This tutorial is part of our SAP FI course and it talks about SAP Payment Differences Processing in Financial Accounting. You will learn about automatic and manual clearing of payment differences in SAP FI and how it is affected by tolerance groups. We will show how to perform posting of documents with payment differences using F-28 transaction.

This tutorial is part of our SAP FI course and it talks about SAP Payment Differences Processing in Financial Accounting. You will learn about automatic and manual clearing of payment differences in SAP FI and how it is affected by tolerance groups. We will show how to perform posting of documents with payment differences using F-28 transaction.

A payment difference usually occurs during open item clearing in financial accounting. The difference is then compared to tolerance limits set for accounting clerks and customers or vendors for which a document is created and is handled accordingly. A payment difference can either be to the advantage of the company or to the disadvantage of the company. If a payment difference is to the advantage of the company, the difference will be treated as revenue increasing profits and if the payment difference is to the disadvantage of the company its treated as an expense reducing profits.

When SAP payment differences occur, the SAP ERP application can handle them in two ways, either automatically or the accounting clerk can handle them manually.

Automatic Clearing of SAP Payment Differences

If the payment difference is insignificantly small, the system can handle it automatically. SAP financial accounting performs automatic clearing by adjusting the cash discount and writing off the difference to a special G/L account that is set up in the configuration. SAP tolerance groups are used to set the limits up to which a difference is considered immaterial. If the payment difference is less than the defined conditions, then the payment difference can be written off automatically by the system as an unauthorized deduction. If there are multiple tolerance groups applicable to a particular document, the lower of the tolerances always applies.

Manual Clearing of SAP Payment Differences

If the payment difference is too high to be considered irrelevant, an accounting clerk must process it manually. There are three methods that can be used to process a payment difference manually. The methods that can be used to process payment difference manually are:

- Adjusting the cash discount manually;

- Posting the payment as a partial payment;

- Posting the payment difference as a residual item or a difference posting.

In this tutorial we are going to demonstrate automatic and manual processing of SAP payment differences when posting incoming payments.

Demonstration of Automatic Processing of SAP Payment Differences

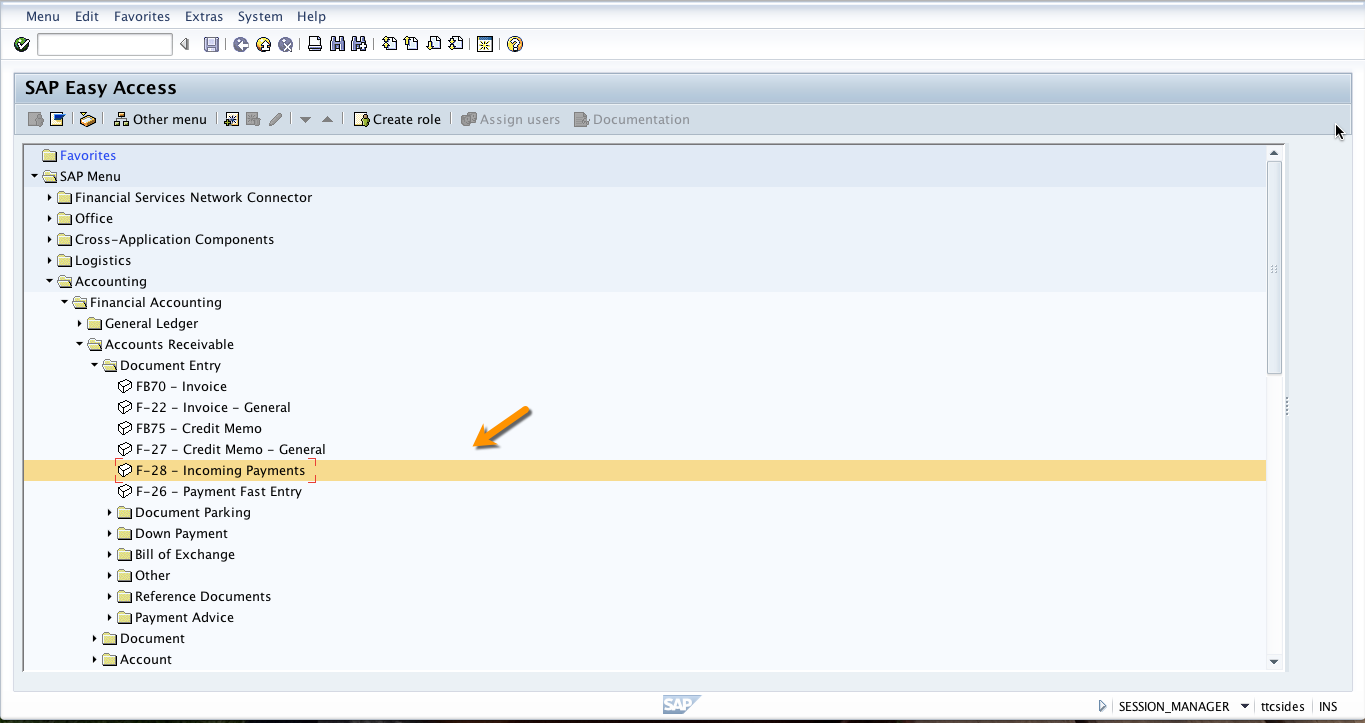

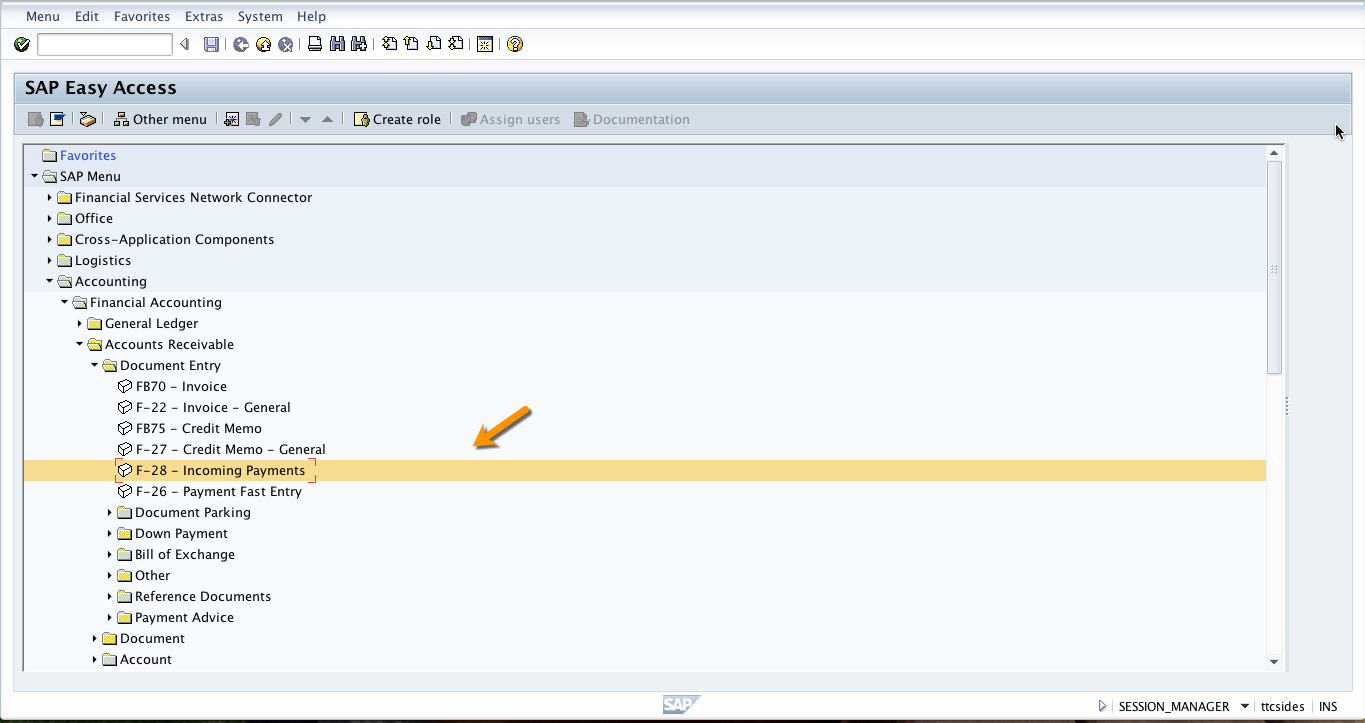

To record an incoming payment, you use transaction code F-28 or navigate to the following path in SAP Easy Access menu:

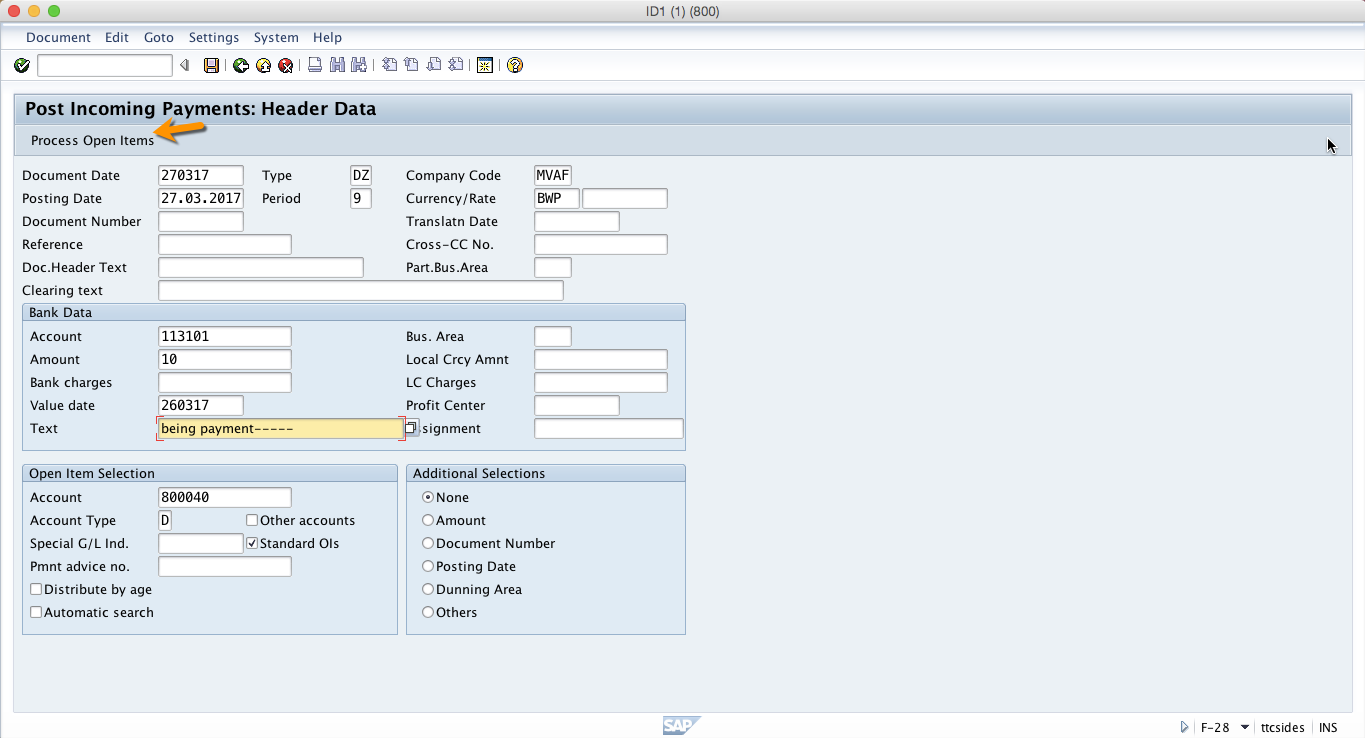

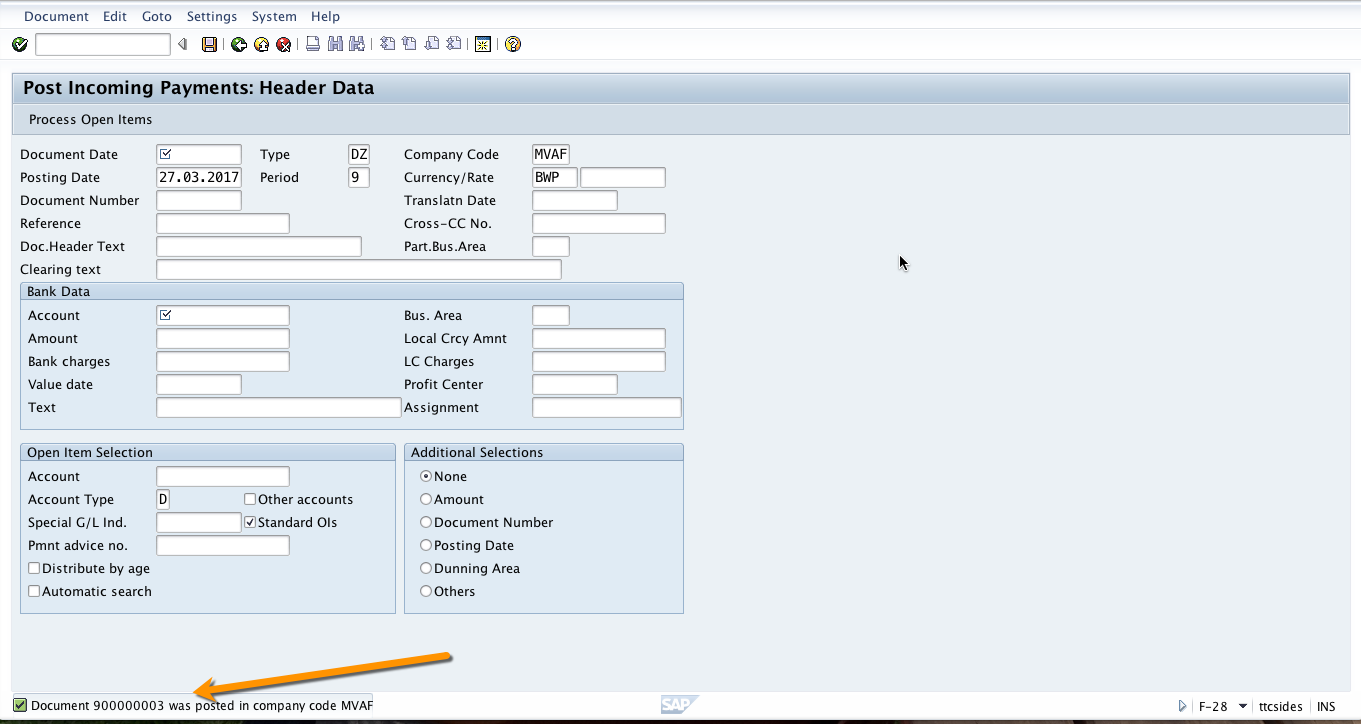

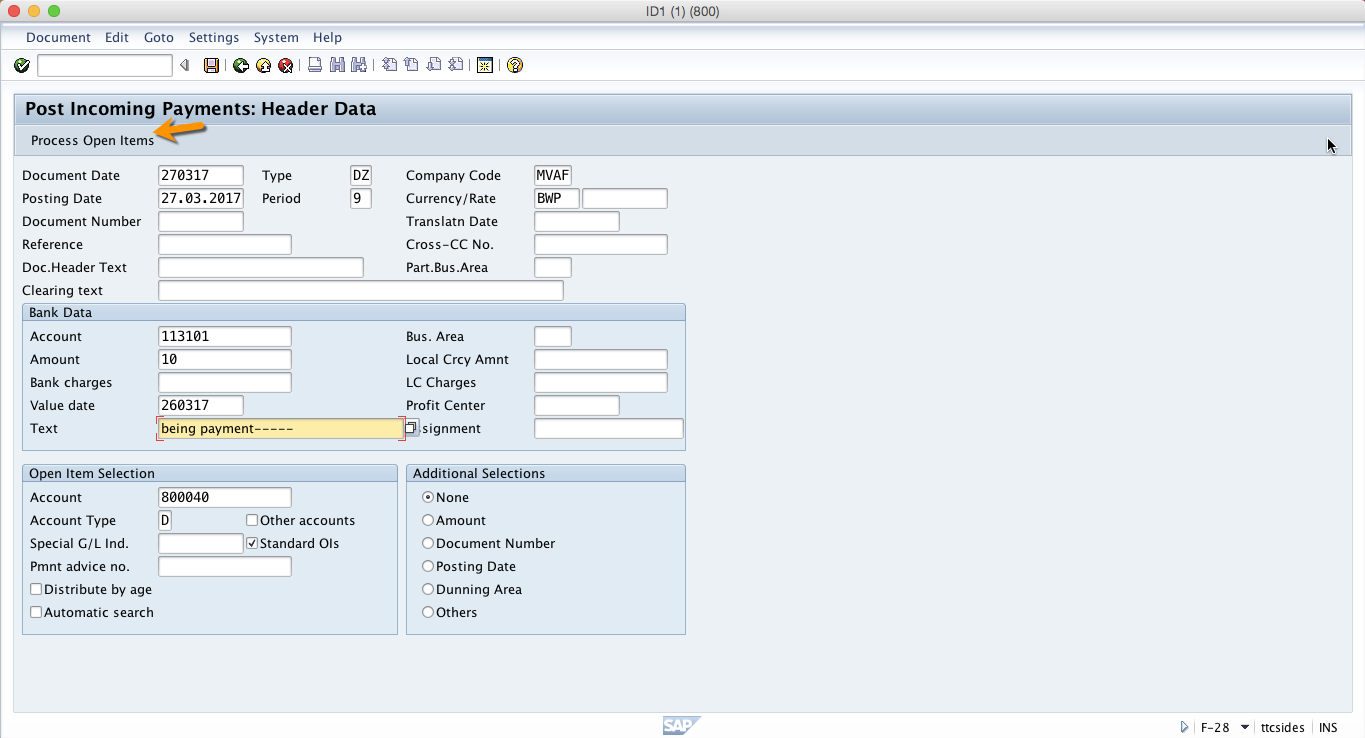

Start this transaction and fill in the header information like date, company code and document type. Also, enter the bank details, the amount being paid and the value date. You also have to select the customer who is paying and click on Process Open Items button as illustrated below.

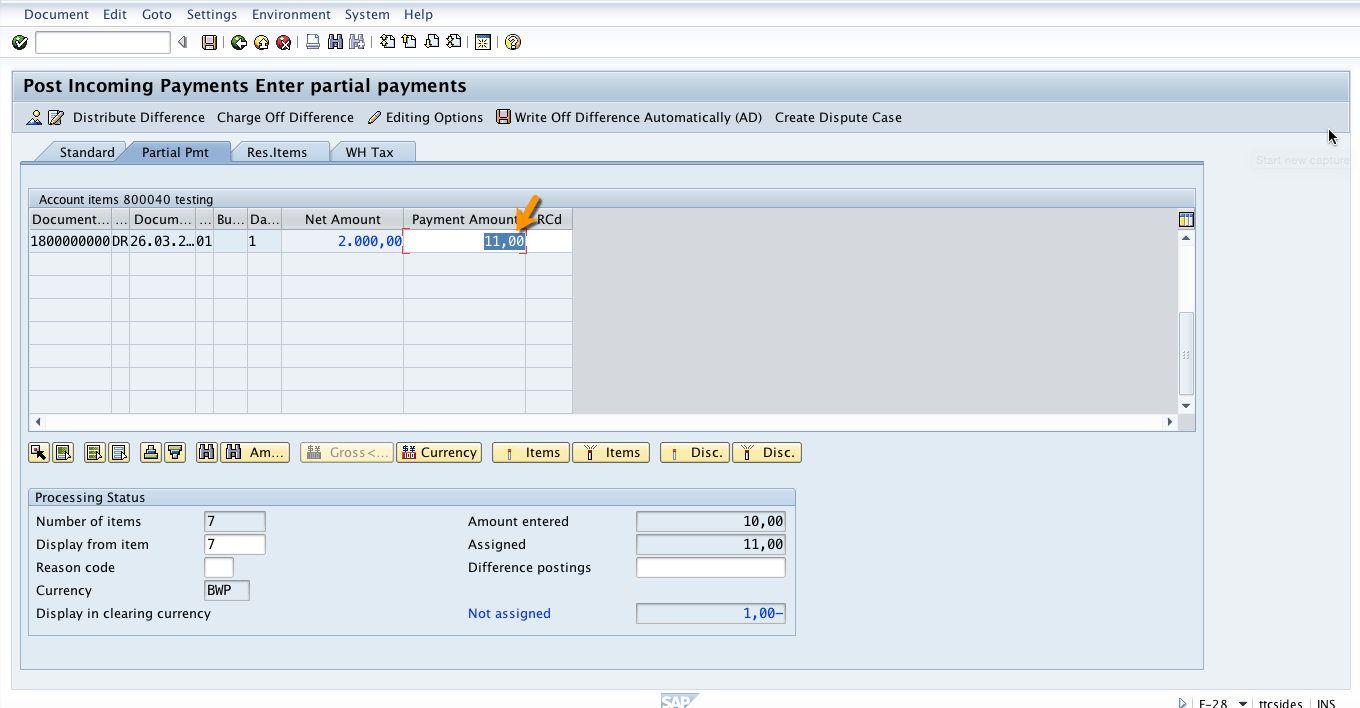

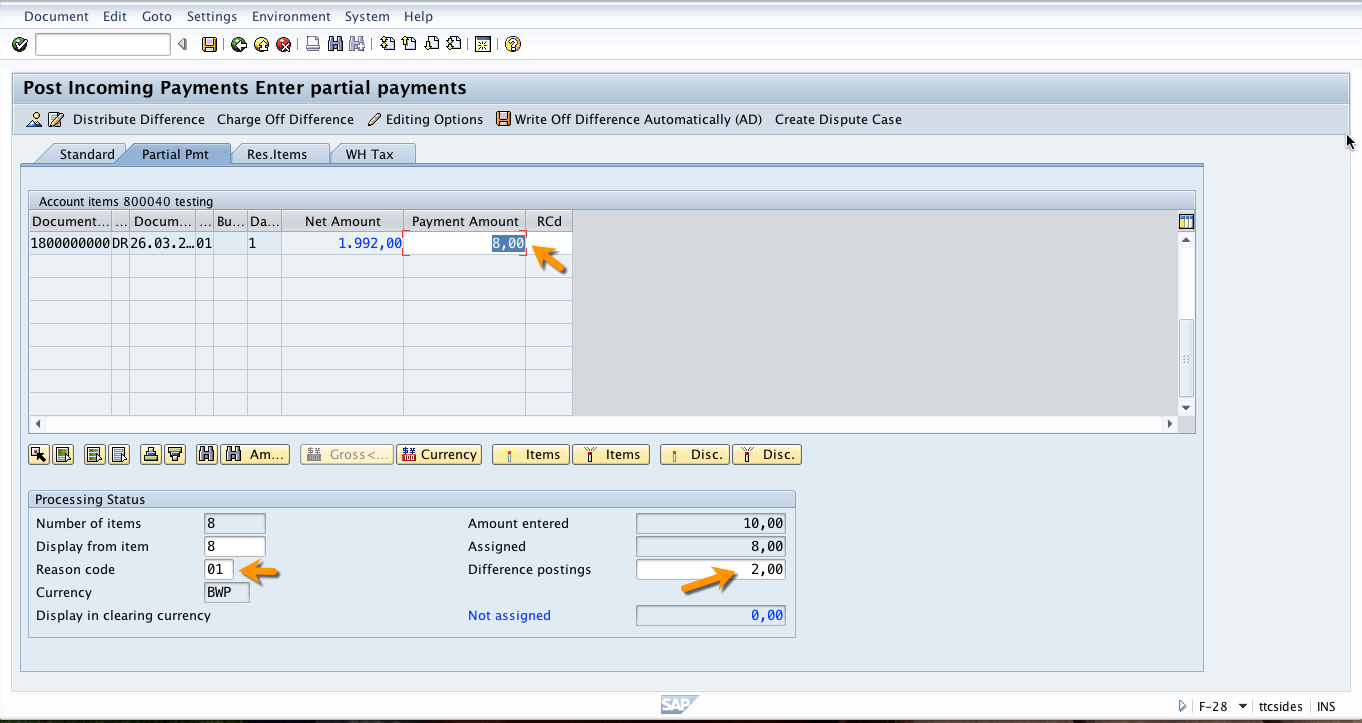

Now, the system will open line items for the customer we have selected. Click on Partial Payment tab and put the amount that is slightly higher or lower to the one that we put on the first screen.

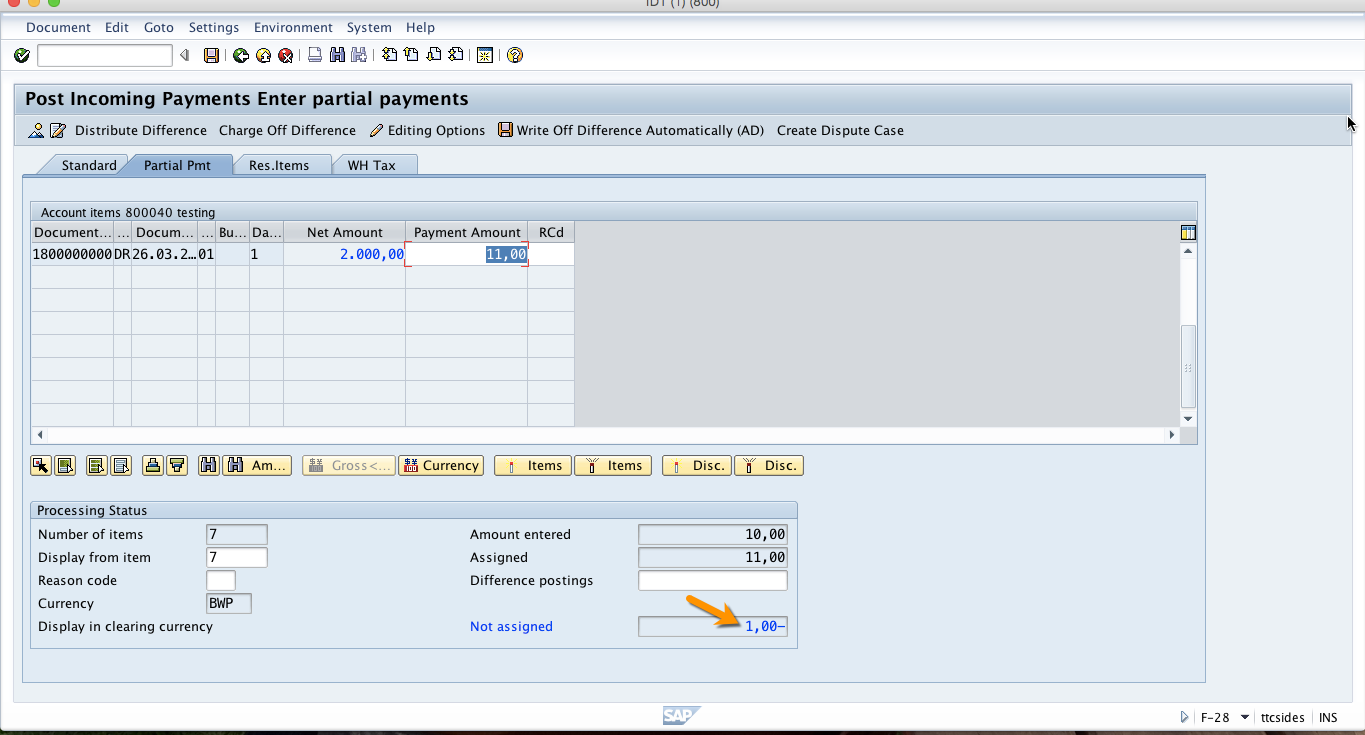

Now, when you press Enter button on the keyboard the system will calculate the payment difference automatically and the difference will be indicated in the not assigned field at the bottom of the screen.

Next, if the difference is within the limit defined for the customer tolerance group, the system will automatically post the difference as a separate line item. When you save the document the system will generate a document number.

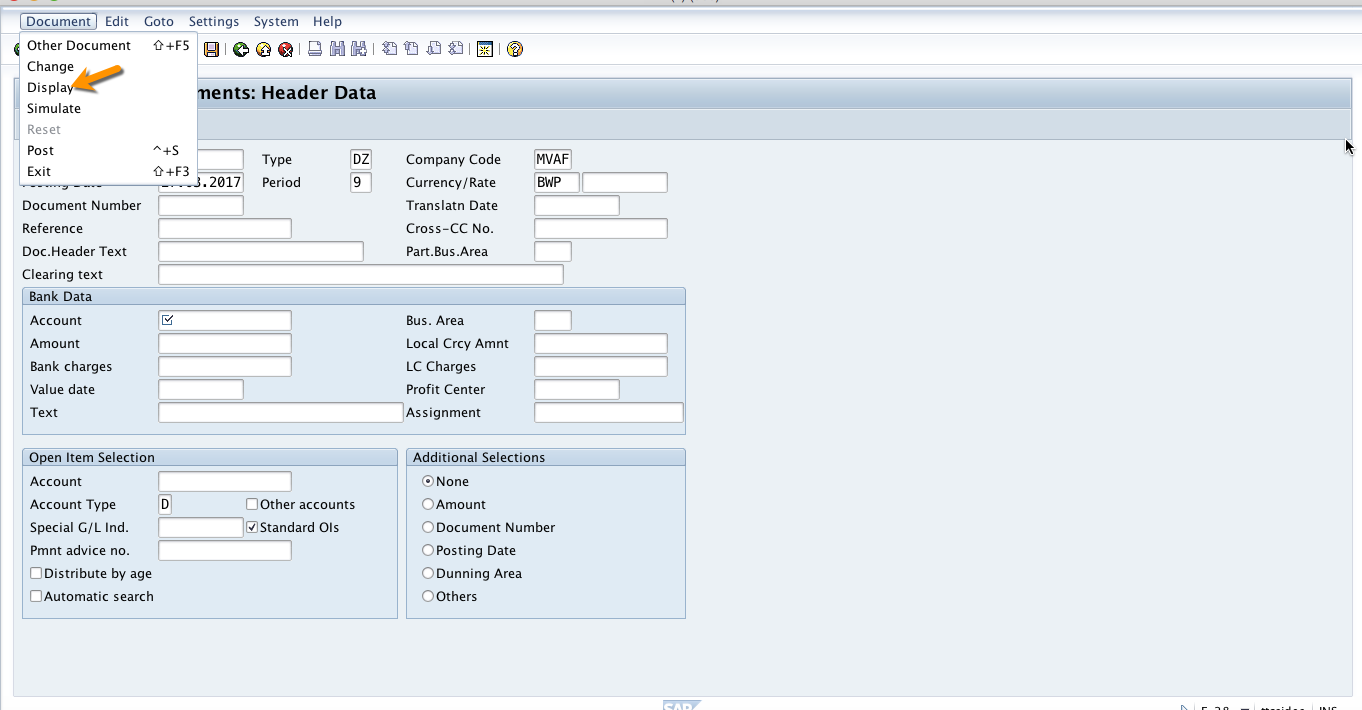

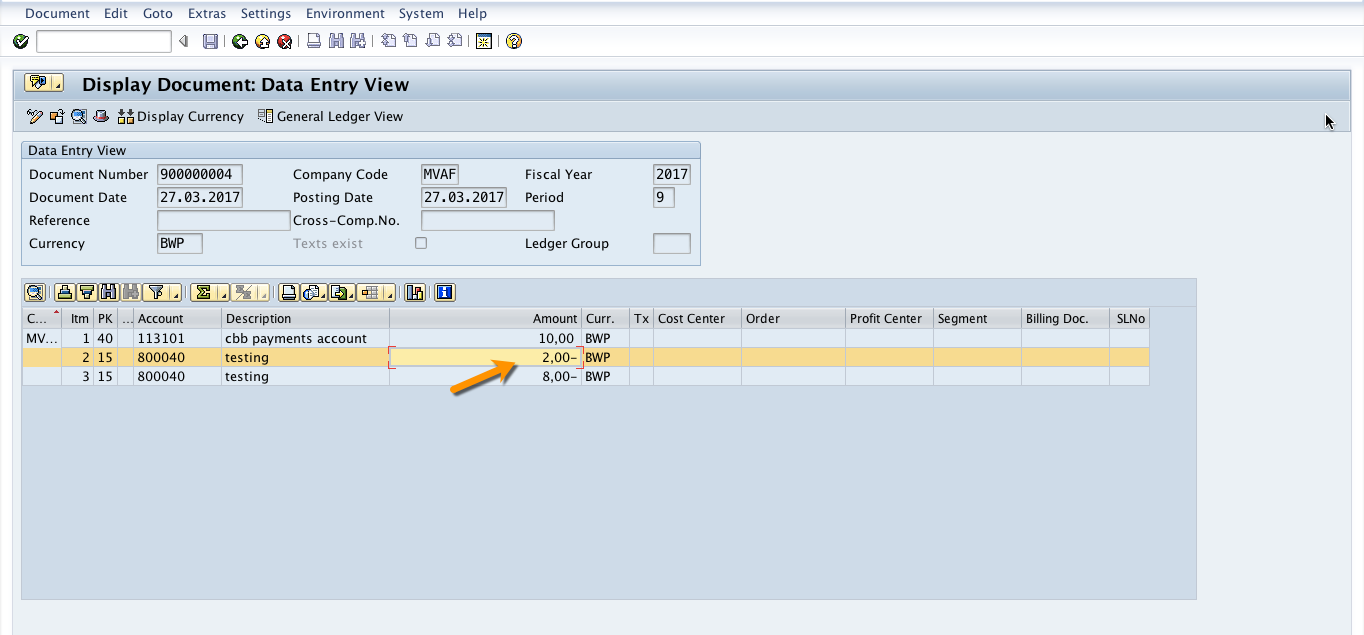

If you display the created document, it will contain a separate line item for the payment difference posted. To display the posted document, click on Document menu and then select Display in the top left corner of the screen.

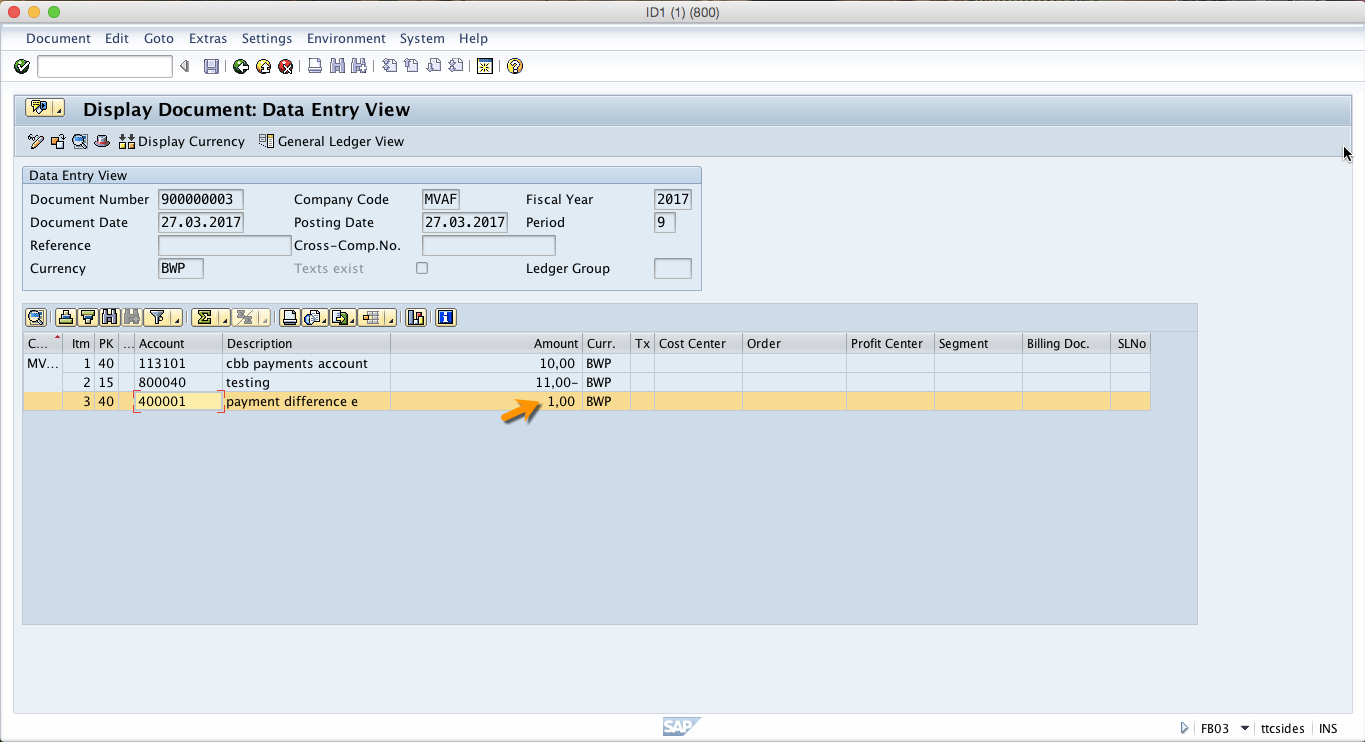

On the next screen, you will see all the line items posted. The payment difference is posted as a separate line item and posted to a separate account that was set up in the configuration to record all payment differences.

Demonstration of Manual Processing of SAP Payment Differences

If a payment difference is larger than the one specified in customer or vendor tolerance groups, the accounting clerk can manually post the difference if it does not exceed the limit in her employee tolerance group. If the difference is larger than the tolerance limit for employees, then the difference cannot be processed.

To record an incoming payment, you should use the transaction code F-28 or navigate to the path as shown below.

Start this transaction and fill in the header information like date, company code and document type. Further, put the bank detail, the amount being paid and the value date. You also have to select the customer who is paying and click on Process Open Items button as illustrated below.

Now, the system will open line items for the customer we have selected. Click on partial payment tab and put the amount that is slightly lower than the one we used for automatic processing of payment differences. In this example, I will use the amount that is $2 less. Select the reason code and put the payment difference manually as shown below.

When you save the posting, the system will create a new document and a separate line item for payment difference will be added in this document. If you click on Document menu on far left corner of the screen and select Display, you will see all the posted line items.

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP Partial and Residual Payments

Go to previous lesson: SAP Tolerance Groups

Go to overview of the course: SAP FI Training

explain payment difference and rounding difference off concept

what is terms of payments?how it effects your payments/revenue

if we allow all tax allowed in fs00 for round off then it is deducting GST and we remove all tax allowed from fs00 then accounting entry is not generating in VF01. so what is the solution.