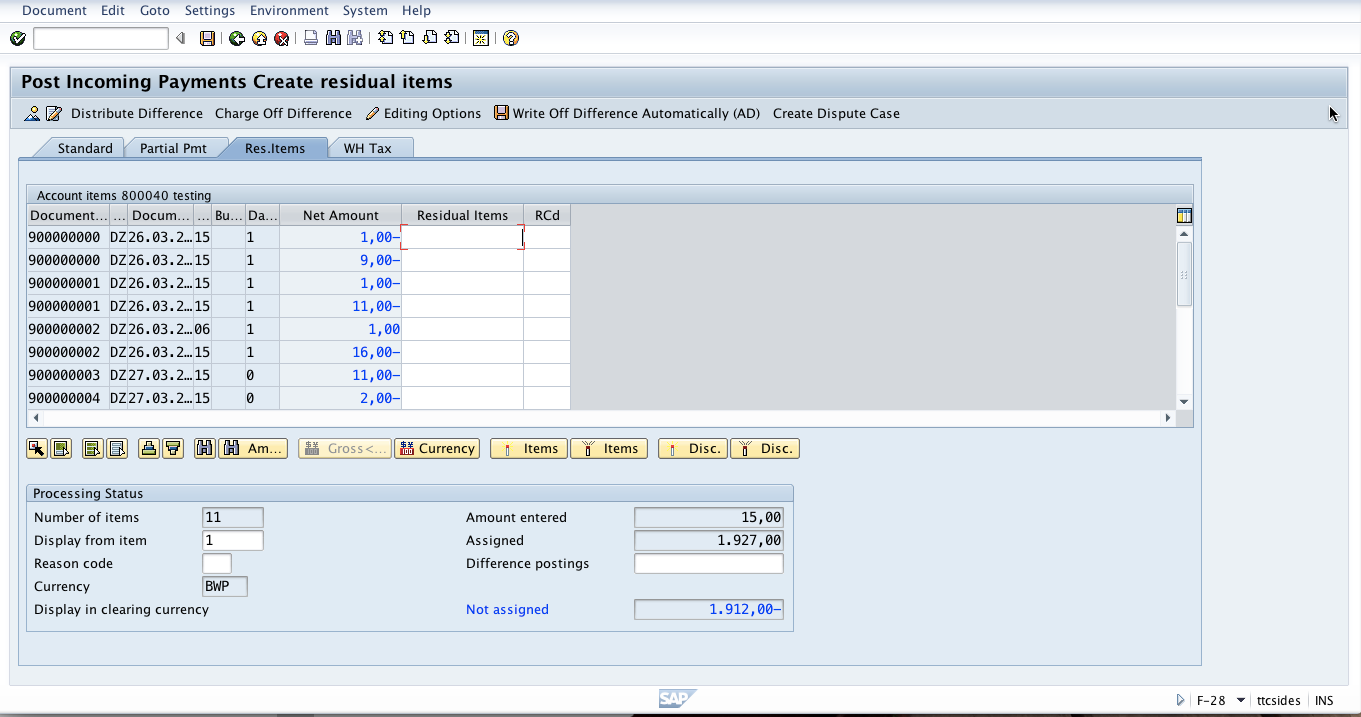

After clicking on Process Open Items, the system will show next screen with the open items for the selected account. Now, to make a residual payment you have to select Residual Payment tab.

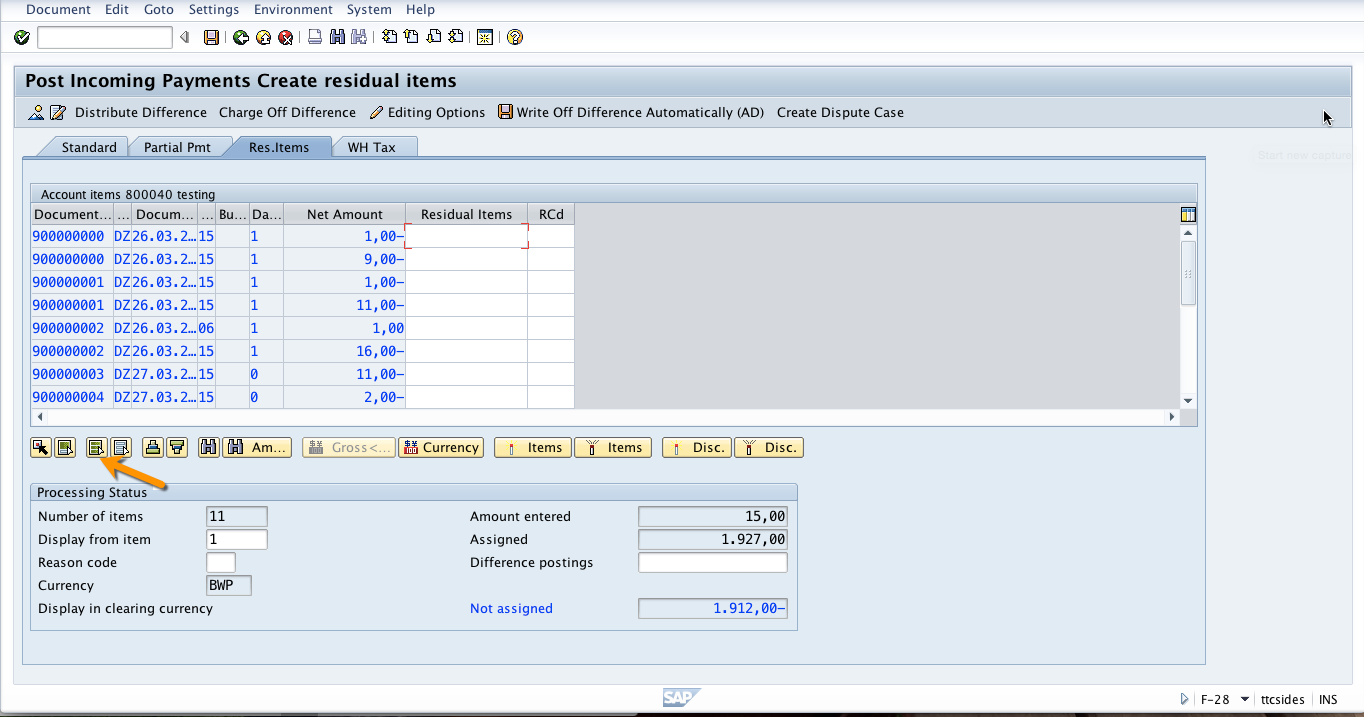

Next, click on Select All icon to select all the items.

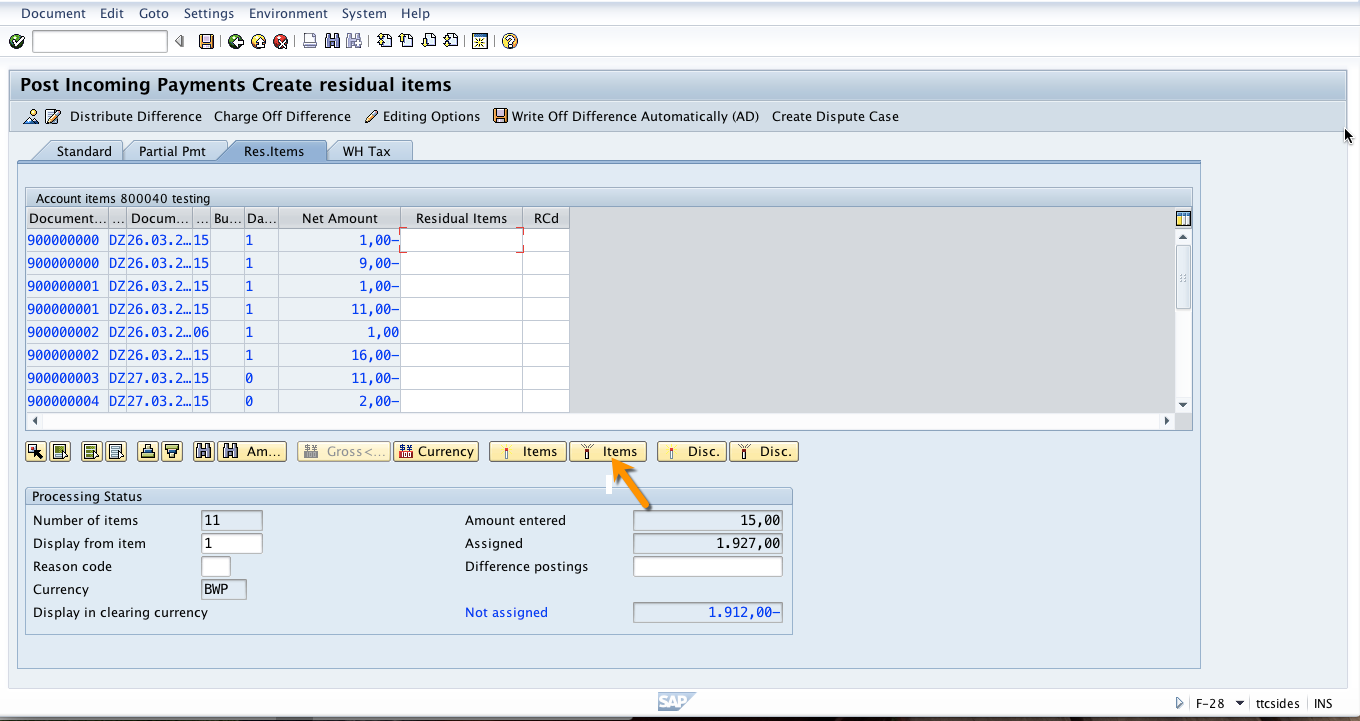

Then, click on Deactivate All icon to deactivate all selected items.

Now, double click on the item that you want to make residual payment for and put the residual amount in the residual amount field. In this field, you put the remaining amount which is to be posted during clearing of a residual item. The residual item represents a new receivable or payable. Now click on Save button and a new document will be generated and posted. The customer account and the bank account will be updated with the residual payment.

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP Exchange Rate Differences

Go to previous lesson: SAP Payment Differences Processing

Go to overview of the course: SAP FI Training

Wonderful. Thanks for great help.

Excellent!

hello,

Thank you for all your explanation.

I would like to know why the system is creating not assigned amount?

Thank you

What is the name of the field on the AR screen that shows the amount paid?