In SAP Financial Accounting, an organization must close out each fiscal year according to the fiscal year variants and calendars configured during system implementation. Depending on the functionality and specific custom programs and processes each organization uses, the activities required will vary. However, there are typical standard processes that organizations universally use in SAP Financial Accounting for closing the core submodules. This tutorial will take a brief look at SAP Year End Closing Process and show you the transactions and program screens used for each step.

In SAP Financial Accounting, an organization must close out each fiscal year according to the fiscal year variants and calendars configured during system implementation. Depending on the functionality and specific custom programs and processes each organization uses, the activities required will vary. However, there are typical standard processes that organizations universally use in SAP Financial Accounting for closing the core submodules. This tutorial will take a brief look at SAP Year End Closing Process and show you the transactions and program screens used for each step.

It is recommended to read SAP Month End Closing Process tutorial before studying this tutorial about SAP Year End Closing Process.

SAP Year End close is typically done by performing a standard period end close for the last fiscal period of the year, and then processing the year end close using special reports, transactions, and procedures to clear final year end entries and carry balances forward to the new year. Often due to timing concerns related to calendar changes and system times, final period end close is meshed with year-end close and is processed together in a step by step plan coordinated between financial accountants and SAP functional and basis support staff. There are many specific activities that occur that lead up to final close that we will not get into here, but as a reference, these may include:

- Review and status correction of IDoc interface programs

- Pre-close activities in FI such as booking of final accruals, running reports on open payables and receivables, bank reconciliation duties, etc.

- Final entry of all logistics documents that impact Materials Management, Sales and Distribution, etc.

- Activities on orders such as overhead being booked, statuses marked as technically complete, orders settled, etc.

- Other activities in Controlling such as processing of assessments and distributions, period locks and unlocks, etc.

- Materials Management period change

With an understanding that there are many variables involved leading up to SAP year end close in FI, this tutorial will review the major activities for the core submodules of general ledger, accounts payable, accounts receivable, and fixed assets.

General Ledger

As discussed above, there are many pre-close activities that may be required in the general ledger module as part of FI close, but here we will look at two of the core activities: foreign currency revaluation and balance carry forward.

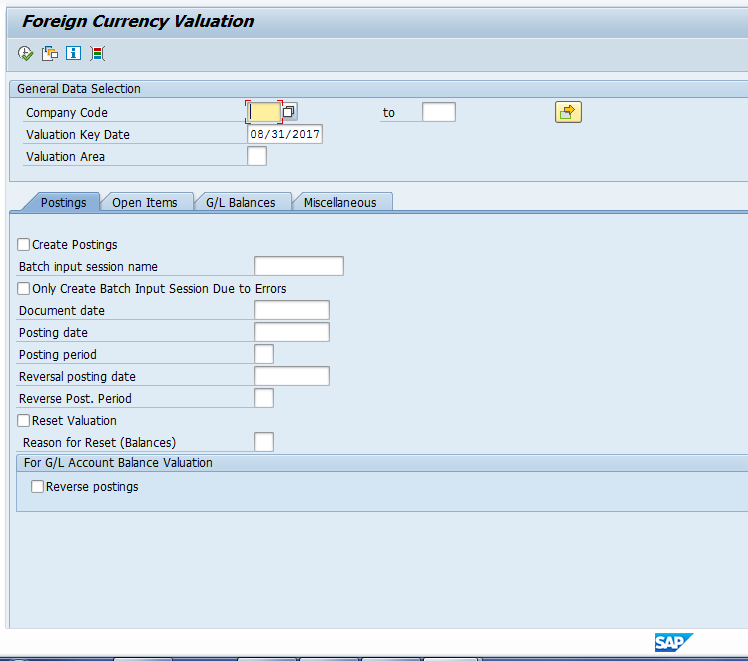

Foreign Currency Revaluation

Given that you have configured valuation methods, defined valuation areas, and prepared your system for automatic postings for foreign currency valuation for booking gains and losses, you can use the Foreign Currency Valuation program to revalue open items at the end of the year with the latest exchange rates to determine a precise financial standing at year end.

To access this program, use transaction code FAGL_FC_VAL or follow menu path:

SAP Easy Access Menu > Financial Accounting > General Ledger > Periodic Processing > Closing > Valuate > Foreign Currency Valuation (New)

Program screen will appear as follows.

There are many options for running the program. Notice the general selection screen at the top for company code, valuation key date, and valuation area. Use this as a start in selecting items to revalue, then use the tabs below to get more specific on what you want to select. Generally, what the program will accomplish is to post differences in valuation between currencies as gains or losses to a P&L account with the offset to a balance sheet adjustment account. Keep in mind that valuation can only be executed once per key date or valuation area. If there are errors, you must reset valuation and reprocess.

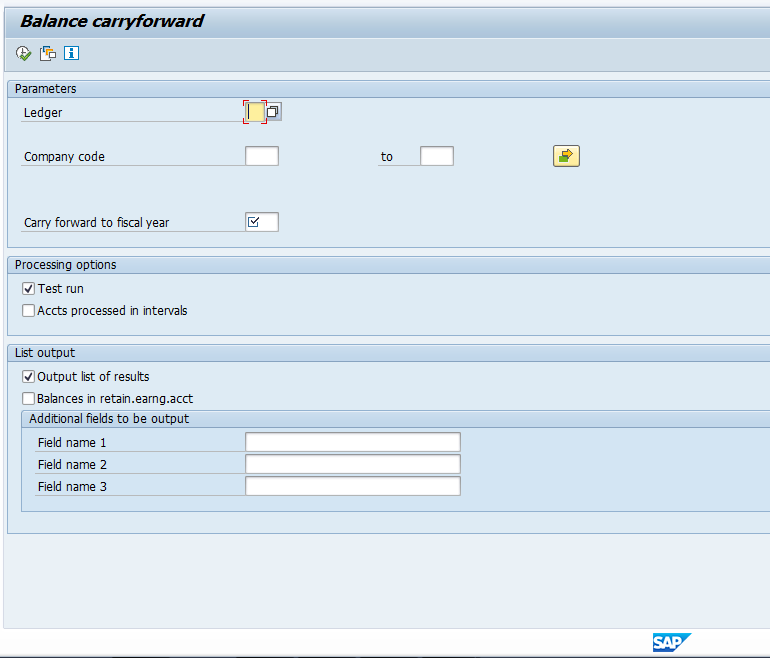

G/L Balance Carryforward

To carry balances forward to the new year in the general ledger, use transaction code F.16 (for classic G/L) or FAGLGVTR (if using the new G/L), or follow menu path:

SAP Easy Access Menu > Financial Accounting > General Ledger > Periodic Processing > Closing > Carrying Forward > F.16 OR FAGLGVTR

Here we will look at FAGLGVTR. The screen will appear as follows.

Using this program, you can carryforward balances within which ever ledger you choose to the new fiscal year. Although it can be repeated, this program is typically executed just one time. Balance sheet accounts will be carried forward with their account assignments, and P&L accounts will be rolled up and transferred to the retained earnings accounts you have configured during implementation.

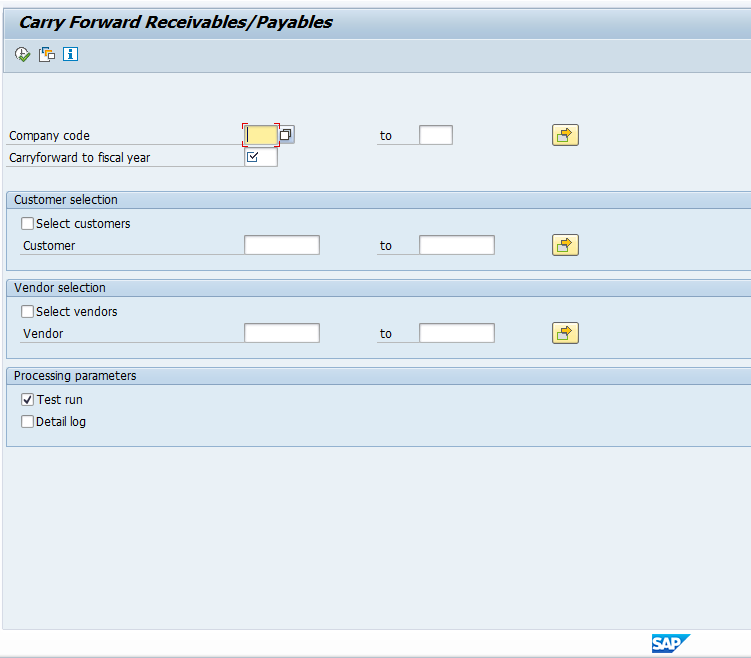

Accounts Receivable and Accounts Payable

To close accounts receivable and accounts payable for the fiscal year, the same program is used to carry balances forward to the new year. To access the carry forward program, use transaction code F.07 or follow menu path:

SAP Easy Access Menu > Financial Accounting > Accounts Receivable OR Accounts Payable > Periodic Processing > Closing > Carry Forward > Balance Carry Forward

The screen will appear as follows:

To execute this program, simply enter the company code or company code range, the new fiscal year, the customers or vendors you want to carry forward, and your processing parameters.

Note: Be aware when reviewing balances in A/R (transaction code FD10N) and A/P (transaction code FK10N) accounts to compare to the log of this program, there may be a mismatch. A simple explanation is that vendor and customer balance reports show the total balance of the account, whereas the log of the carryforward report will show the difference of what is being carried forward and what has already been carried forward. For more information, see SAP Note 37529.

Fixed Assets

To close the Fixed Assets submodule for the year, following the last depreciation recalculations, review of incomplete assets, settlement of assets under construction, capitalization of any low value or remaining assets, asset account reconciliations, and final posting of periodic depreciation, there are two standard close programs that must be executed – the year end closing program and the fiscal year change program.

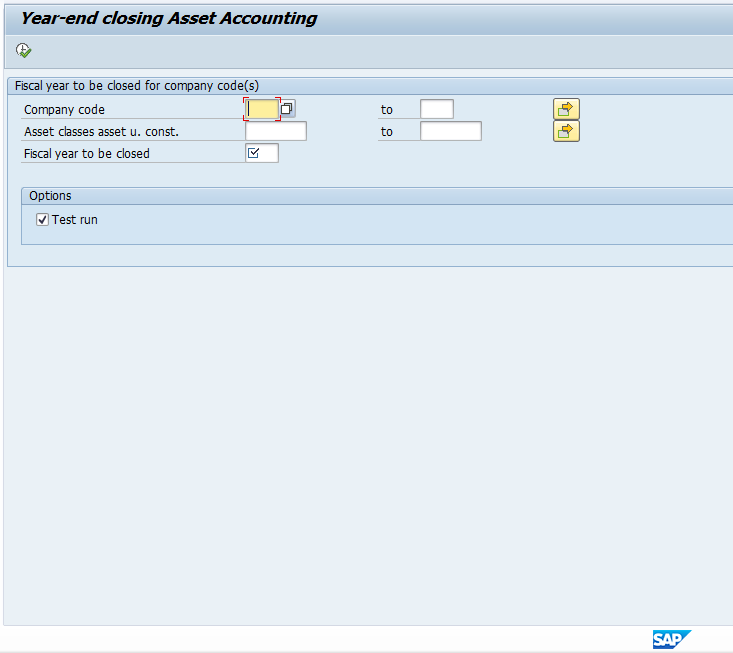

To run the year-end close program, use transaction code AJAB or follow menu path:

SAP Easy Access Menu > Accounting > Financial Accounting > Fixed Assets > Periodic Processing > Year-End Closing > Execute

The screen will appear as follows.

This program will lock the prior year in the asset accounting submodule (close the annual values) so that no further postings can be made. It is highly recommended that this program is first executed in test mode to review for possible errors, then upon satisfactory review, executed in productive mode as a background job.

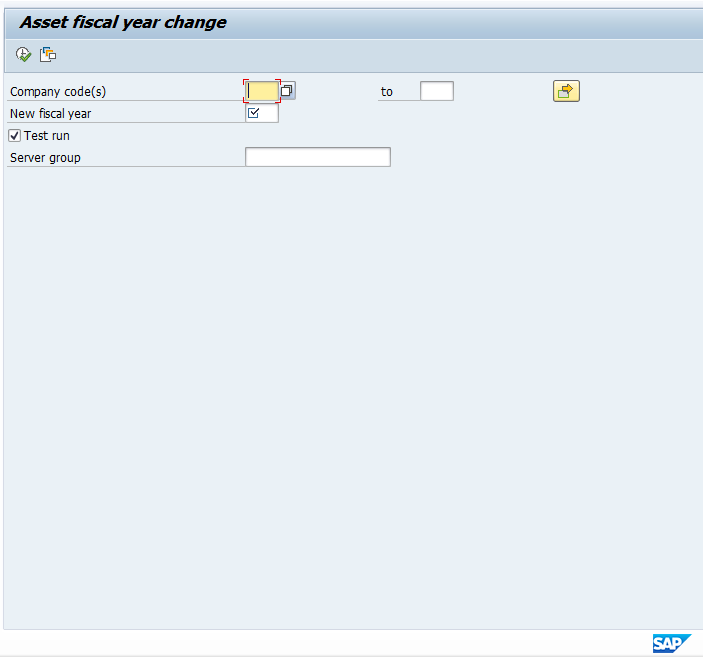

The other program you will need to execute is to open the new fiscal year. To do this, use transaction code AJRW or follow menu path:

SAP Easy Access Menu > Accounting > Financial Accounting > Fixed Assets > Periodic Processing > Fiscal Year Change

The screen will appear as follows.

Input your company codes and the new fiscal year and execute in test mode. Upon satisfactory review, execute the program as a background job. This is just a technical step that carries balances forward and allows you to run reports in the new year.

Other

A couple of other common steps for year-end closing in financial accounting are to lock company code posting variants by account type for the previous year and open them for the new year and to copy number ranges to the new year.

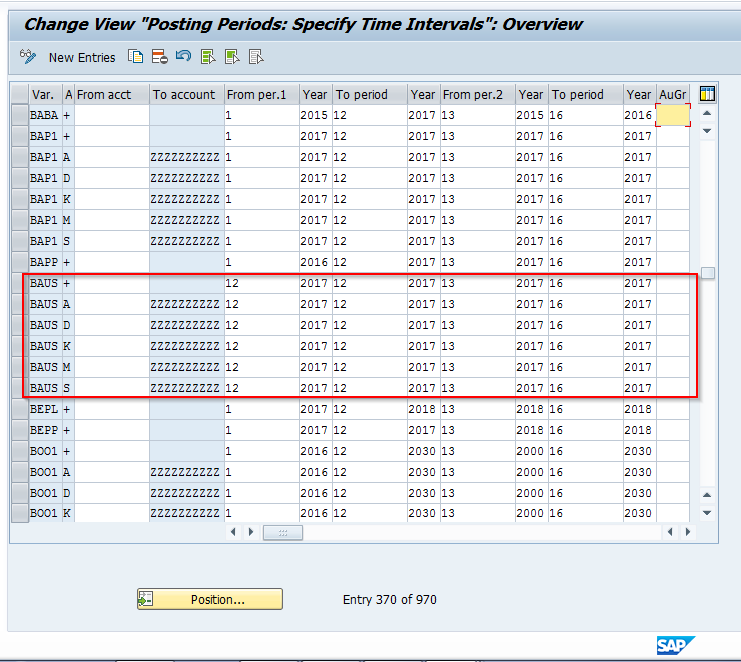

Changing the posting periods by account type is a routine period close activity, but critical enough to be mentioned here in the year end close tutorial as a reminder. Remember that the posting period variant is configured and assigned to the company code in the global parameters of the company code in the IMG. In this task, you will update the posting period variant to reflect the open year and period. To carry out this task, use transaction code OB52 or follow menu path:

SPRO > SAP Reference IMG > Financial Accounting > Financial Accounting Global Settings > Document > Posting Period > Open and Close Posting Periods

The screen will appear as follows.

Scroll to the posting period variant assigned to the company codes you are closing, and change the “from” and “to” periods for both regular posting periods and special posting periods to the new period and year.

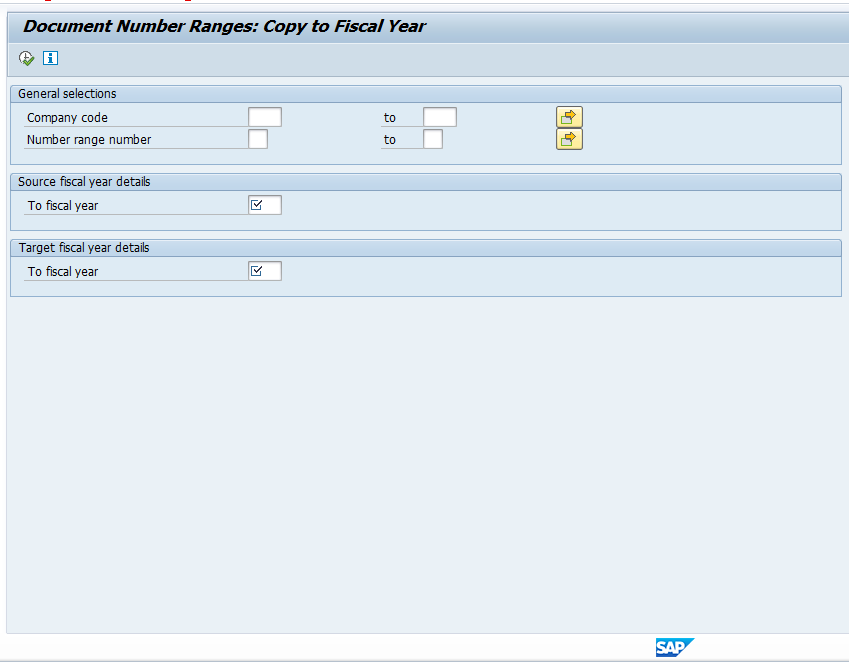

The next task is to copy document number ranges to the new fiscal year. Carry out this task by using transaction OBH2, or follow menu path:

SPRO > SAP Reference IMG > Financial Accounting > Financial Accounting Global Settings > Document > Document Number Ranges > Copy to Fiscal Year

The screen will appear as follows.

Enter the company code, number range, source year, and target year and execute.

Note: If you are using the new general ledger, this will be a two-step process in which you copy the document ranges for entry view and general ledger view separately. This is found under the Financial Accounting Global Settings (New) menu in the SPRO transaction.

Conclusion

This tutorial reviewed the most common and required steps used in each submodule of Financial Accounting for SAP Year End closing process. Remember that the year-end process is tightly meshed with the fiscal period end process and there are many other programs that may be required depending on the organization’s implementation. There are also steps in other modules that must be executed, of which examples were given in the first part of this document.

—

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP Financial Statement Version

Go to previous lesson: SAP Month End Closing Process

Go to overview of the course: SAP FI Training

nice explanation

Nice

thanks for the valuable input.

AJRW is not exist in S4 HANA 1709.

Very useful; thanks!

Hi Team,

I want to maintain TDS (194Q) exemption and rates for all Business partners next financial year,

so how can we do this in SAP s4HANA

thanks

venkatesh